NVIDIA Jumps Nearly 4% as Chipmaker Leads Tech Gains

New York, September 10:

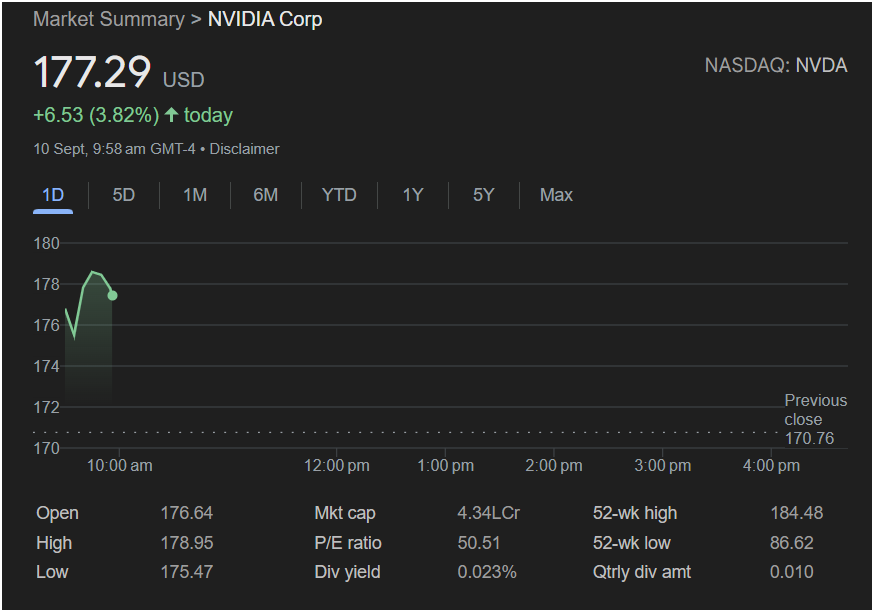

Shares of NVIDIA Corp. (NASDAQ: NVDA) surged in early Tuesday trading, outperforming most large-cap tech peers. By 9:58 a.m. ET, the stock was up $6.53 (+3.82%) at $177.29, compared to the previous close of $170.76.

Intraday Performance

- Opening price: $176.64

- Day’s high: $178.95

- Day’s low: $175.47

- Market cap: $4.34 trillion

- P/E ratio: 50.51

- Dividend yield: 0.023% (quarterly dividend: $0.01)

NVIDIA opened higher and extended gains, hitting an intraday high of $178.95 within the first hour of trading. The move reflects strong investor momentum, pushing the stock closer to its record levels.

52-Week Performance

Over the past year, NVIDIA shares have traded between a 52-week high of $184.48 and a low of $86.62. The current level keeps the stock near the top of that range, underscoring continued optimism around the company’s AI and semiconductor leadership.

Market Sentiment

Analysts credit today’s surge to rising demand for AI-driven data center chips and ongoing optimism surrounding NVIDIA’s role in the artificial intelligence boom. With a valuation that has already pushed the company to one of the largest market caps in the world, investor interest remains strong despite concerns over high multiples.

Analyst Perspective

“While NVIDIA’s stock looks expensive on a traditional P/E basis, its growth story in AI infrastructure is unparalleled,” said one market strategist. “Every major tech company relies on its GPUs, and that’s a powerful long-term moat.”