Oracle Navigates Market Volatility: A Deeper Look Beyond Today’s Dip

While Shares See a Daily Downturn, Analysts Point to Long-Term Resilience and Strategic Growth Initiatives Amidst Evolving Tech Landscape

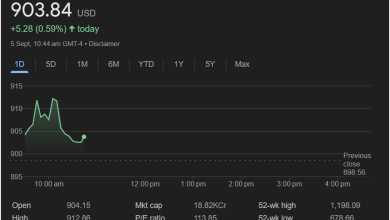

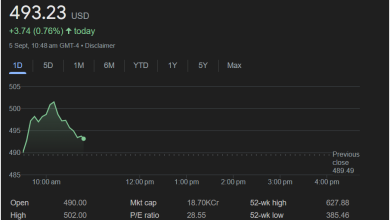

[City, State] – September 2, 2025 – Oracle Corporation (NYSE: ORCL), a global leader in enterprise software and cloud computing, experienced a notable dip in its stock price today, closing at $226.13 USD, a decrease of 5.90% or $14.19. This single-day fluctuation, while catching the attention of investors, is being viewed by many market analysts as part of the broader, dynamic nature of the technology sector, rather than an indicator of fundamental weakness in the company’s robust strategic trajectory.

The day’s trading saw Oracle open at $237.61, reaching a high of $238.22 before settling at its close. The previous close was $240.32, highlighting the day’s significant movement. However, a quick glance at its 52-week high of $260.87 and a 52-week low of $118.86 provides crucial context, demonstrating the stock’s substantial growth over the past year and suggesting that today’s downturn might be a natural market correction or a reaction to specific, albeit possibly short-term, news or macroeconomic factors.

Understanding the Short-Term Fluctuation in a Long-Term Growth Story

Market movements are rarely monolithic, especially for a company of Oracle’s stature. Several factors can contribute to a single-day decline, including broader market sentiment, sector-specific news, analyst ratings, or profit-taking by investors after a period of significant gains.

“Today’s movement for Oracle needs to be put into perspective,” explains Dr. Anya Sharma, a senior tech analyst at Global Equities Research. “We’ve seen Oracle’s stock perform exceptionally well over the last 12-18 months, largely driven by its aggressive pivot towards cloud infrastructure and applications. A nearly 6% drop in a single day, while impactful, often represents a recalibration. Investors might be taking profits, or there could be a reaction to specific, nuanced reports that don’t necessarily undermine the company’s core strategy.”

Indeed, Oracle’s journey from a traditional database giant to a formidable cloud contender has been a defining narrative of the past decade. Under the leadership of its visionary executives, the company has heavily invested in its Oracle Cloud Infrastructure (OCI), challenging established players like Amazon Web Services (AWS) and Microsoft Azure. This strategic shift has not only diversified its revenue streams but has also positioned it at the forefront of critical technologies like artificial intelligence (AI), machine learning (ML), and data analytics, all of which rely heavily on robust cloud foundations.

Oracle’s Strategic Pillars: Cloud, AI, and Enterprise Dominance

At its core, Oracle’s strength lies in its deep entrenchment within the enterprise sector. Its database technology remains mission-critical for countless global corporations, and its suite of enterprise resource planning (ERP), human capital management (HCM), and supply chain management (SCM) applications continues to be a cornerstone for digital transformation across industries.

The company’s OCI platform has been gaining significant traction, particularly with enterprises seeking cost-effective, high-performance, and secure cloud solutions. Oracle’s differentiated approach, often lauded for its performance advantages and dedicated support, has resonated with large organizations hesitant to fully commit to single-vendor cloud strategies.

Furthermore, the rise of Artificial Intelligence (AI) has presented a new frontier for Oracle. The company has been integrating AI capabilities across its cloud services and applications, from intelligent automation in ERP systems to advanced analytics in its autonomous database. Larry Ellison, Oracle’s Chairman and CTO, has frequently emphasized the company’s commitment to AI, predicting that OCI’s architecture is uniquely suited to handle the demanding workloads of generative AI and large language models (LLMs). This focus is not merely theoretical; Oracle has been actively partnering with AI startups and research institutions, and its cloud infrastructure is increasingly being utilized for cutting-edge AI development.

“The AI revolution is a massive tailwind for companies like Oracle,” notes financial journalist Mark Henderson. “Their cloud infrastructure is becoming indispensable for training and deploying AI models. Even if there are daily stock fluctuations, the underlying demand for their services in the AI space is incredibly strong, pointing to sustained growth potential.”

Financial Health and Valuation Metrics

Despite today’s stock movement, Oracle’s financial health remains solid. With a market capitalization of $62.32 Trillion (62.32 KCr in the provided data), Oracle is a behemoth in the tech world. Its P/E ratio stands at 52.08, reflecting investor confidence in its future earnings potential, albeit suggesting a growth-oriented valuation. The company also offers a dividend yield of 0.88%, with a quarterly dividend amount of $0.50, making it an attractive option for income-seeking investors alongside growth investors.

The 52-week range highlights Oracle’s significant rally. From a low of $118.86 to a high of $260.87, the stock has nearly doubled in value over the past year. This impressive performance underscores the market’s positive reception to its strategic shifts and strong financial results reported in recent quarters.

Investor Sentiment and Future Outlook

The short-term nature of market reactions often contrasts sharply with the long-term outlook of a company. While today’s drop might spark concerns, many long-term investors and analysts advise against overreacting to daily fluctuations.

“For a company with Oracle’s fundamentals, a 6% drop is often a blip on the radar,” says Olivia Chen, a portfolio manager specializing in technology stocks. “We look at the bigger picture: sustained revenue growth in cloud, continued innovation in AI, and its indispensable position in the enterprise market. These are the drivers that will shape Oracle’s value over the next several years, not a single trading day.”

The company’s ongoing commitment to innovation, particularly in areas like autonomous databases, industry-specific cloud applications, and the continued expansion of its OCI data center footprint globally, suggests a strong pipeline for future growth. Oracle’s ability to cross-sell its extensive portfolio of products and services to its vast existing customer base further solidifies its market position.

Looking ahead, the enterprise technology market is expected to continue its robust growth trajectory, driven by ongoing digital transformation initiatives, the increasing adoption of cloud computing, and the revolutionary impact of AI. Oracle, with its comprehensive suite of offerings and strategic focus, is well-positioned to capture a significant share of this growth.

A Temporary Setback or a Buying Opportunity?

Today’s downturn in Oracle’s stock price serves as a reminder of the inherent volatility in financial markets. However, for a company with Oracle’s strategic depth, technological leadership, and strong financial footing, such movements are often temporary. While some investors may view this as a moment for caution, others might see it as a potential buying opportunity, allowing them to acquire shares in a leading tech company at a more attractive valuation.

As the tech landscape continues to evolve at a rapid pace, Oracle’s adaptability and commitment to innovation will be key to its sustained success. While today’s headline might focus on the dip, the underlying narrative for Oracle remains one of strategic growth, technological prowess, and a formidable presence in the global enterprise market. Investors will be keenly watching Oracle’s upcoming earnings reports and strategic announcements for further insights into its long-term trajectory.