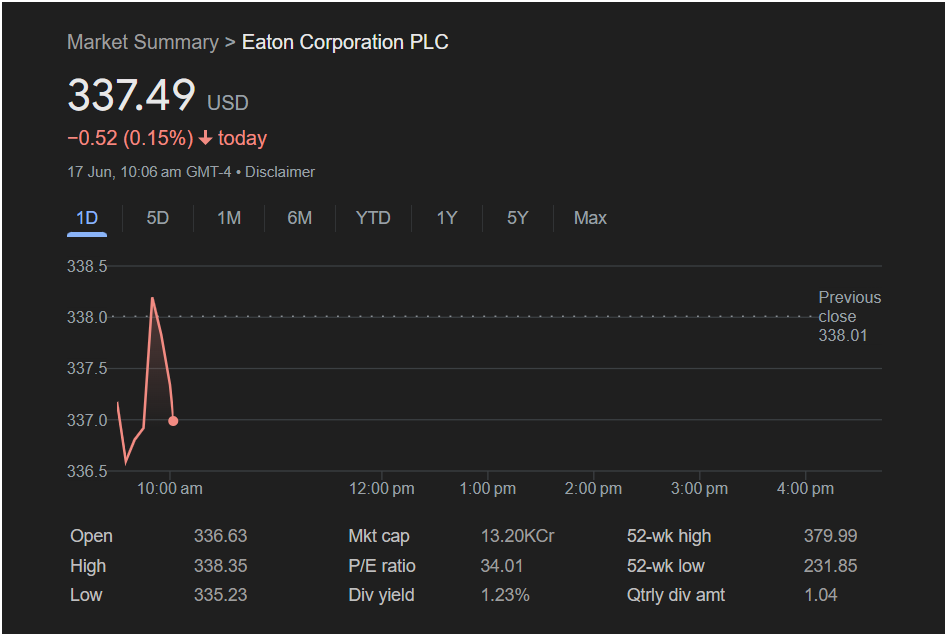

Eaton Corporation Stock Shows Intense Volatility Monday: Key Levels to Watch

Eaton Corporation PLC (NYSE: ETN) stock experienced a turbulent start to the trading week, with shares swinging dramatically in the opening hour on Monday, June 17th. For traders trying to navigate the session, the early price action has provided both warning signs and potential opportunities.

Today’s Market Action: A Rollercoaster Session

As of 10:06 am GMT-4, Eaton’s stock was trading at

0.52 (0.15%). However, this small change masks a story of significant intraday volatility.

The stock opened at $336.63, gapping down from the previous close of

335.23**. At that point, buying interest surged, driving the stock on a sharp rally all the way to a high of $338.35, briefly pushing it into positive territory for the day. This “V-shaped” recovery from the lows indicates that dip-buyers were active, though sellers re-emerged at the highs, pushing the price back down to its current level.

This battle between buyers and sellers has defined the early session, making it crucial for investors to monitor key price levels.

Key Financial Metrics for Investors

Understanding the fundamental picture is essential for any investment decision. Here are the vital statistics for Eaton Corporation:

-

Market Capitalization: 13.20KCr (This regional notation translates to a market cap of approximately $135 Billion USD), establishing Eaton as a large-cap industrial powerhouse.

-

P/E Ratio: The stock’s Price-to-Earnings ratio stands at 34.01. This valuation reflects solid investor confidence in the company’s earnings power and future growth prospects.

-

52-Week Range: Over the past year, ETN has traded between a low of

379.99. The current price is near the top of this range, highlighting the stock’s strong performance over the last 12 months.

-

Dividend Information: Eaton offers a reliable dividend yield of 1.23%, with a quarterly dividend of $1.04 per share, making it attractive to income-focused investors.

Should You Invest Today? Outlook for Monday

The sharp rebound from the morning low is a bullish sign, suggesting strong underlying support for the stock. However, the failure to hold the daily high indicates that resistance remains.

-

The Bullish Case: If Eaton stock can hold above the morning low (

338.35) and the previous close ($338.01), it could signal a continuation of its long-term uptrend. The morning dip may have been a healthy consolidation before the next move up.

-

The Bearish Case: If the stock fails to regain upward momentum and breaks below the $335.23 low, it could be a sign of a short-term trend reversal, potentially leading to further declines.

for Traders:

Given the high volatility, caution is advised.

-

Day traders should watch the session’s high and low as critical inflection points. A decisive move above or below these levels could dictate the trend for the rest of the day.

-

Long-term investors might view the morning dip as a potential buying opportunity to enter a fundamentally strong company. The solid dividend and strong market position support a positive long-term outlook. However, waiting for the price to stabilize before committing capital may be a more prudent approach.

The key takeaway from Monday’s early trading is the presence of both strong buying support and notable selling pressure. The direction the stock takes from here will likely depend on which side wins this intraday battle.

Disclaimer: This article is for informational purposes only, based on the data provided in a single screenshot. It should not be considered financial advice. All investors should conduct their own due diligence and consult with a qualified financial professional before making any investment decisions.