Meta Platforms Inc. Sees Modest Gain Amidst Shifting Market Dynamics

Stock Closes Strong, Analysts Eye Future Growth and Valuation Metrics

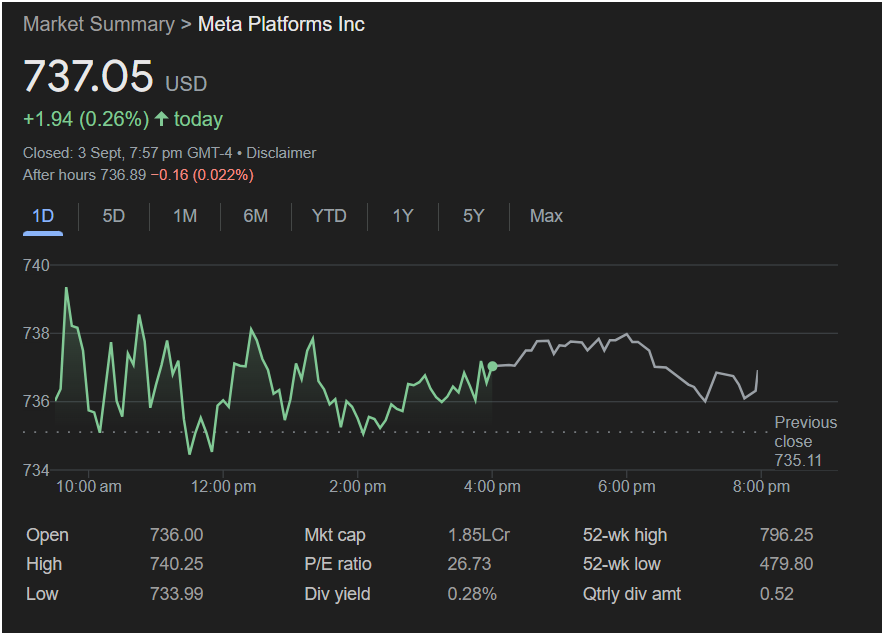

September 4, 2025 – Meta Platforms Inc. (META) delivered a solid performance on September 3rd, 2025, with its stock price climbing to $737.05 USD, marking a modest gain of $1.94 (0.26%) during regular trading hours. This upward movement, following an open at $736.00 and reaching a daily high of $740.25, indicates a stable and cautiously optimistic investor sentiment for the tech giant.

The trading day saw Meta’s stock fluctuate between a low of $733.99 and its closing price, demonstrating some intraday volatility but ultimately settling higher than its previous close of $735.11. In after-hours trading, the stock saw a slight dip of $0.16 (0.022%), hovering around $736.89, suggesting a period of adjustment as the market digested the day’s events.

Key Financial Indicators Under Scrutiny

With a substantial market capitalization of 1.85 trillion LCr (likely referring to Lakh Crores, a unit commonly used in some regions for large sums, or a placeholder for Trillion USD), Meta continues to be a dominant force in the global technology landscape. Its current Price-to-Earnings (P/E) ratio stands at 26.73, a metric closely watched by investors to gauge the company’s valuation relative to its earnings. This P/E ratio, while not excessively high, suggests that investors maintain healthy expectations for Meta’s future profitability.

Furthermore, Meta offers a modest dividend yield of 0.28%, with a quarterly dividend amount of $0.52. While not a primary attraction for growth-oriented tech investors, this dividend provides a steady return, adding to the stock’s overall appeal for a broader investor base.

Performance Against 52-Week Benchmarks

Looking at the broader context, Meta’s current price of $737.05 sits comfortably below its 52-week high of $796.25 but significantly above its 52-week low of $479.80. This wide range highlights both the company’s impressive growth over the past year and the inherent volatility within the tech sector. The substantial recovery from its 52-week low demonstrates the market’s renewed confidence in Meta’s strategic direction and its ability to navigate competitive pressures and regulatory scrutiny.

Analyst Perspectives and Future Outlook

Market analysts continue to monitor Meta’s strategic initiatives closely, particularly its investments in the metaverse, artificial intelligence, and its core social media platforms (Facebook, Instagram, WhatsApp). While the metaverse remains a long-term bet, progress in AI integration across its advertising and content recommendation engines is seen as a crucial driver for near-term revenue growth.

“Meta’s consistent performance, even with minor daily fluctuations, reflects a maturing but still innovative company,” commented financial analyst Dr. Anya Sharma. “The slight upward movement today, combined with strong fundamentals like its P/E ratio, suggests that investors are buying into the long-term vision, even if the path isn’t always linear.”

The company’s ability to maintain its massive user base, monetize its platforms effectively, and explore new growth avenues will be critical in sustaining its market position and driving further stock appreciation. Regulatory challenges and competition from emerging platforms remain persistent headwinds, but Meta’s vast resources and technological prowess position it to adapt and evolve.

As September progresses, investors will be keen to observe Meta’s performance, especially in light of any upcoming product announcements, financial guidance updates, or broader market shifts. The tech giant’s daily movements, however small, contribute to the larger narrative of its ongoing journey in a rapidly evolving digital world.