Meta Platforms Stock Climbs 0.50% to Close at $751.11 as Investors Eye AI and VR Growth

Shares of Meta Platforms Inc. rise on August 28, 2025, reflecting steady investor optimism despite after-hours dip

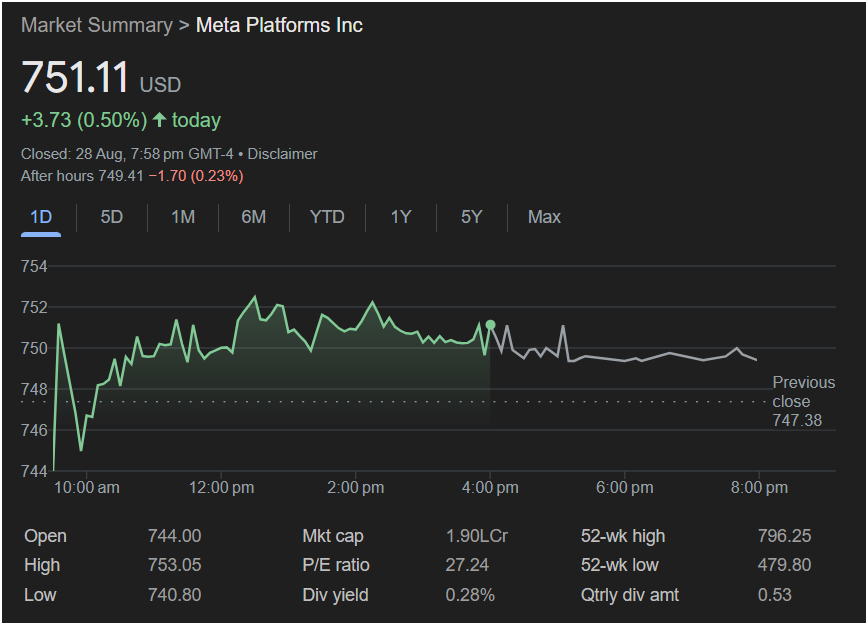

On August 28, 2025, Meta Platforms Inc. (NASDAQ: META), the parent company of Facebook, Instagram, WhatsApp, and Reality Labs, saw its shares rise by 0.50%, closing at $751.11. The stock advanced $3.73 from the previous day’s close of $747.38, signaling steady investor optimism in the tech giant’s long-term strategy centered on artificial intelligence (AI), virtual reality (VR), and digital advertising.

Despite minor volatility throughout the day and a slight after-hours decline to $749.41 (-0.23%), Meta continues to show resilience in a competitive technology landscape.

Daily Performance Overview

- Opening Price: $744.00

- Day’s High: $753.05

- Day’s Low: $740.80

- Closing Price: $751.11

- After-Hours Price: $749.41 (-1.70, -0.23%)

Meta opened lower than the previous close, briefly dipping to $740.80 in morning trading. However, strong mid-day buying pushed the stock upward, peaking at $753.05 before stabilizing around the $750 range.

Market Valuation and Key Metrics

Meta remains one of the largest companies in the world by market capitalization, valued at $1.90 trillion as of August 28. The company’s valuation reflects its strong dominance in social media, online advertising, and growing presence in AI and the metaverse.

- Price-to-Earnings (P/E) Ratio: 27.24 – suggesting investors are willing to pay a premium for future growth.

- Dividend Yield: 0.28%

- Quarterly Dividend Amount: $0.53

- 52-Week High: $796.25

- 52-Week Low: $479.80

This wide range illustrates both the volatility of the tech sector and Meta’s impressive recovery from earlier lows.

Sector Context: Technology & AI Momentum

The technology sector has been booming in 2025, with companies like Meta benefiting from:

- Artificial Intelligence Integration – Meta’s AI-powered recommendation systems and chatbot features on WhatsApp are driving engagement and monetization.

- Virtual Reality Expansion – Through its Reality Labs division, Meta continues to push the adoption of VR headsets and immersive experiences, despite ongoing profitability challenges.

- Digital Advertising Growth – Meta remains a key player in online advertising, capturing billions in revenue through Facebook, Instagram, and Reels.

These trends continue to support investor confidence in Meta’s stock, even amid broader market uncertainties.

Historical Performance: A Year in Review

- Meta’s stock reached a 52-week low of $479.80, reflecting investor concerns about high metaverse spending and regulatory challenges.

- Since then, shares have rallied nearly 60%, driven by stronger-than-expected earnings and growth in AI-driven advertising.

- In early 2025, Meta announced record user engagement across Instagram Reels and WhatsApp, boosting confidence in its ability to diversify revenue streams.

Analyst Opinions and Market Sentiment

Financial analysts remain mixed but cautiously optimistic about Meta’s future.

- Bullish Case: Strong advertising revenues, robust AI-driven innovations, and early success in VR/AR markets could push the stock toward new highs above $800.

- Bearish Case: Critics argue that heavy spending in Reality Labs may continue to weigh on profits, and regulatory risks in both the U.S. and EU could limit growth.

Price targets from major investment banks currently range between $760 and $820 over the next quarter.

Investor Confidence and Dividend Appeal

Meta’s decision to initiate dividends earlier this year has added a layer of stability for long-term investors. Although its 0.28% dividend yield is modest compared to traditional blue-chip companies, it signals the company’s maturity and commitment to shareholder returns.

Future Outlook: What’s Next for Meta?

Meta’s performance going forward will depend on several critical factors:

- Q3 2025 Earnings Report – Investors are closely watching revenue growth in digital ads and Reality Labs.

- AI Expansion – Continued development of AI-driven tools across platforms will be a major growth catalyst.

- Metaverse Monetization – Progress in VR and AR adoption will determine whether Reality Labs can become a profit center.

- Regulatory Developments – Antitrust scrutiny and privacy regulations remain risks in global markets.

Meta’s stock climb to $751.11 on August 28, 2025, underscores investor confidence in its diversified growth strategy, despite challenges in VR investments and global regulatory pressures. With strong fundamentals, increasing adoption of AI technologies, and a steady advertising business, Meta Platforms remains one of the most influential players in the global tech ecosystem.

While volatility may persist, the company’s long-term outlook continues to look promising, making it a stock to watch closely in the months ahead.