Qualcomm Stock Price Today: Detailed Analysis, Future Outlook & Investment Insights

Qualcomm Inc. Shares Surge 0.63% Amid Positive Market Sentiment – What’s Next for Investors

Meta Description:

Qualcomm stock (QCOM) is trading at $160.52, up 0.63% today. Explore a detailed technical and fundamental analysis, future projections, and investment insights for long-term and short-term investors.

Qualcomm Inc. (QCOM) Stock Analysis & Future Outlook

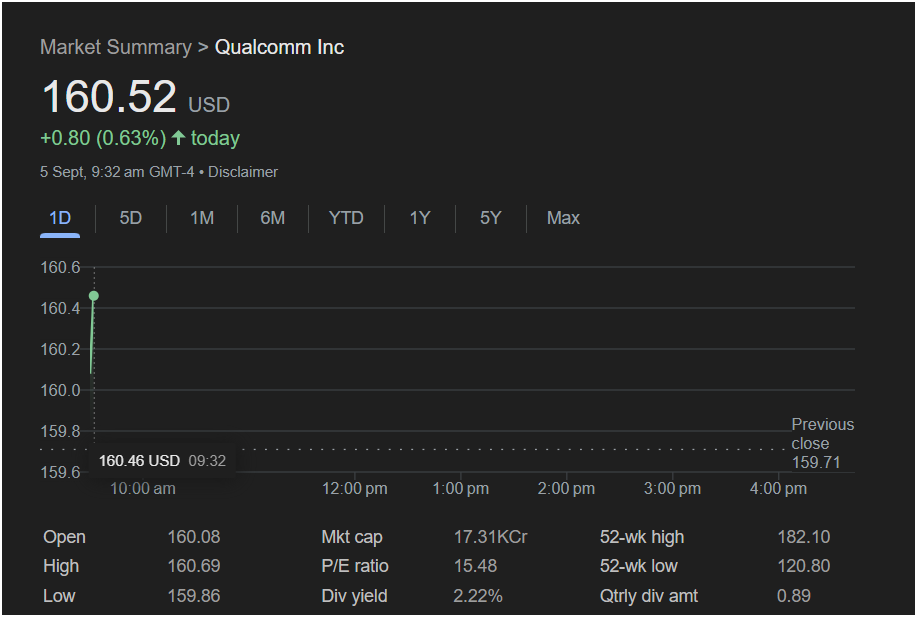

Qualcomm Inc. (NASDAQ: QCOM) is one of the leading semiconductor and wireless technology companies in the world, known for its innovations in 5G, AI, and connected devices. Today, QCOM stock opened at $160.08 and is currently trading at $160.52, marking a 0.63% increase from yesterday’s close of $159.71.

This uptick reflects positive investor sentiment amid optimism about the semiconductor market and Qualcomm’s strategic position in the global 5G ecosystem.

Qualcomm Stock Today: Key Highlights

- Current Price: $160.52 USD

- Change: +0.80 (+0.63%)

- Day’s Range: $159.86 – $160.69

- Market Cap: $173.1 Billion

- P/E Ratio: 15.48 (attractive valuation compared to peers)

- Dividend Yield: 2.22% (quarterly dividend of $0.89)

- 52-Week Range: $120.80 – $182.10

Why This Matters for Investors

A consistent upward movement in QCOM stock price shows investor confidence in Qualcomm’s growth strategy, robust chip demand, and leadership in wireless technology. The attractive dividend yield also makes QCOM a compelling choice for income-focused investors.

Fundamental Analysis of Qualcomm

Revenue & Earnings Strength

Qualcomm’s diversified revenue streams—from mobile chips, automotive solutions, IoT, and licensing—make it resilient to market fluctuations. Its steady earnings growth is supported by increasing adoption of 5G-enabled devices worldwide.

Valuation Metrics

With a P/E ratio of 15.48, Qualcomm is trading at a relatively fair valuation compared to other semiconductor giants like NVIDIA and AMD, making it an attractive buy for value investors.

Dividend Policy

Qualcomm has a long history of rewarding shareholders through dividends and buybacks. Its 2.22% dividend yield remains attractive for those seeking regular income.

Technical Analysis & Price Trends

Short-Term Momentum

Currently trading near the mid-point of its 52-week range, Qualcomm shows moderate bullish momentum. Breaking above the $160.69 intraday resistance could push the price toward the next key level at $165.