ServiceNow Soars: A Day of Robust Growth and Promising Horizons

Shares Climb as Tech Giant Continues Upward Trajectory, Signalling Strong Market Confidence

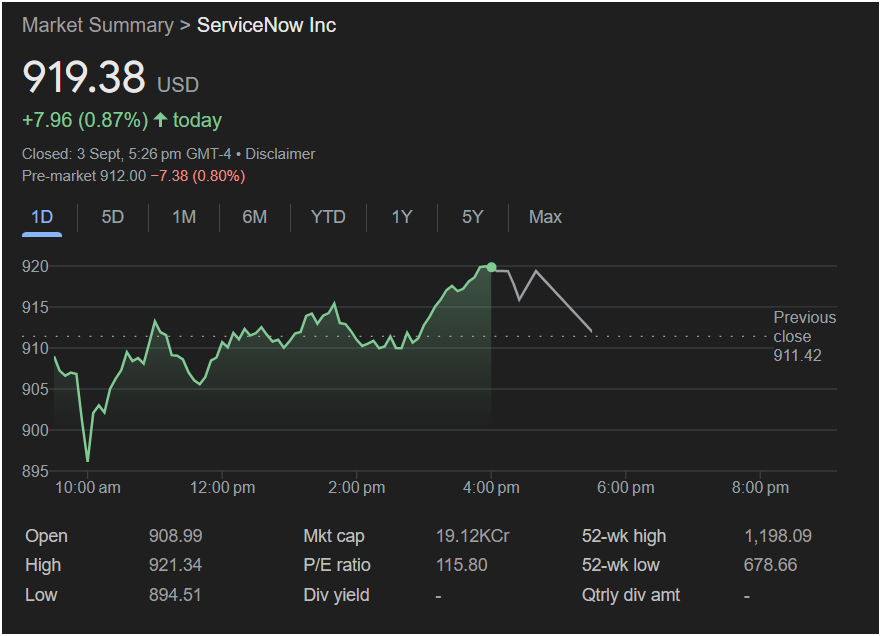

September 4, 2025 – ServiceNow Inc. (NYSE: NOW) kicked off September with a strong performance on the markets, demonstrating resilience and significant investor confidence. As of the close on September 3, 2025, the cloud computing giant’s stock price surged to $919.38 USD, marking an impressive +7.96 (0.87%) gain for the day. This robust upward movement adds to ServiceNow’s reputation as a consistent performer in the technology sector, underscoring its pivotal role in enterprise digital transformation.

The daily chart reveals a dynamic trading session that saw ServiceNow shares experience both healthy dips and powerful rallies. Opening at

912.00, a slight -7.38 (0.80%) correction from its previous close of $911.42. However, this early volatility was swiftly overcome as the day progressed, illustrating strong buying interest and underlying positive sentiment.

A Day of Steady Ascent

Throughout the trading day, ServiceNow’s stock price showed a compelling pattern of growth. After touching an intraday low of

921.34. This broad trading range highlights active participation from investors, with significant upward momentum pushing the stock to its daily high in the late afternoon. The closing price of $919.38, while slightly off its absolute peak, represents a formidable gain and positions the company favorably for future trading sessions.

The sustained interest in ServiceNow is not surprising. The company has carved out an indispensable niche in providing cloud-based platforms that streamline workflows and automate IT, employee, and customer service for large enterprises. In an increasingly digital-first world, the demand for such solutions continues to escalate, making ServiceNow a critical partner for businesses striving for operational efficiency and enhanced customer experience.

Key Financial Indicators Point to Strength

Beyond the daily stock movement, several key financial indicators highlighted in the market summary reinforce ServiceNow’s strong market standing:

-

Market Capitalization: With a substantial market cap of 19.12KCr (likely indicating 19.12 Lakh Crores or a similar large denomination depending on regional interpretation, signifying a massive valuation), ServiceNow remains a dominant player, reflecting its extensive market penetration and significant asset base.

-

P/E Ratio: A P/E ratio of 115.80 suggests that investors are willing to pay a premium for ServiceNow’s earnings, anticipating continued high growth and strong future profitability. While seemingly high, this is often characteristic of high-growth technology companies that are rapidly expanding their market share and innovation pipeline.

-

52-Week High and Low: The stock’s current price sits comfortably within its 52-week range, with a high of

678.66. This wide range indicates that while the stock has experienced fluctuations, its current position shows it has recovered well from its lows and still has significant room for growth towards its previous peak, offering an attractive proposition for long-term investors.

Looking Ahead: Continued Innovation and Market Leadership

ServiceNow’s consistent performance is underpinned by its relentless focus on innovation and its strategic expansions into new markets and product offerings. The company’s commitment to artificial intelligence (AI), machine learning, and automation tools integrated within its Now Platform continues to drive adoption across various industries. This technological leadership ensures that ServiceNow remains at the forefront of the digital transformation wave, providing essential solutions that enhance productivity and resilience for its global client base.

Analysts often point to ServiceNow’s strong subscription-based revenue model as a key driver of its stability and predictable growth. This model fosters long-term relationships with customers and provides a steady stream of income, making the company less susceptible to short-term economic fluctuations.

As the market looks towards the remainder of 2025, ServiceNow appears well-positioned to continue its trajectory of growth and value creation for shareholders. The positive close on September 3rd serves as a strong indicator of the company’s robust health and the optimistic outlook shared by investors regarding its future prospects.