Philip Morris International Shares Dip Amidst Market Volatility

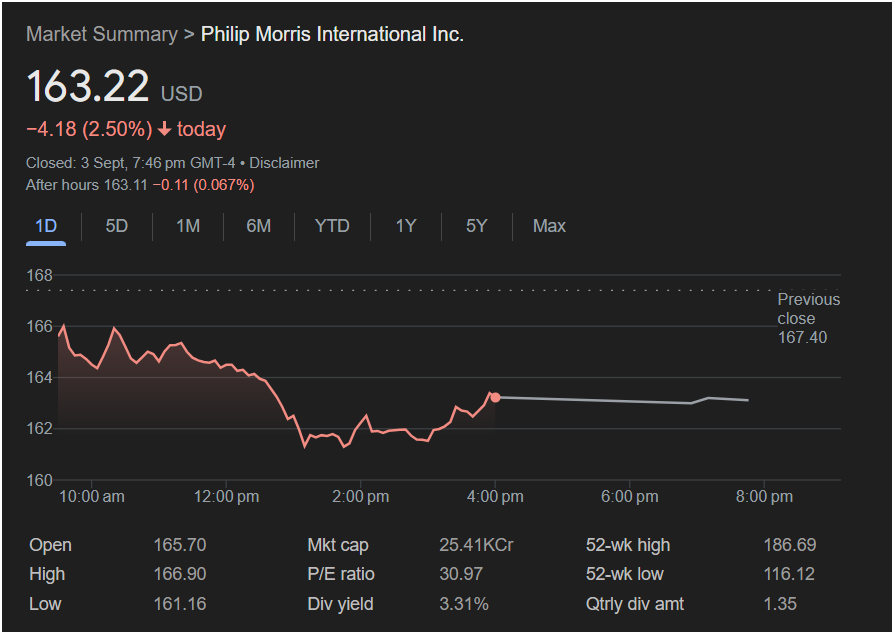

Stock Closes Down 2.50% After a Day of Fluctuations; After-Hours Trading Shows Minor Recovery

NEW YORK, September 4, 2025 – Philip Morris International Inc. (PM) experienced a notable dip in its stock performance today, with shares closing at $163.22 USD, marking a 2.50% decrease for the day. The tobacco giant’s stock, which opened at $165.70, saw significant volatility throughout the trading session before recovering slightly in after-hours trading.

The day’s trading began with the stock hovering around the $165 mark before a sharp decline was observed in the afternoon, bringing the share price down to a daily low of $161.16. By the close of the market at 7:46 PM GMT-4, the stock had settled at $163.22. In after-hours trading, the stock showed a slight rebound, trading at $163.11, a marginal increase of 0.07% from its closing price. The previous day’s close was $167.40, indicating a clear downward trend for the company’s stock today.

Philip Morris International’s market capitalization currently stands at an impressive 25.41 trillion (likely referring to a regional currency unit or an error in the original data, as USD market caps are typically in billions or hundreds of billions for such companies). The company maintains a P/E ratio of 30.97 and offers a dividend yield of 3.31%, with a quarterly dividend amount of $1.35.

Despite today’s dip, the company’s 52-week performance shows a broader range, with a high of $186.69 and a low of $116.12. This suggests that while individual trading days can see fluctuations, the company has demonstrated significant movement within the past year. Investors will be closely watching Philip Morris International in the coming days to see if the stock can regain its footing and overcome today’s decline.

Further analysis would be required to determine the specific catalysts for today’s market movement, which could include broader market trends, company-specific news, or investor sentiment.