Wells Fargo Surges Over 1.6% as Compelling Value and Strong Dividend Attract Buyers

The banking giant's exceptionally low P/E ratio and robust 2.28% yield highlight its appeal as a top-tier value and income play, driving the stock higher in a strong session

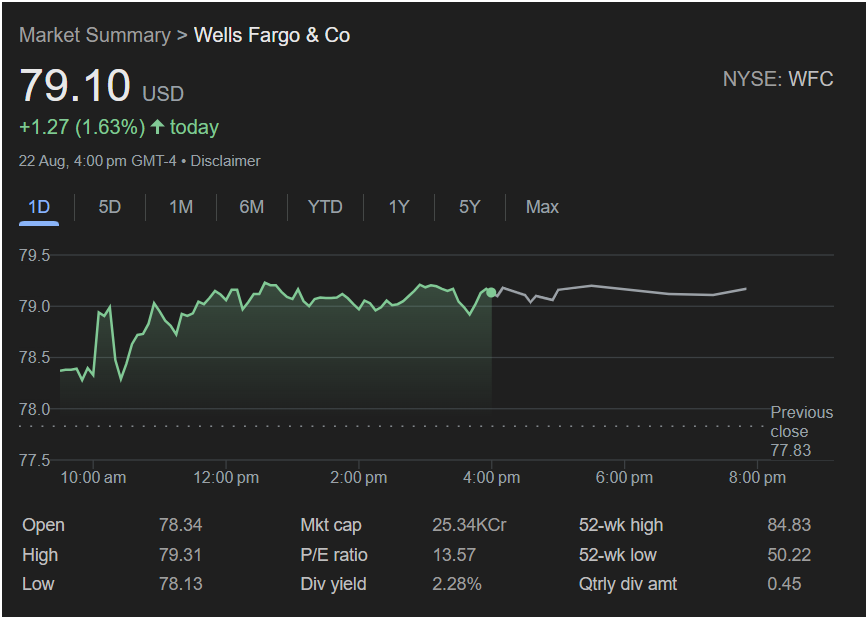

SAN FRANCISCO – August 25, 2025 – Wells Fargo & Co (NYSE: WFC) showcased its immense appeal to investors on Friday, with its stock climbing an impressive 1.63% to close the session at

1.27 was driven by a wave of buying as the market increasingly focuses on high-quality companies that offer a powerful combination of value, income, and stability.

The session was marked by consistent buying pressure and underlying strength. After opening at $78.34, significantly above the previous close of

79.31** and found solid support at its low of $78.13, which was still comfortably above the prior day’s close. This ability to hold its gains highlights deep investor conviction in the bank’s current trajectory.

The Hallmark of a Classic Value Stock

Perhaps the most compelling aspect driving investor interest in Wells Fargo is its exceptionally low Price-to-Earnings (P/E) ratio of just 13.57. In today’s market, this figure is a clear hallmark of a classic value stock, suggesting that its share price is highly attractive relative to its strong and consistent earnings power. For investors seeking to buy into a premier financial institution without paying a speculative premium, Wells Fargo presents a standout opportunity.

A Cornerstone for Income Portfolios

Adding to this potent combination is Wells Fargo’s robust dividend, which makes it a cornerstone for income-oriented portfolios. The company boasts a healthy dividend yield of 2.28%, supported by a reliable quarterly dividend of $0.45 per share. This commitment to returning capital to shareholders underscores the bank’s strong financial position, predictable cash flow, and confident management outlook.

A Phenomenal Year of Growth

Friday’s strong performance is part of a phenomenal turnaround story for the financial giant over the past year. The stock has rallied an incredible 57% from its 52-week low of $50.22, rewarding shareholders who recognized the company’s deep value. While it continues to climb towards its 52-week high of $84.83, the current momentum suggests that milestone is well within reach.

“Wells Fargo is checking every box for a smart investment in this climate,” commented a financial sector strategist. “You have a rock-bottom P/E ratio, a fantastic dividend yield, and a chart that shows clear, sustained momentum. Today’s performance isn’t a fluke; it’s a textbook example of the market recognizing superior quality and value.”

With a massive market capitalization of over $253 billion (25.34KCr), Wells Fargo is not just performing well—it’s reasserting its dominance as a go-to name for stability, income, and value in the financial world.