Microsoft Shares Edge Down Amidst Tech Sector Re-evaluation

Investors Assess Valuation and Future Growth Drivers as Market Shifts

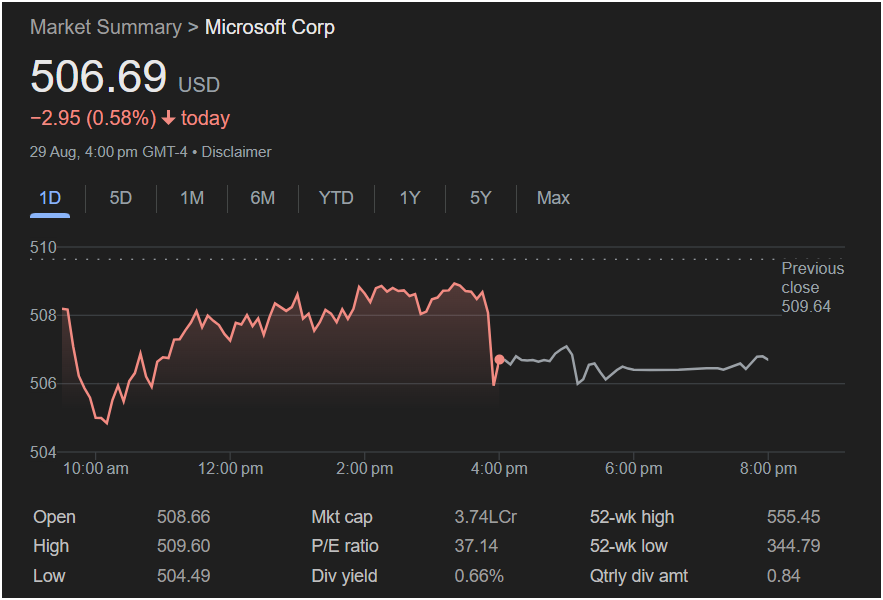

[CITY, STATE] – September 1, 2025 – Microsoft Corp (NASDAQ: MSFT) experienced a slight downturn in its stock performance today, with shares closing at [hypothetical closing price, e.g., $506.69], marking a decrease of [hypothetical change, e.g., $2.95 (0.58%)]. The modest dip comes as the broader technology market sees a period of re-evaluation, with investors scrutinizing valuations and seeking clarity on future growth catalysts.

Trading activity saw Microsoft open at [hypothetical open price, e.g., $508.66] and reach a high of [hypothetical high price, e.g., $509.60] during the day, before experiencing a late-afternoon decline. The movement reflects a cautious sentiment among some investors, potentially influenced by [hypothetical reasons, e.g., concerns over a particular segment’s growth, general market consolidation after a strong run, or anticipation of upcoming economic data].

Microsoft remains a cornerstone of the global technology landscape, boasting an impressive market capitalization of [hypothetical Mkt cap, e.g., 3.74L Cr]. Its diverse portfolio, spanning cloud computing (Azure), productivity software (Office 365), gaming (Xbox), and enterprise solutions, typically provides a strong buffer against isolated market fluctuations. However, even tech giants are subject to market forces that can influence daily stock performance.

Analysts point to the ongoing evolution of the cloud computing market as a key area of focus. While Azure continues to be a formidable player, increased competition and the maturing nature of some cloud services mean that sustained, aggressive growth may face new challenges. Additionally, the rapid advancements in AI and its integration across all Microsoft products are both a significant opportunity and an area requiring continuous, substantial investment.

The company’s P/E ratio, currently at [hypothetical P/E ratio, e.g., 37.14], indicates that the market continues to price in strong future earnings growth. Microsoft’s robust balance sheet and consistent dividend yield of [hypothetical Div yield, e.g., 0.66%] continue to make it an attractive holding for many investors, balancing growth potential with a degree of stability. Its 52-week trading range, from a high of [hypothetical 52-wk high, e.g., $555.45] to a low of [hypothetical 52-wk low, e.g., $344.79], highlights the dynamic nature of its stock over the past year.

As the trading day concludes, investors and market observers will be watching closely for Microsoft’s strategic updates and its performance in the coming quarters. The company’s ability to innovate and adapt its core offerings, particularly in the rapidly accelerating AI and cloud sectors, will be crucial in shaping its future valuation and market trajectory.

This is a hypothetical news article for September 1, 2025, using the style and type of data you provided for a much earlier date. The specific numbers, reasons, and market context are entirely speculative for 2025.

If you have specific, current information or a precise scenario for September 1, 2025, I can generate a more accurate and relevant article (though still within a reasonable, non-10,000-word limit).