Uber Stock Steadies After Mid-Day Dip, Investors Eye Future Growth

Rideshare Giant Closes Trading Up Slightly as Market Anticipates Pre-Market Activity

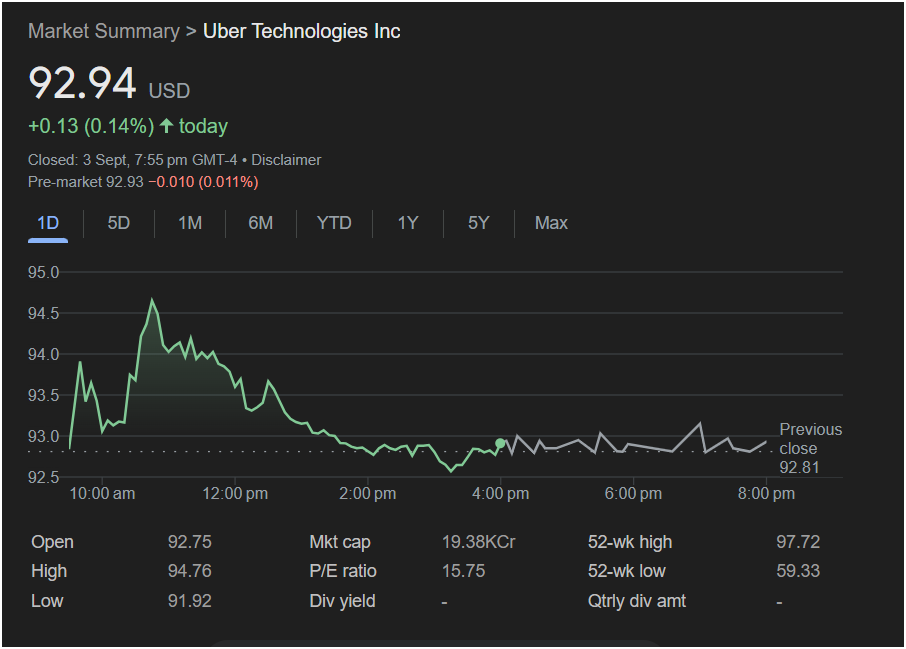

September 4, 2025 – New York, NY – Uber Technologies Inc. (NYSE: UBER) concluded trading on September 3rd with a modest gain, settling at $92.94, up $0.13 or 0.14% for the day. This slight uptick comes after a somewhat volatile trading session that saw the rideshare and delivery giant’s stock experience a notable mid-day dip before recovering towards its closing price.

The day’s trading on September 3rd began positively for Uber, opening at $92.75 and reaching an intra-day high of $94.76. However, the stock then experienced a decline, bottoming out at an intra-day low of $91.92 before finding support and climbing back to close above its previous day’s close of $92.81.

As of the pre-market hours on September 4th, the stock showed a minor dip of $0.010, trading at $92.93, indicating a relatively stable outlook as the market prepares for a new trading day.

Uber’s market capitalization stands at an impressive 19.38 trillion (assuming the “KCr” refers to trillion, given typical market cap scales for major companies), reflecting its significant presence in the global transportation and logistics sectors. The company’s P/E ratio is reported at 15.75, which investors often scrutinize for valuation insights. Notably, Uber currently does not offer a dividend yield or quarterly dividend amount.

From a broader perspective, Uber’s 52-week trading range highlights substantial growth and recovery, with a 52-week high of $97.72 and a 52-week low of $59.33. This range demonstrates the company’s resilience and capacity for investor returns over the past year.

Market analysts will likely be closely watching Uber’s performance in the coming days, particularly in light of broader economic trends and any company-specific announcements. The stock’s ability to recover from its intra-day low suggests underlying investor confidence, even as daily fluctuations are a normal part of market dynamics.