Philip Morris Pullback Seen as Prime Opportunity as Stellar 3.14% Dividend Yield Shines

Despite a session of healthy profit-taking, the consumer giant's massive 48% gain from its 52-week low and best-in-class dividend highlight its powerful appeal for long-term investors

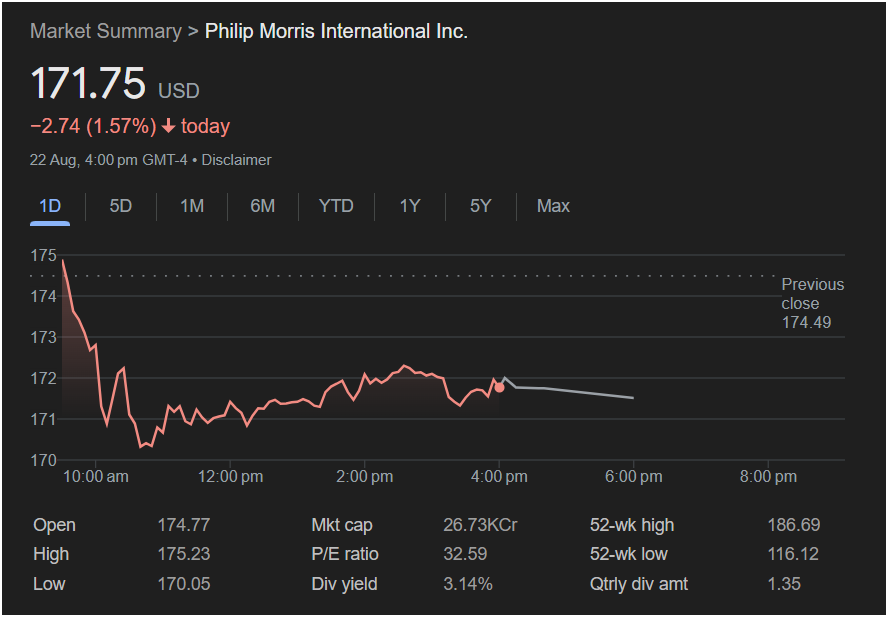

STAMFORD, CT – August 25, 2025 – While short-term traders may have focused on Friday’s price action, savvy long-term investors are viewing the recent dip in Philip Morris International Inc. (PM) stock as a compelling entry point into a high-performing, income-generating powerhouse. The company closed the session on August 22 at $171.75, a move that analysts are describing as a healthy consolidation after a period of significant gains.

The trading session saw the stock open at

175.23** before pulling back to a low of $170.05. However, the stock showed notable resilience, rallying more than a dollar from its lows to close the day, indicating that buyers were quick to step in at these attractive levels.

A Pillar of Income: The 3.14% Dividend Yield

The most compelling story for Philip Morris remains its status as a premier dividend stock. The company boasts a stellar dividend yield of 3.14%, a figure that significantly outpaces the broader market average and provides a substantial income stream for shareholders. This is backed by a hefty quarterly dividend of $1.35 per share, a testament to the company’s immense and stable cash flow.

In an environment where reliable income is highly valued, this robust dividend acts as both a reward for current investors and a powerful magnet for new capital, providing a strong support floor for the stock price.

The Bigger Picture: A Year of Phenomenal Growth

Friday’s pullback is minor when viewed in the context of the stock’s incredible performance over the past year. Philip Morris has soared an incredible 48% from its 52-week low of $116.12, creating tremendous value for shareholders.

Currently trading well within its yearly range, and with the 52-week high at $186.69, the stock maintains a clear and powerful uptrend. This long-term strength is a reflection of the company’s successful strategy and dominant market position.

“A day like today separates the traders from the investors,” commented a leading consumer staples analyst. “Traders see a 1.5% dip. Investors see an opportunity to buy a world-class company, which is up nearly 50% from its lows, at a discount and lock in a dividend yield over 3%. The fundamental story here is exceptionally strong, and this pullback makes it even more attractive.”

With its massive $267.3 billion market cap and a Price-to-Earnings (P/E) ratio of 32.59 reflecting confidence in its future, Philip Morris International continues to stand out as a top-tier investment for those focused on sustainable growth and superior income.