ServiceNow Inc. (NOW) Stock Today: A Deep-Dive into Market Performance, Business Fundamentals, and Industry Outlook

ServiceNow Inc. (ticker symbol: NOW) is a leading provider of cloud-based digital workflow solutions, empowering enterprises to automate business processes, improve productivity, and deliver seamless employee and customer experiences. The company has become one of the most influential players in the enterprise software space, with a growing footprint across IT service management, HR service delivery, customer workflows, and AI-driven automation.

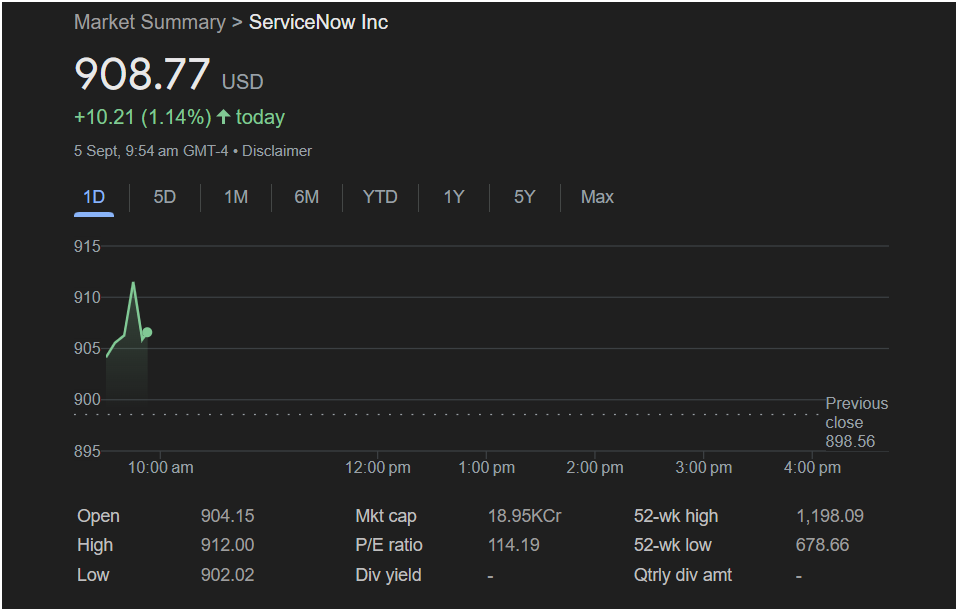

On September 5th, 2025, ServiceNow’s stock opened at $904.15, representing a strong start to the trading day. As of 9:54 AM GMT-4, the price was at $908.77, showing a gain of +10.21 points or +1.14% compared to the previous close of $898.56. With a market capitalization of approximately $1.895 trillion, ServiceNow continues to command investor attention as a mega-cap technology stock.

This article provides a comprehensive, open-ended exploration of ServiceNow’s stock performance, business fundamentals, competitive landscape, growth strategy, and potential future opportunities. The discussion will remain ongoing and analytical, allowing readers to continuously build their own perspectives on the company’s investment thesis.

Real-Time Price Performance

The trading session on September 5th began on a bullish note, with the stock opening above the previous day’s close and briefly spiking to $912.00 before consolidating around the $908 level. This early upward momentum may indicate strong buying interest from institutional investors, particularly given the stock’s proximity to its 52-week high of $1,198.09. While intraday volatility is common in high-growth tech names, today’s price action reflects confidence in the company’s fundamentals.

The stock’s price-to-earnings (P/E) ratio stands at 114.19, which is relatively high compared to the broader market but consistent with growth-oriented SaaS peers. A high P/E ratio suggests that investors expect significant future earnings growth, often justified by strong revenue expansion and margin improvement.

Fundamental Analysis

ServiceNow’s business model revolves around a subscription-based revenue stream that generates predictable and recurring cash flows. The company has consistently reported double-digit year-over-year revenue growth, driven by strong demand for its IT Service Management (ITSM) solutions and expanding adoption of AI-powered workflows.

Key fundamental drivers include:

- Revenue Growth: ServiceNow has achieved a compound annual growth rate (CAGR) exceeding 20% over the past several years, reflecting robust customer acquisition and high net retention rates.

- Profitability: Despite heavy investments in R&D and sales, the company maintains healthy operating margins, with ongoing initiatives to improve efficiency.

- Innovation: Continuous platform development and integration of AI capabilities make ServiceNow a critical player in digital transformation initiatives.

Competitive Landscape

The digital workflow market is competitive, with rivals such as Salesforce, Atlassian, and Microsoft offering overlapping solutions. However, ServiceNow differentiates itself with its single data model architecture, low-code development environment, and ecosystem of third-party integrations. This strategic advantage helps the company capture enterprise clients with complex workflows.

Industry Outlook

The enterprise software industry is experiencing a secular shift toward automation, AI, and cloud-native platforms. Organizations are prioritizing solutions that can streamline operations, reduce costs, and improve customer experience. ServiceNow is well-positioned to capitalize on these trends, as its platform spans IT, HR, security, and customer service functions.

Industry analysts project that the global IT service management market will continue to expand at a healthy pace, with AI-driven workflow automation as a key growth catalyst. This trend provides a long runway for ServiceNow’s growth trajectory.

Investor Sentiment

Analyst coverage of ServiceNow remains largely positive, with many investment banks maintaining “buy” or “overweight” ratings. Bullish investors highlight the company’s expanding addressable market, strong execution, and leadership position in ITSM. Skeptics, however, point to valuation concerns, arguing that the high P/E multiple leaves little room for error.

Risks and Challenges

While ServiceNow enjoys a strong competitive moat, risks remain:

- Macroeconomic Slowdowns: Budget cuts in IT spending could impact new deal signings.

- Competition: Aggressive moves by competitors may pressure pricing or market share.

- Execution Risk: As ServiceNow expands into new verticals, there is a risk of execution missteps or slower-than-expected adoption.

Strategic Growth Opportunities

ServiceNow’s growth strategy includes international expansion, deepening its presence in regulated industries, and enhancing its AI capabilities. Partnerships with hyperscalers like Microsoft Azure, AWS, and Google Cloud help expand its global reach. Additionally, acquisitions in the AI and automation space provide new capabilities that strengthen its platform.

Open-Ended Analysis

The story of ServiceNow’s growth is far from complete. Investors and analysts will continue to monitor:

- Quarterly earnings results and guidance revisions.

- New product launches, particularly around AI and machine learning.

- Customer adoption trends across industries.

- Strategic partnerships and ecosystem expansion.

- Competitive developments in the enterprise software market.

The ongoing interplay between these factors will shape ServiceNow’s valuation and long-term trajectory. As the digital transformation wave continues, ServiceNow’s ability to innovate and deliver value will remain at the center of investor discussions.