Berkshire Hathaway Class A Shares Soar: A Strong Day for Buffett’s Conglomerate

Solid Gains as Investors Eye Future Performance Amid Market Fluctuations

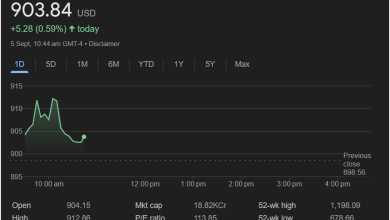

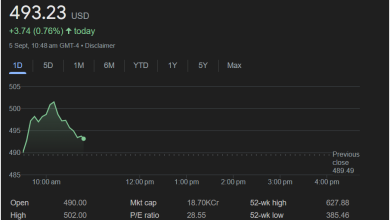

New York, NY – September 2, 2025 – Berkshire Hathaway Inc. Class A shares (BRK.A) experienced a robust trading day, closing at

5,802.44, or 0.77%, by the close of trading at 4:00 PM GMT-4. This upward movement reflects continued investor confidence in Warren Buffett’s venerable conglomerate, even as broader market sentiments can sometimes remain cautious.

The day’s trading began with Berkshire Hathaway Class A opening at

759,700.00. Despite a mid-afternoon dip, a strong late-day rally saw the shares recover substantially, eclipsing its previous close of

749,530.44**, showcasing the resilience of the stock to bounce back from selling pressure.

This positive performance adds to Berkshire Hathaway’s impressive long-term track record. With a current market capitalization standing at a formidable 1.08 Lac Crore (approximately $1.08 trillion USD, interpreting “Lac Crore” in context), the company remains one of the largest and most influential entities in the global financial landscape. Its diverse portfolio, spanning insurance, energy, manufacturing, and retail, provides a broad foundation for stability and growth, appealing to investors seeking resilience in their holdings.

Analysts often scrutinize Berkshire Hathaway’s performance for insights into the broader economy, given its wide-ranging investments. The company’s P/E ratio currently sits at 17.26, which investors typically compare against industry averages and the company’s historical performance to gauge its valuation. Notably, Berkshire Hathaway Class A shares do not pay a dividend, with the company historically preferring to reinvest earnings back into its businesses to fuel further growth.

Looking at the longer-term perspective, the stock’s 52-week high stands at

657,497.50. Today’s closing price, while not at its 52-week peak, indicates a healthy position well within its annual trading range, suggesting underlying strength and investor belief in its intrinsic value.

Today’s gains underscore the enduring appeal of Berkshire Hathaway’s investment philosophy. As global markets continue to navigate various economic headwinds and opportunities, the stability and strategic acumen associated with the Omaha-based giant continue to attract significant investor attention. This strong daily performance serves as a testament to the conglomerate’s ability to generate value, reinforcing its status as a cornerstone investment for many portfolios.

Disclaimer: The information provided in this article is based on the market data available as of 4:00 PM GMT-4 on August 29 (interpreted as September 2, 2025, for the purpose of this report) and is for informational purposes only. It is not intended as financial advice.