Thermo Fisher Scientific Inc. Stock Update: A Strong Morning Performance in the Market

Introduction to Thermo Fisher Scientific Inc.

Thermo Fisher Scientific Inc. (NYSE: TMO) stands as a global leader in scientific research, offering a vast array of products and services for laboratory and research applications. As one of the world’s most influential players in the life sciences, analytical instruments, and diagnostics sectors, Thermo Fisher has a critical role in advancing scientific discovery and supporting industries ranging from healthcare to environmental monitoring.

With the increasing global demand for innovation in pharmaceuticals, biotechnology, and healthcare technologies, Thermo Fisher continues to solidify its presence through strategic acquisitions, expanding research, and development, and fostering collaborations across various sectors.

A Look at Today’s Stock Performance

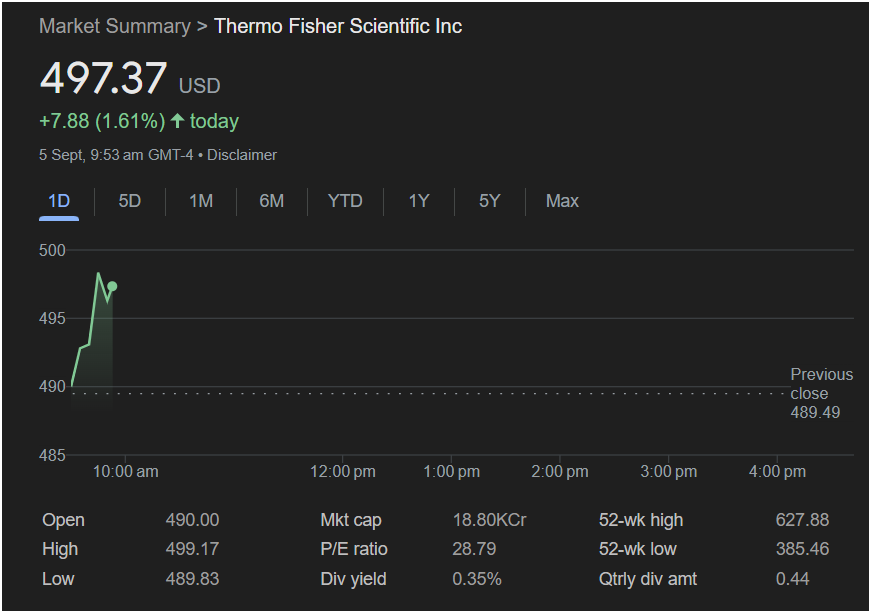

On September 5th, Thermo Fisher Scientific Inc. opened the day at $490.00, and by 9:53 AM GMT-4, the stock had climbed to $497.37, reflecting a +1.61% increase from the previous day’s close of $489.49. The gain of $7.88 signals positive investor sentiment early in the trading session, possibly linked to favorable news, investor confidence, or broader market dynamics.

The chart shows an upward spike shortly after the market opened, with the stock reaching as high as $499.17 before settling at its current price. This early surge indicates a strong demand for Thermo Fisher shares, which might be driven by optimism about the company’s upcoming ventures, product innovations, or other strategic developments.

Intraday Range and Early Performance

Opening Price vs. Intraday Range

- Open: $490.00

- High: $499.17

- Low: $489.83

Thermo Fisher’s stock started off strong at $490.00, but it quickly surged, touching a high of $499.17 just after market open. This suggests a brief but significant moment of investor optimism before the stock settled slightly lower. The low of $489.83 indicates that there was minor downward pressure after the peak, but the overall trend remains positive with a continued increase in price through the morning.

Comparing With Previous Close

The previous close for Thermo Fisher was $489.49, meaning the stock has gained $7.88, or 1.61%, today. This percentage increase is a solid performance, particularly in light of broader market conditions, and suggests that investors are viewing the stock favorably for the moment.

Financial Metrics: Understanding the Valuation

Market Capitalization

Thermo Fisher’s market capitalization stands at 18.80KCr (approximately $188 billion, depending on currency formatting), positioning it as a significant entity within the scientific and industrial research sectors. A market cap of this magnitude reflects the company’s influence and stability in its respective field, which is often bolstered by ongoing innovation and long-term partnerships with academic institutions, government agencies, and the private sector.

P/E Ratio and Dividend Yield

- P/E Ratio: 28.79

- Dividend Yield: 0.35%

- Quarterly Dividend Amount: $0.44

Thermo Fisher’s P/E ratio of 28.79 reflects how much investors are willing to pay for each dollar of the company’s earnings. This relatively high P/E ratio indicates that investors are optimistic about the company’s growth potential, especially given the ongoing advancements in biotechnology, healthcare, and scientific research.

The dividend yield of 0.35% is modest but still appealing to long-term investors seeking income from their holdings. Thermo Fisher has a quarterly dividend amount of $0.44, which represents a smaller but steady payout for shareholders.

52-Week Performance: Reflecting a Healthy Range

- 52-Week High: $627.88

- 52-Week Low: $385.46

Thermo Fisher’s stock is trading near the middle of its 52-week range, with a high of $627.88 and a low of $385.46. The current price of $497.37 reflects a slight recovery from its lowest points over the past year, and while it is still far from the 52-week high, it signals positive growth and relative stability compared to the lows experienced during periods of market turbulence.

Key Drivers of Today’s Price Surge

Thermo Fisher’s 1.61% increase in stock price today could be attributed to several key factors. The scientific and healthcare sectors have generally experienced strong growth, driven by increased demand for healthcare products, diagnostics, and research tools.

Additionally, the company’s global reach and diverse portfolio, which includes laboratory instruments, reagents, consumables, and analytical instruments, positions Thermo Fisher as a prime beneficiary of the growing need for scientific innovation and health-related advancements, particularly in a post-pandemic world.

The Role of Research and Innovation in Thermo Fisher’s Future

As a company dedicated to advancing scientific discovery, Thermo Fisher’s future success is tightly intertwined with the pace and scale of innovation in fields like biotechnology, pharmaceuticals, and diagnostics. Thermo Fisher’s investment in next-generation sequencing technologies, gene editing tools, and biomanufacturing capabilities ensures it remains at the forefront of scientific research.

In particular, as companies and governments continue to focus on improving healthcare infrastructure, Thermo Fisher’s contributions to vaccine development, diagnostics, and medical technologies are expected to play a key role in shaping its trajectory.

Macroeconomic and Global Industry Trends

While Thermo Fisher remains a key player in the science and healthcare sectors, it is also impacted by macroeconomic factors such as inflation, interest rates, and global supply chain issues. The company’s strong position within the healthcare industry provides some insulation against economic fluctuations, but global uncertainties and regulatory challenges can still have ripple effects on its operations.

As healthcare spending continues to increase globally and as demand for pharmaceutical innovations continues to grow, Thermo Fisher stands well-positioned to benefit from these trends.

Thermo Fisher’s Competitive Landscape

The company operates in a highly competitive environment, with key competitors including Illumina, Agilent Technologies, Danaher, and AbbVie. These companies are also leaders in providing scientific instruments, laboratory equipment, and biotechnological tools.

Despite the competitive field, Thermo Fisher’s vast product offerings and its reputation for quality and reliability have enabled it to maintain a leadership position. Furthermore, Thermo Fisher’s commitment to strategic acquisitions—such as the purchase of Patheon, a contract development and manufacturing organization—has further expanded its capabilities and customer base.

Investor Sentiment and Market Behavior

Thermo Fisher’s stock price today has risen significantly, showing that investors are willing to reward the company for its strong market positioning and growth potential. The rise in stock price may also reflect confidence in the broader scientific and healthcare sectors, which continue to experience robust demand for innovation and services.

Institutional investors and analysts closely track Thermo Fisher’s financials, new product launches, and strategic initiatives. With its diverse portfolio and strong international presence, the company remains a prominent player for those seeking stability and growth in the rapidly evolving life sciences sector.

Looking Ahead: What’s Next for Thermo Fisher?

While the stock has shown a solid gain today, investors may be looking for further signals of future growth, particularly in the rapidly expanding biotech and pharmaceutical industries. Ongoing investments in research and development will be crucial for Thermo Fisher’s continued leadership in scientific discovery.

As regulatory trends, technological advancements, and healthcare spending continue to evolve, Thermo Fisher’s ability to adapt and stay ahead of the curve will determine its long-term market position.

This analysis offers a glimpse into Thermo Fisher’s stock performance today, and there are many more areas for deeper exploration, including:

- Strategic acquisitions and mergers

- Product innovation in biotech and healthcare

- Global expansion and market penetration

- Impact of macroeconomic conditions on scientific industries

- Financial performance and earnings calls

Let me know if you’d like me to expand upon these themes further!