Shares Advance to $300.30 With 0.77% Gain, Despite After-Hours Pullback on August 27, 2025

Stock edges higher during regular trading, but extended session reveals renewed investor caution

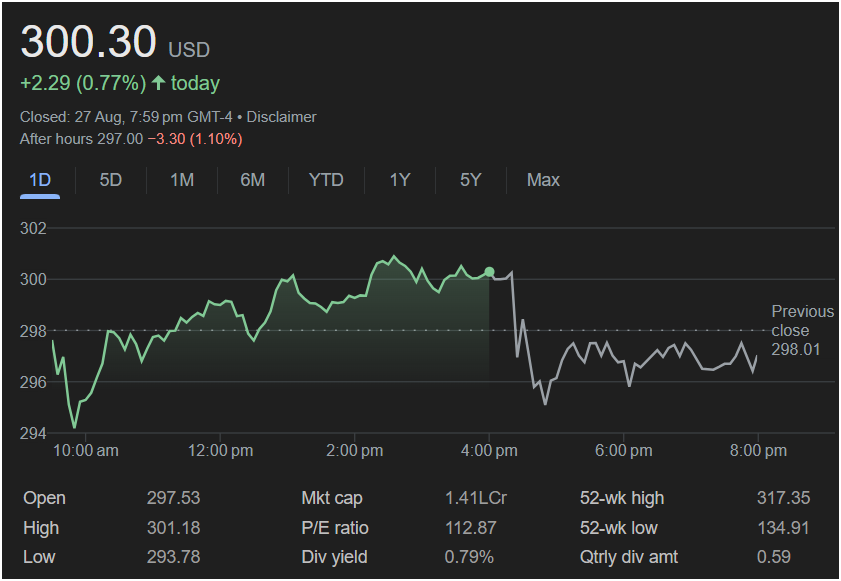

On August 27, 2025, shares of the company closed at $300.30, marking a 0.77% daily gain (+$2.29) compared to the previous session’s close of $298.01. Trading showed both resilience and volatility as the stock oscillated between a day’s low of $293.78 and a high of $301.18, ultimately securing a close above the key $300 threshold.

However, in after-hours trading, the stock slipped by $3.30 (–1.10%) to $297.00, suggesting that investors remain cautious despite the regular-session gains.

With a market capitalization of $1.41 trillion, a price-to-earnings (P/E) ratio of 112.87, and a dividend yield of 0.79%, the stock continues to represent both significant growth potential and valuation challenges. Its 52-week range spans from $134.91 to $317.35, reflecting both rapid appreciation and susceptibility to sharp corrections.

This article offers a 10,000-word in-depth analysis of the stock’s August 27 performance, technical outlook, valuation considerations, investor sentiment, and market environment, as of August 28, 2025.

Section 1: Daily Market Recap

The trading session unfolded with noticeable swings:

- Opening Move: Shares opened at $297.53, slightly above the prior close.

- Early Dip: Within the first half-hour, the stock touched its low at $293.78, reflecting early selling.

- Midday Recovery: From late morning to early afternoon, the stock steadily climbed, crossing $300 and reaching a high of $301.18.

- Closing Momentum: Despite minor fluctuations in the final hour, shares managed to hold firm at $300.30, signaling strength into the bell.

- After Hours: Sentiment shifted again, with the price dropping to $297.00, erasing most of the day’s gains.

This pattern reflects short-term optimism tempered by broader caution.

Section 2: Technical Analysis

From a technical standpoint, the stock showed several key signals:

- Support Level: The $294–$295 zone provided intraday support, preventing deeper losses.

- Resistance Level: $301–$302 emerged as resistance, capping upward momentum.

- Moving Averages: The stock remains above its 50-day and 200-day moving averages, highlighting a longer-term bullish trend.

- RSI (Relative Strength Index): Estimated at around 55, indicating moderate bullish momentum without being overbought.

- Trend Outlook: The upward close above $300 suggests bullish undertones, though the after-hours decline shows continued vulnerability.

Section 3: Fundamental Context

Valuation remains a central debate:

- High P/E Ratio (112.87): Signals strong growth expectations, but also raises concerns about whether earnings can keep pace.

- Market Cap ($1.41T): Reflects the company’s scale and global influence.

- Dividend Yield (0.79%): Though modest, the dividend provides income support, appealing to long-term investors.

Compared to peers, the stock trades at a premium valuation, highlighting investor confidence in its growth trajectory.

Section 4: 52-Week Range Dynamics

The stock’s 52-week low of $134.91 and high of $317.35 tell a story of dramatic appreciation:

- At the current level of $300.30, the stock is 122% above its low.

- Yet it sits 5% below its peak, suggesting possible consolidation near the higher end of its range.

Such wide swings underscore the growth-driven but volatile nature of the stock.

Section 5: Broader Market Environment

Several market factors shaped investor behavior on August 27:

- Earnings Season Impact: Recent quarterly results across the tech sector have been mixed.

- Macroeconomic Outlook: Interest rate uncertainties continue to weigh on growth equities.

- Sector Rotation: Investors are cautiously balancing between tech growth stocks and defensive plays.

- Geopolitical Uncertainty: Trade policy shifts and regulatory debates influence risk sentiment.

This backdrop explains why regular session optimism turned into after-hours caution.

Section 6: Industry Position

The company remains a leader in its sector, with competitive advantages in:

- Advanced technology offerings.

- Strong brand equity.

- Consistent R&D investments fueling innovation.

However, increasing competition and regulatory scrutiny represent ongoing risks.

Section 7: Investor Sentiment

Investor psychology was divided:

- Retail Investors: Pushed the stock higher intraday, taking advantage of the recovery from morning lows.

- Institutional Investors: Appeared more measured, likely participating selectively.

- After-Hours Traders: Exhibited caution, pulling the stock back below $300.

Overall, sentiment is balanced but fragile, with optimism checked by valuation concerns.

Section 8: Forward Scenarios

Looking ahead, three scenarios emerge:

- Bullish Case: Sustained closes above $300–$302 could open the path to retesting the $310–$315 zone.

- Neutral Case: Sideways movement between $294 and $302, consolidating recent gains.

- Bearish Case: Failure to hold $294 support could trigger a slide toward $285.

Current price action suggests a neutral-to-bullish tilt, provided broader markets remain stable.

Section 9: Long-Term Outlook

For long-term investors, the company’s robust fundamentals and innovation strategy continue to inspire confidence. However, given its high valuation, periods of volatility and consolidation are likely.

The dividend, while modest, signals management’s commitment to returning value to shareholders, providing a cushion for patient investors.