Intuit Stock Plummets Over 2%, Breaches Critical $700 Support Level in Heavy Sell-Off

The financial software giant faced a relentless sell-off throughout the trading day, with its high-growth valuation coming under pressure, though a slight pre-market bounce offers a glimmer of hope

August 20, 2025 – Shares of Intuit Inc. (NASDAQ: INTU), the company behind popular financial software like TurboTax and QuickBooks, experienced a significant downturn on Tuesday, August 19, 2025. The stock was hit by sustained selling pressure that pushed it below a key psychological threshold, reflecting a sharp negative turn in investor sentiment for the high-flying tech name.

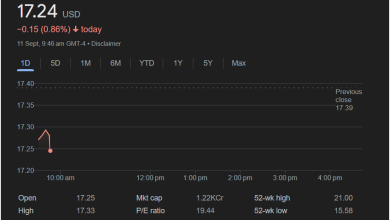

Intuit’s stock closed the official trading session at

16.27, or 2.27%, from the previous day’s close of $717.21. While the stock managed to reclaim the $700 level by the bell, its intraday dip and the overall bearish trend of the day have put investors on high alert.

Anatomy of a Downtrend: A Day Controlled by Sellers

The trading session for Intuit was a clear demonstration of bearish control from start to finish.

The day began with a “gap down” open at $715.08, already more than $2 below the prior close, signaling negative sentiment had built up overnight. In the first few minutes of trading, there was a brief and deceptive spike upwards, with the stock hitting its session high of $719.10. This move, which momentarily pushed the stock into positive territory, proved to be a “bull trap,” as it was immediately and decisively rejected.

From that morning peak, the stock began a steady and persistent decline that would last for the rest of the day. The share price trended consistently lower, making a series of “lower highs” and “lower lows” on the intraday chart—a classic sign of a market dominated by sellers.

The selling pressure intensified in the afternoon, culminating in the stock breaking below the critical, psychological $700 level. It hit its intraday low of $698.77, a moment that likely triggered stop-loss orders and heightened investor anxiety. In the final minutes of trading, a small wave of buying interest emerged, allowing the stock to stage a minor bounce and close just above the $700 mark. However, closing near the session’s low after a failed morning rally paints a decidedly bearish picture for the day.

Pre-Market Rebound Offers a Tentative Reprieve

In a potentially encouraging sign for the bulls, pre-market activity ahead of the next session indicated a slight recovery. Intuit shares were quoted at

1.55 (0.22%) from the official close.

This modest uptick could suggest that some investors view the sell-off as a buying opportunity or that the negative catalyst from the previous day has begun to fade. However, pre-market moves can be fickle, and investors will be watching the opening bell closely to see if this initial strength can hold against any residual selling pressure.

High-Growth Valuation Under the Microscope

The significant sell-off puts Intuit’s premium valuation into sharp focus. Understanding its financial metrics is key to understanding the day’s price action.

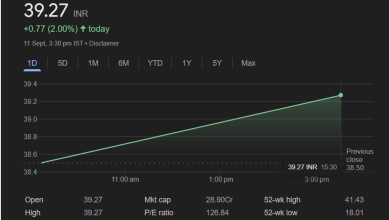

Market Capitalization (Mkt cap): 19.56KCr

This figure, likely represented in Indian Crores, translates to a very large $195.6 Billion USD. This places Intuit among the top tier of software-as-a-service (SaaS) companies, reflecting its dominant market position in personal and small business finance software.

P/E Ratio: 57.04

This is the most critical metric for understanding Intuit’s stock narrative. A Price-to-Earnings (P/E) ratio of 57.04 is high and places Intuit squarely in the “growth stock” category. It means that investors are willing to pay $57 for every dollar of the company’s annual earnings. This lofty valuation is based on strong expectations for continued rapid growth in its subscriber base and the expansion of its financial technology platform.

However, a high P/E ratio also makes a stock vulnerable. When market sentiment turns negative or there are concerns about future growth, high-valuation stocks are often the first to be sold off as investors rotate into safer, less expensive assets. Tuesday’s 2.27% drop is a classic example of this dynamic.

Dividend Yield: 0.59%

The dividend yield is very modest at 0.59%. This is typical for a growth-focused company like Intuit. The company’s strategy is to reinvest the vast majority of its profits back into the business—to fund R&D, marketing, and strategic acquisitions—rather than paying out a large dividend. Investors in Intuit are primarily seeking capital appreciation, not income.

Quarterly Dividend Amount (Qtrly div amt): $1.03

This is the cash value of the quarterly dividend, which, while small in yield terms, has been consistently grown by the company over time.

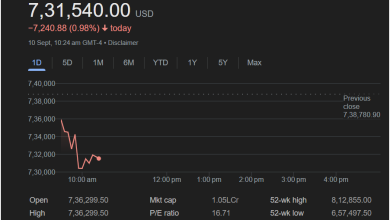

The 52-Week Context: A Pullback From a Lofty Position

To properly contextualize Tuesday’s sell-off, it is essential to look at the stock’s performance over the past year.

-

52-Week High: $813.48

-

52-Week Low: $532.64

The closing price of $700.94, while a painful drop for the day, still positions the stock well above its 52-week low. It is up a substantial 31% from its yearly bottom, highlighting the powerful rally the stock has enjoyed.

However, the stock is now trading approximately 14% below its 52-week high, placing it firmly in “correction” territory. Tuesday’s decline is not an isolated event but rather a continuation of a pullback from its peak, suggesting that investors are reassessing its high valuation.

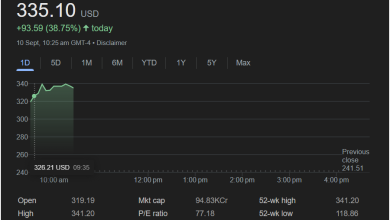

Outlook: A Test for a Market Leader

The sharp sell-off in Intuit’s shares likely reflects broader market concerns about high-growth technology stocks, possibly fueled by macroeconomic data, interest rate fears, or sector-specific news.

Investors will now be closely watching several key factors:

-

Small Business Health: The performance of Intuit’s QuickBooks ecosystem is a direct proxy for the health of small and medium-sized businesses (SMBs).

-

Tax Season Performance: The success of the TurboTax franchise is a major seasonal revenue driver.

-

Competitive Landscape: The fintech space is increasingly crowded, and Intuit’s ability to innovate and maintain its market leadership is paramount.

In conclusion, the trading session on August 19 served as a stark reminder of the risks associated with high-valuation growth stocks. The breach of the $700 level was a technically significant event that has put the bears in control in the short term. The stock’s ability to hold this level and build on its pre-market bounce will be the key test in the days ahead.