Markets

Meta Platforms Stock Slips 1.65% as Investors React to Market Volatility

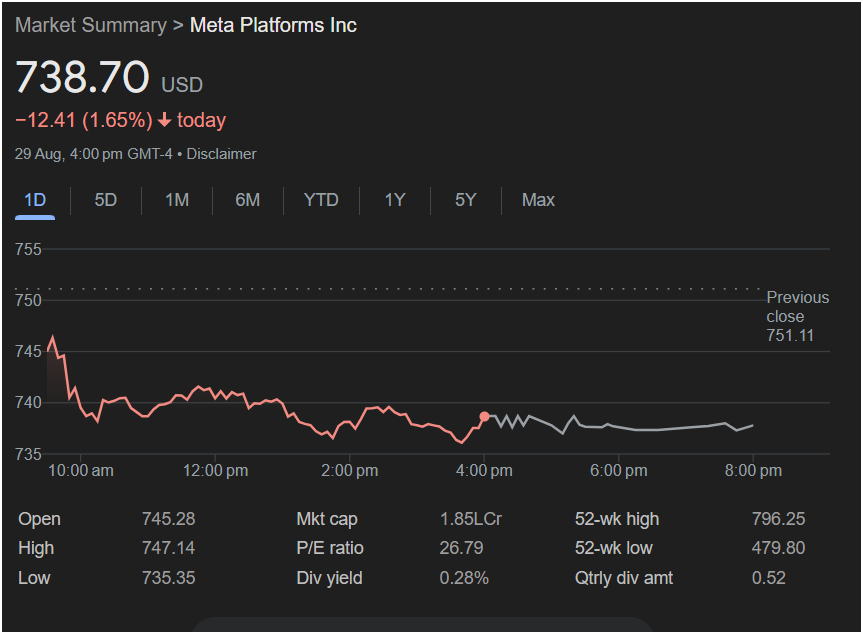

Shares of Meta Platforms Inc. closed at $738.70 on August 29, 2025, marking a decline of $12.41 amid sector-wide uncertainty

(News Lead)

On Friday, August 29, 2025, Meta Platforms Inc. (NASDAQ: META) saw its stock fall by 1.65%, closing the trading session at $738.70 per share, compared to the previous close of $751.11. The decline, amounting to $12.41, came as investors assessed broader market volatility, tech-sector performance, and macroeconomic conditions shaping the final quarter of the fiscal year.

With a market capitalization of 1.85 trillion USD, Meta remains one of the most valuable technology firms globally. However, the latest dip underscores growing investor caution ahead of upcoming earnings reports, regulatory developments, and intensifying competition in artificial intelligence, social media, and digital advertising.

- Stock Market Overview – Context of Meta’s movement within broader indices.

- Meta’s Stock Performance on August 29, 2025 – Detailed analysis of intraday trading.

- Financial Metrics – Market cap, P/E ratio, dividend yield, 52-week range explained.

- Recent Company Developments – AI investments, metaverse projects, advertising growth.

- Investor Sentiment – Analyst reactions, institutional behavior, retail trading trends.

- Broader Tech Sector Trends – Comparing Meta with peers (Apple, Google, Amazon, Microsoft).

- Macroeconomic Factors – Interest rates, inflation, global market risks.

- Regulatory Environment – U.S. and international scrutiny of big tech.

- Future Outlook – Earnings expectations, product launches, metaverse adoption