UnitedHealth Gains Ground, But Late-Day Weakness Raises Red Flags for Monday

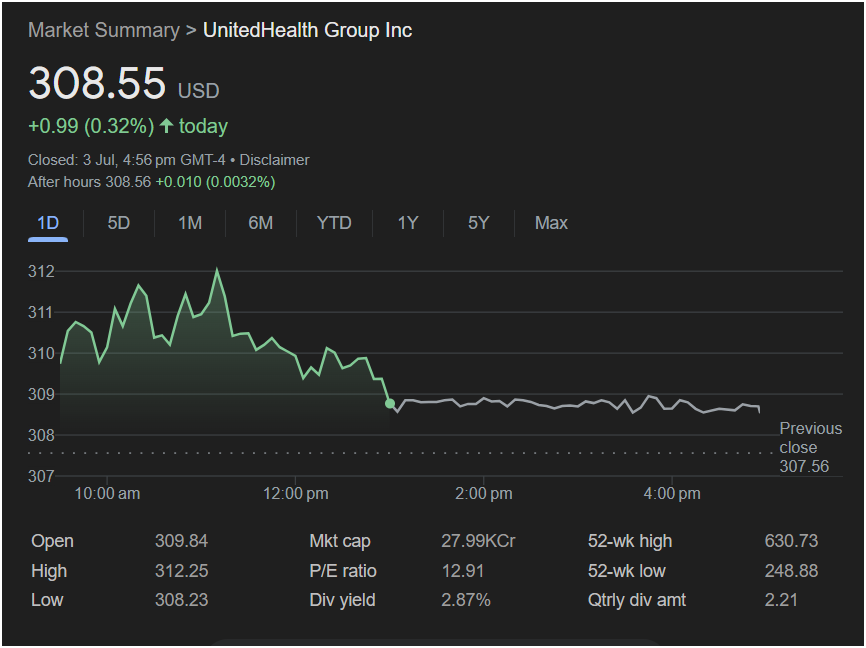

MINNETONKA, MN – Health insurance giant UnitedHealth Group Inc. (NYSE: UNH) finished Friday’s trading session in positive territory, but a story of morning strength followed by a significant afternoon fade has cast a shadow of uncertainty over Monday’s market open. The stock closed at $308.55, a gain of 0.32%, yet this final figure hides a day where sellers ultimately seized control.

The market opened with vigor for UnitedHealth, with the stock quickly surging from its open of

312.25**. This early rally, however, proved unsustainable. By early afternoon, the stock had completely reversed course, shedding all its gains and falling to a low of $308.23.

For the remainder of the session, UnitedHealth entered a period of tight consolidation, trading flat just above its daily low. While it managed to close above the previous day’s finish of $307.56, the inability to recover any of the lost ground is a concerning signal for investors. A minuscule gain in after-hours trading did little to change the cautious sentiment.

The Outlook for Monday:

The case for a downward trend (Bearish):

-

The stock’s close was significantly below both its high (

309.84), a classic sign that sellers dominated the day’s action despite the positive closing number.

-

The trend in the second half of the day was clearly negative, and the stock showed no buying power to fight back against the sell-off.

-

The flat trading in the afternoon suggests buyer exhaustion, which could carry over into Monday’s session.

The case for an upward trend (Bullish):

-

The stock successfully held support above its daily low and, more importantly, above the previous day’s close.

-

A positive close, however small, can still provide a psychological boost for the bulls.

-

The lack of further selling in the after-hours session suggests the immediate downward pressure may have subsided.

While UnitedHealth officially ended the day with a win, the underlying price action tells a more bearish story. The impressive morning rally completely unraveled, showing that sellers are actively resisting prices above the

312 range. The momentum is tilted to the downside heading into Monday.

Traders will be closely monitoring the opening bell. If the stock opens below Friday’s close and challenges the low of

309.84 opening level to prove that Friday’s fade was a one-off event.

Disclaimer: This article is for informational purposes only and is based on the data provided in the screenshot. It does not constitute financial advice. Investors should conduct their own research before making any trading decisions.