Meta Platforms Faces Slight Dip Amidst Broader Market Movements

Stock Performance Shows Minor Fluctuations, Yet Long-Term Outlook Remains Stable

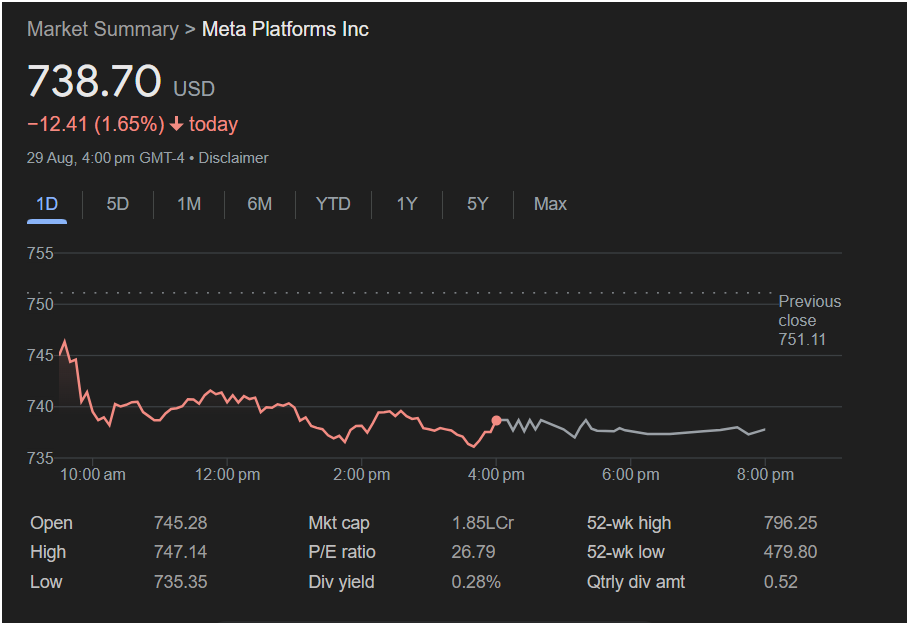

September 1, 2025 – Meta Platforms Inc. (META) experienced a minor downturn in its stock performance on August 29, 2025, closing at $738.70, a decrease of 12.41 points or 1.65% from its previous close of $751.11. The day’s trading saw the tech giant open at $745.28, reach a high of $747.14, and touch a low of $735.35, indicating a day of slight volatility within a relatively narrow band.

Despite the intraday dip, Meta’s market capitalization stands strong at 1.85 trillion, reflecting its substantial presence in the global technology landscape. The company’s Price-to-Earnings (P/E) ratio is reported at 26.79, and it offers a dividend yield of 0.28%, with a quarterly dividend amount of $0.52. These figures suggest a company with solid financial fundamentals and a commitment to shareholder returns.

A look at Meta’s 52-week performance shows a robust range, with a high of $796.25 and a low of $479.80. This wide spread underscores the dynamic nature of the stock, influenced by various market factors, company announcements, and technological advancements. While the recent 1-day dip might catch the eye of short-term traders, the broader historical context reveals significant growth and resilience.

Industry analysts will be watching closely to see if this minor dip is an isolated event or part of a larger trend. However, given Meta’s ongoing investments in areas like artificial intelligence, virtual reality, and its expansive social media platforms, the long-term outlook for the company remains a topic of considerable interest and generally positive sentiment among investors and experts alike. The tech giant’s consistent innovation and strategic expansions are expected to continue driving its value and influence in the evolving digital economy.