Coca-Cola Rallies but Late-Day Fade Casts Shadow on Monday’s Outlook

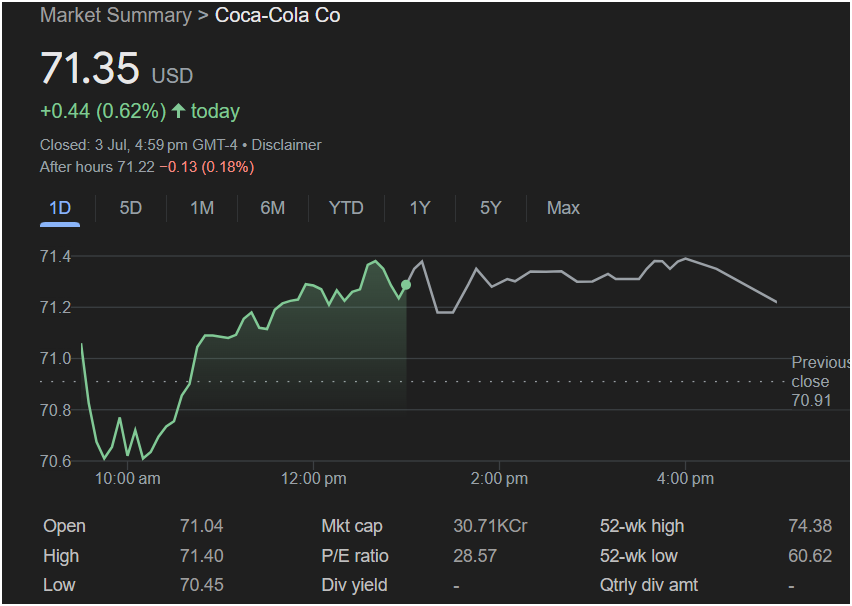

NEW YORK – The Coca-Cola Co (KO) finished Wednesday’s trading session on a positive note, but signs of waning momentum into the close suggest the beverage giant could face headwinds when the market reopens next week. The stock closed at

0.44 (0.62%).

The day began with a sharp dip, with Coca-Cola’s shares hitting a low of $70.45 in early trading. However, buyers responded with vigor, driving a powerful rally that saw the stock climb to a session high of $71.40 by early afternoon. This strong recovery demonstrated significant investor appetite for the blue-chip stock.

Despite the impressive rally, the momentum stalled in the latter half of the day. After peaking, the stock failed to push higher and instead began a slow, steady drift downward into the closing bell. This late-day weakness was further confirmed in after-hours trading, where the stock slipped an additional $0.13 (0.18%) to $71.22.

Outlook for Monday:

The technical signals from Wednesday’s trading chart point toward a potential for downward pressure on Monday.

While the overall gain is positive, the end-of-day price action is often a more reliable indicator of near-term sentiment. Here’s why caution is warranted:

-

Failure at the Peak: The stock’s inability to hold its session high of $71.40 indicates that buying power was exhausted at that level, and sellers began to take control.

-

Negative Closing Momentum: The price trended lower for the final three hours of the session, a bearish signal that momentum had shifted.

-

After-Hours Decline: The continued dip in after-hours trading reinforces the idea that sellers were still active after the market closed, suggesting this sentiment may carry over.

Investors should watch the $71.40 level closely on Monday. If Coca-Cola’s stock fails to reclaim this high early in the session, it is likely to trend lower as the market digests the late-day profit-taking from before the holiday weekend.