Verizon Communications Inc. Stock Price Update: A Steady Yet Subtle Rise Amidst Market Dynamics

Understanding Verizon Communications Inc. and Its Market Position

Verizon Communications Inc. (NYSE: VZ) is one of the largest telecommunications companies in the United States, providing wireless services, broadband, and digital television. The company plays a critical role in the country’s infrastructure, with a broad customer base ranging from individual consumers to businesses and government entities.

Verizon’s consistent presence in the market is backed by its aggressive investment in next-generation technologies, particularly in 5G networks. As the world moves closer to a more connected future, companies like Verizon are positioned to benefit from the increasing demand for high-speed data and more advanced digital solutions.

A Closer Look at Today’s Market Movement

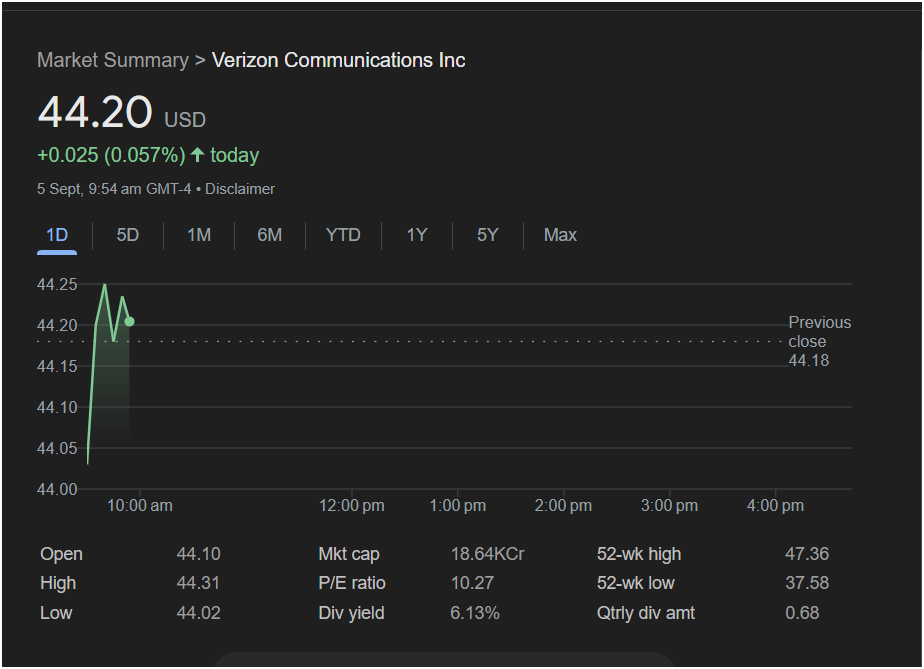

As of September 5th, Verizon Communications Inc. opened at $44.10, marking a stable start to the trading day. By 9:54 AM GMT-4, the stock price reached $44.20, reflecting a +0.025 USD increase, or a modest 0.057% rise. While this gain is relatively small, it is an indication of slight bullish sentiment, given the broader market environment and the current state of the telecommunications sector.

The early stock chart indicates that Verizon’s price movement today has been relatively stable, with a brief upward spike just after market open, peaking at $44.31 before settling down closer to $44.20. Such fluctuations may be influenced by investor reactions to news or data releases, although the movement does not suggest any significant volatility in the stock at this time.

Key Metrics to Watch: The Financial Health of Verizon

Opening Price vs. Intraday Range

- Open: $44.10

- High: $44.31

- Low: $44.02

The stock’s opening price at $44.10 is near its intraday low, signaling that the stock started off slightly below the day’s average. The high of $44.31 during the morning session indicates a brief upward movement, followed by a slight pullback to its current price, reflecting a minor but notable market reaction.

Comparing with Previous Close

Verizon’s price has moved up from the previous day’s close of $44.18, showing a minor gain of +0.025 USD. This upward shift may suggest a slight optimism among investors, albeit in a cautious manner, considering the generally low percentage change of just 0.057%.

Evaluating Verizon’s Valuation: Key Financial Indicators

Market Capitalization

With a market cap of 18.64KCr (approximately $186.4 billion, depending on currency formatting), Verizon remains a heavyweight in the telecommunications sector. Its market cap signifies the scale of the company, which continues to benefit from a broad customer base across multiple sectors, including retail, enterprise, and government.

P/E Ratio and Dividend Yield

- P/E Ratio: 10.27

- Dividend Yield: 6.13%

- Quarterly Dividend Amount: $0.68

Verizon’s P/E ratio of 10.27 suggests that the stock is trading at a relatively low valuation compared to its earnings, which may indicate undervaluation or potential for long-term growth. Meanwhile, the dividend yield of 6.13% remains attractive to income-focused investors, reinforcing Verizon’s position as a stable dividend payer. The quarterly dividend amount of $0.68 indicates Verizon’s commitment to delivering shareholder value, which is often viewed favorably in a low-interest-rate environment.

52-Week Range: A Year of Stability and Opportunity

- 52-Week High: $47.36

- 52-Week Low: $37.58

The current stock price of $44.20 is comfortably positioned between Verizon’s 52-week high of $47.36 and its 52-week low of $37.58, signifying a relatively stable year for the company in terms of stock price. Verizon’s stock has had room to grow, but it has also faced challenges, as is common in the telecommunications industry, where significant capital expenditures and regulatory pressures can often impact price movements.

Analyzing the Subtle Price Action: Market Forces at Play

The modest 0.057% increase in Verizon’s stock price suggests that investor sentiment may currently be somewhat neutral. This could be due to various factors, including broader market conditions, news flow, and investor expectations surrounding the company’s upcoming earnings report or other corporate announcements.

It is important to note that Verizon, like many large-cap stocks, often experiences stable but less volatile price movements compared to smaller or more speculative companies. The relatively small uptick in stock price might indicate that investors are waiting for more concrete signals from the company’s next earnings or strategic initiatives to drive further growth.

The Role of Technology and 5G in Verizon’s Future

One of the key drivers for Verizon in recent years has been its continued investment in 5G technology. Verizon has committed significant resources to building out its 5G network, which has the potential to drive growth in both the consumer and enterprise markets. The rollout of 5G networks is seen as a transformative moment in telecommunications, and Verizon’s leadership in this space could provide a long-term growth catalyst.

In addition to 5G, Verizon is also investing in fiber-optic networks, internet of things (IoT) solutions, and edge computing, all of which are expected to be critical components of the next generation of digital services.

As Verizon continues to focus on expanding its 5G infrastructure, it stands to benefit from a broader shift toward data-driven technologies and connected devices, potentially providing a stable revenue stream from both its consumer and business segments.

Macroeconomic Factors and Their Impact on Verizon

While Verizon operates in a relatively stable industry, it is not immune to broader economic conditions. Macroeconomic factors such as interest rates, inflation, and regulatory changes can affect consumer spending behavior, business demand for services, and overall market sentiment.

For instance, if inflation remains high or interest rates continue to rise, consumers and businesses may tighten their budgets, which could lead to slower growth for telecommunications providers. Conversely, Verizon’s strong position in the 5G and broadband spaces may buffer it against some of these risks, as the demand for high-speed internet and mobile services is expected to remain robust.

Verizon’s Competitive Landscape

Verizon operates in a highly competitive environment, with major rivals like AT&T, T-Mobile, and smaller players in the wireless and broadband markets. The competitive landscape is characterized by fierce pricing wars, innovation in service offerings, and ongoing technological investments.

One of Verizon’s strategic advantages is its network reliability. The company consistently ranks highly for network performance in the U.S., which helps retain existing customers and attract new ones. This competitive edge could prove essential as consumers and businesses continue to prioritize reliable connectivity in an increasingly digital world.

Investor Sentiment and Institutional Activity

Verizon’s steady market performance today suggests that investors are cautiously optimistic about the company’s prospects, though no major excitement is evident. The company’s large institutional following, with ownership by numerous pension funds, mutual funds, and hedge funds, likely provides a level of stability to its stock price.

Institutional investors, who typically hold longer-term views, may be assessing Verizon’s ability to sustain its dividend yield and return on investment while simultaneously capitalizing on 5G and broadband expansion.

Open-Ended Thoughts: The Ongoing Investor Debate

Like many large-cap stocks, Verizon’s price today represents just a single data point in the broader conversation about its long-term viability and growth prospects. The company faces both challenges and opportunities ahead, and it remains a key stock to monitor for any strategic shifts, technological advancements, or market disruptions that may drive its future performance.

Let me know if you’d like to dive deeper into specific areas, such as:

- 5G rollout progress and industry impact

- Verizon’s debt management and fiscal health

- Quarterly earnings breakdown and expectations

- Impacts of regulatory changes on Verizon’s operations

- Customer satisfaction and brand loyalty metrics

- Technological innovation and future market positioning

Feel free to guide me toward expanding on any of these or other aspects you’d like to explore further.