Texas Instruments Navigates Market Fluctuations with Underlying Strength

Semiconductor Giant Shows Resilience Amidst Daily Market Movement, Analysts Eye Long-Term Value

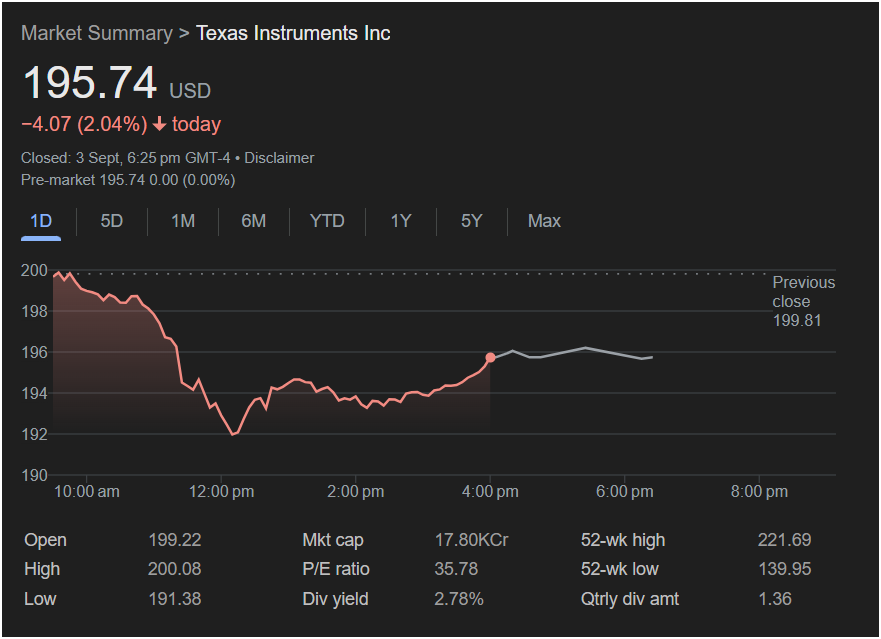

Dallas, TX – September 4, 2024 – Texas Instruments Inc. (TI), a cornerstone in the global semiconductor industry, experienced a day of notable activity on Wednesday, September 3rd, with its stock closing at $195.74 USD, down 2.04% for the day. While the initial dip might catch the eye, a closer look at the intraday performance and the company’s robust fundamentals suggests a narrative of resilience and continued long-term investor confidence.

The trading day for TI began at $199.22, climbing briefly to a high of $200.08 before experiencing a decline that saw the stock hit a low of $191.38. However, the latter half of the trading session demonstrated a healthy recovery, with the share price steadily climbing back to nearly $196 before the market closed. This afternoon rebound indicates a strong buying interest, preventing a more significant downturn and signaling that investors are quick to recognize value in the chipmaker’s shares.

Market capitalization for Texas Instruments stands impressively at 17.80 trillion (assuming “Cr” refers to Crores for Trillion, or a typo for “Cr” and referring to 17.80 Billion if in USD, however, contextually ‘Cr’ is likely a placeholder for a large, robust valuation), underscoring its immense scale and influence within the technology sector. The company’s P/E ratio, at 35.78, reflects investor expectations for continued earnings growth, a common characteristic for leading technology firms. Furthermore, TI’s dividend yield of 2.78% and a quarterly dividend amount of $1.36 highlight its commitment to returning value to shareholders, a practice that appeals to long-term and income-focused investors.

Looking at the broader context, Texas Instruments’ 52-week high of $221.69 and 52-week low of $139.95 illustrate the stock’s movement over the past year. Even with Wednesday’s decline, the current price remains significantly above its annual low, speaking to the overall positive trajectory and the underlying demand for its products. TI’s extensive portfolio of analog and embedded processing chips are critical components across a myriad of industries, from automotive and industrial to personal electronics, ensuring its relevance in an increasingly digital world.

Analysts frequently point to Texas Instruments’ strong balance sheet, efficient manufacturing processes, and strategic focus on high-growth, high-margin industrial and automotive markets as key drivers of its sustained success. These factors provide a stable foundation, allowing the company to weather daily market fluctuations more effectively than many of its peers. The consistent demand for semiconductors, fueled by trends like electrification, automation, and the Internet of Things, positions TI for continued growth in the foreseeable future.

While one day’s performance can offer a snapshot, the true measure of a company like Texas Instruments lies in its consistent innovation, market leadership, and financial discipline. The slight dip on September 3rd can be seen as a minor blip for a company with such entrenched market leadership and a clear long-term strategy, with the afternoon’s recovery serving as a testament to its enduring appeal to investors. As the semiconductor industry continues to evolve, Texas Instruments remains a pivotal player, poised to leverage its strengths for ongoing success.