Tesla Navigates Market Volatility: A Snapshot of Recent Trading

Despite a Daily Dip, Analysts Eye Long-Term Fundamentals and Future Innovations

September 1, 2025 (Retrospective Analysis of August 29, 2025 Trading)

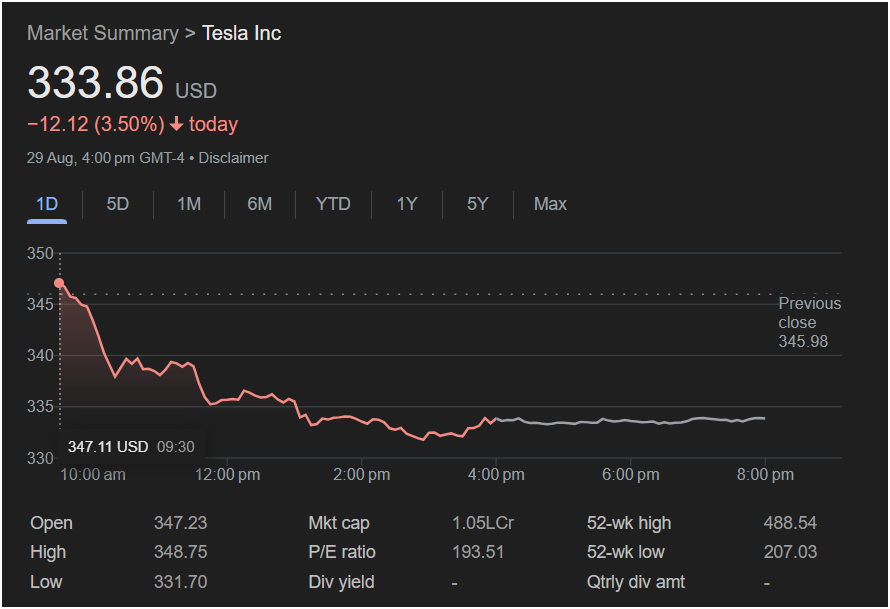

In the fast-paced world of electric vehicles and sustainable energy, Tesla Inc. (TSLA) continues to be a focal point for investors and market watchers alike. While the company frequently captures headlines for its groundbreaking innovations and ambitious growth strategies, a recent trading day, August 29, 2025, offered a glimpse into the dynamic nature of its stock performance. On this particular day, Tesla shares experienced a notable decline, closing at 333.86 USD, down 12.12 USD or 3.50% from its previous close of 345.98 USD.

The trading session for August 29 opened with Tesla shares at 347.23 USD, quickly reaching a daily high of 348.75 USD. However, momentum shifted throughout the day, leading to a low of 331.70 USD before settling at the closing price. The intraday chart illustrates a consistent downward trend from the morning, reflecting investor reactions to various market factors or company-specific news not immediately apparent from the graph alone.

Despite this daily fluctuation, it’s crucial for investors to consider the broader context of Tesla’s market position. The company maintains an impressive market capitalization of 1.05 trillion USD, underscoring its significant presence and influence in the global automotive and technology sectors. Its P/E ratio stands at 193.51, a figure that, while high, is often characteristic of growth-oriented technology companies where future earnings potential is heavily factored into the stock price. This valuation reflects market confidence in Tesla’s long-term trajectory and its ability to disrupt established industries.

Looking at the 52-week performance provides further perspective. Tesla’s 52-week high stands at 488.54 USD, with a 52-week low of 207.03 USD. This wide range highlights the stock’s inherent volatility but also its capacity for significant upward movement over a longer period. The August 29 performance, therefore, can be seen as part of this natural ebb and flow rather than an isolated indicator of fundamental weakness.

Analysts often point to Tesla’s unwavering commitment to innovation as a key driver of its long-term value. From advancements in battery technology and autonomous driving (Full Self-Driving software) to expansions in its Gigafactory network and the introduction of new vehicle models like the Cybertruck or next-generation platforms, the company consistently strives to stay at the forefront of technological progress. Furthermore, its expanding energy generation and storage solutions, including solar and Powerwall products, contribute to a diversified business model with significant growth potential beyond just electric vehicles.

While daily stock movements are a reality for any publicly traded company, savvy investors often look past short-term dips to evaluate the underlying strengths and future prospects. For Tesla, these include its strong brand loyalty, global manufacturing footprint, vertical integration, and a visionary leadership team. The August 29 trading session serves as a reminder of market dynamics, but for many, the broader narrative of Tesla’s transformative impact on transportation and energy remains compelling.

As the electric vehicle market continues to mature and competition intensifies, Tesla’s ability to innovate, scale, and maintain its technological edge will be paramount. Investors and industry observers will undoubtedly continue to watch its performance closely, understanding that each trading day, whether up or down, contributes to the larger, evolving story of this automotive and tech titan.