UnitedHealth Group Experiences Slight Dip Amidst Sector Scrutiny

UNH Shares Close Down 0.52% to $302.29 on August 29th, Highlighting Market Adjustments in Healthcare

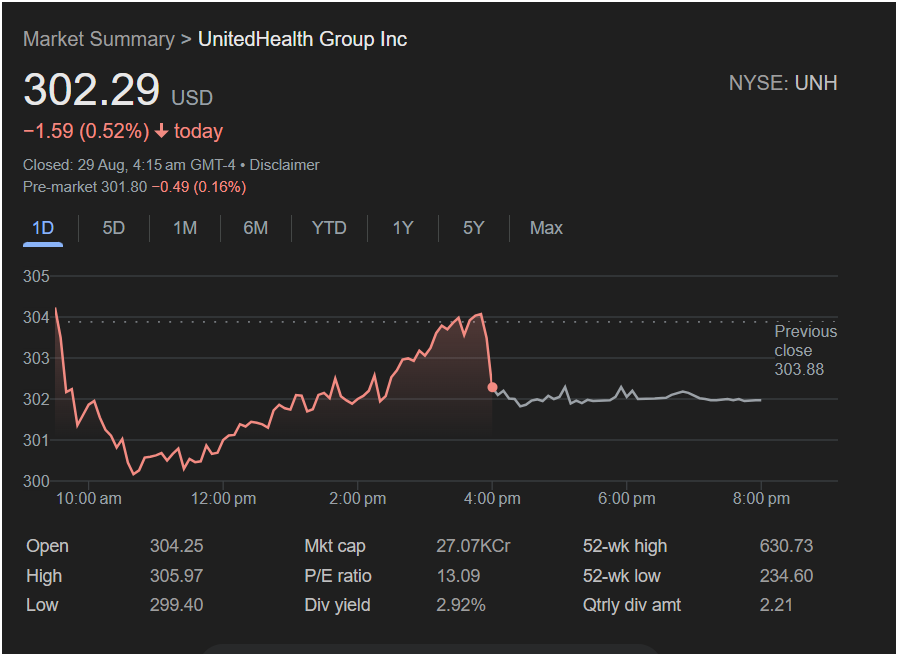

Minnetonka, MN – August 29, 2025 – UnitedHealth Group Inc. (NYSE: UNH), a bellwether in the managed healthcare and insurance industry, saw its shares close modestly lower today, finishing the trading session at $302.29. This represents a decline of $1.59, or 0.52%, from its previous close, signaling a day of slight retrenchment for the healthcare giant.

The day began with UNH opening at $304.25, building on its prior close of $303.88. Throughout the trading session, the stock reached an intra-day high of $305.97 before finding its low point at $299.40. The intraday chart shows a significant drop around 4:00 PM GMT-4, pushing the stock into negative territory for the day. This late-day movement suggests a reaction to specific market news or a general shift in investor sentiment regarding the healthcare sector.

Pre-market trading further indicated caution, with shares trading at $301.80, down $0.49 or 0.16% from the official close. This minor pre-market dip suggests continued scrutiny of the company’s outlook.

Financially, UnitedHealth Group commands a substantial market capitalization of 27.07 KCr. The company’s Price-to-Earnings (P/E) ratio stands at a reasonable 13.09, suggesting a more value-oriented investment compared to high-growth tech stocks, reflecting its mature and stable position within the healthcare industry.

A significant aspect of UNH’s appeal to investors is its consistent dividend. The company boasts a healthy dividend yield of 2.92%, with a quarterly dividend amount of $2.21, making it an attractive option for income-focused portfolios.

Over the past year, UNH has experienced considerable fluctuation, with its 52-week high reaching $630.73 and its 52-week low at $234.60. This broad range underscores the dynamic nature of the healthcare market, influenced by regulatory changes, technological advancements, and evolving patient needs.

As healthcare remains a central theme in national discourse, UnitedHealth Group’s performance will continue to be closely watched. Today’s slight downturn could be interpreted as a natural market correction or a response to broader industry pressures, rather than a fundamental shift in the company’s strong long-term position.