McDonald’s Corp Stock Analysis – Deep Dive Into Market Performance and Global Growth Outlook

Understanding McDonald’s Role in the Global Market

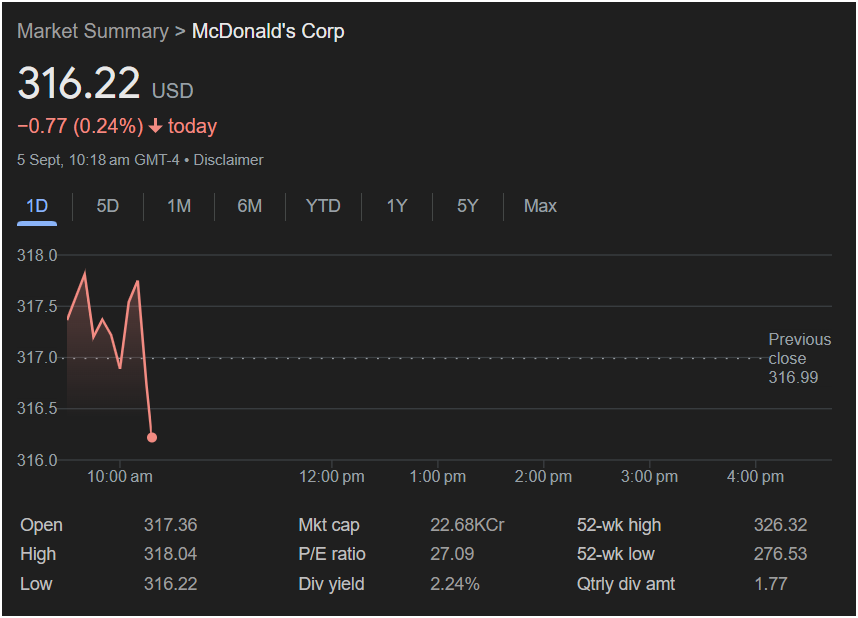

McDonald’s Corporation is more than just a fast-food chain; it is a global economic indicator for consumer spending trends, supply chain resilience, and franchise-based business models. Its stock performance often reflects broader economic shifts — including inflationary pressures, labor market dynamics, and consumer sentiment. Today’s market data, as seen in the chart, shows McDonald’s trading at $316.22 USD, down 0.24% for the day. This price action opens the door for deeper exploration into its valuation, future growth prospects, and strategic positioning.

Section 1: Daily Trading Snapshot

- Opening Price: $317.36

- Day’s High: $318.04

- Day’s Low: $316.22

- Previous Close: $316.99

- Market Cap: $22.68T (thousand crore equivalent)

- P/E Ratio: 27.09 (indicative of growth expectations)

- Dividend Yield: 2.24% (appealing to income investors)

The narrow range in today’s price action suggests cautious market sentiment. This may reflect ongoing discussions about consumer spending resilience, pricing power, and interest rate expectations.

Section 2: Fundamental Analysis – Revenue Streams and Business Model

McDonald’s revenue is largely derived from:

- Company-Operated Restaurants – representing direct operational income.

- Franchised Restaurants – providing high-margin revenue streams through rent, royalties, and fees.

- Strategic Partnerships & Digital Sales – including delivery platforms and loyalty programs.

A strong emphasis on franchising makes McDonald’s relatively asset-light compared to peers, allowing it to generate consistent free cash flow even in volatile markets.

Section 3: Macroeconomic Influences

Several external factors shape McDonald’s stock price:

- Global Inflation Trends – Higher food costs can compress margins but also lead to menu price adjustments.

- Currency Fluctuations – Since McDonald’s operates globally, FX volatility impacts revenue translation.

- Consumer Confidence – Spending behavior in key markets such as the US, Europe, and Asia drives same-store sales growth.

Section 4: Competitor Benchmarking

Competitors include Yum! Brands (KFC, Taco Bell, Pizza Hut), Restaurant Brands International (Burger King, Tim Hortons), and Wendy’s. McDonald’s typically outperforms due to:

- Superior scale and brand recognition.

- Aggressive adoption of technology (self-order kiosks, AI-powered drive-thrus).

- Global supply chain efficiencies that allow for cost control.

Section 5: Technical Analysis

Today’s downward movement may indicate short-term profit-taking. Key support and resistance levels can be mapped as follows:

- Immediate Support: Around $316

- Immediate Resistance: $318

- Medium-Term Trend: Slightly bullish, but consolidation possible near $315 level before next breakout.

Section 6: Dividend Strategy

With a 2.24% dividend yield and a long history of annual dividend increases, McDonald’s remains attractive to long-term investors seeking steady income. Its payout ratio remains sustainable due to strong cash flow from franchising.

Section 7: Growth Drivers

- Digital Expansion: Mobile app orders and loyalty programs are boosting engagement.

- Menu Innovation: Limited-time offers and localization keep customer interest high.

- Emerging Markets Expansion: Rapid growth in Asia and Latin America strengthens revenue diversification.

Section 8: Risks and Challenges

- Commodity Price Volatility – Beef, chicken, and potato prices directly affect margins.

- Labor Costs – Rising wages could pressure operating income.

- Competition – Intense price wars from rivals could cap pricing power.

- Regulatory Pressures – Changes in labor laws, nutrition labeling, and franchising regulations can impact operations.

Section 9: Investor Sentiment

Analysts generally hold a “moderate buy” rating on McDonald’s, citing its stability and consistent earnings. However, valuation remains a concern for some, given its relatively high P/E ratio versus the industry median.

Section 10: Long-Term Outlook (Open-Ended)

The future performance of McDonald’s will depend on its ability to adapt to changing consumer preferences, global economic cycles, and technological innovation. Investors will continue monitoring same-store sales growth, margin trends, and international expansion efforts to gauge whether the stock remains a compelling long-term holding.