Mastercard Shares Climb as Digital Payments Sector Remains Robust

Financial Services Giant Sees 0.81% Increase, Nearing 52-Week High

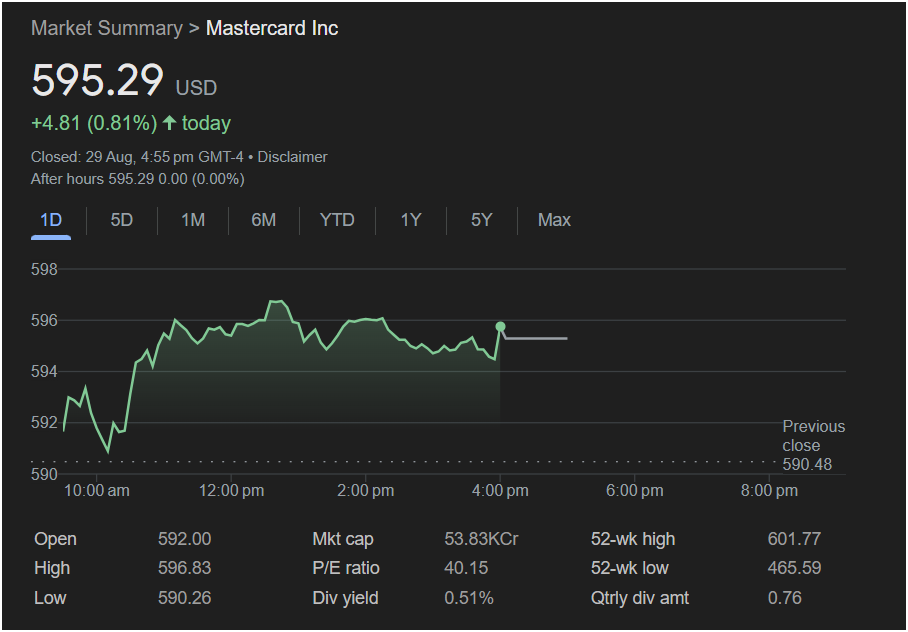

New York, August 31, 2025 – Mastercard Inc. (NYSE: MA) closed its trading day on a positive note, with shares rising to $595.29 USD. This represents a gain of $4.81, or 0.81%, by the market close on Friday, August 29th, 2025, at 4:55 PM GMT-4. The strong performance underscores the continued growth and stability within the digital payments industry.

The financial services powerhouse opened the day at $592.00, demonstrating consistent upward momentum throughout the trading session. Mastercard shares reached a daily high of $596.83, while the lowest point recorded was $590.26. The stock’s previous close was $590.48, setting the stage for today’s favorable movement. After-hours trading showed no change, holding steady at $595.29.

Mastercard commands a significant market capitalization of 53.83 trillion Indian Rupees, solidifying its position as a global leader in payment processing. The company’s P/E ratio stands at 40.15, indicative of strong investor confidence in its future earnings potential and continued expansion. Mastercard also offers a dividend yield of 0.51%, with a quarterly dividend amount of $0.76, providing a return to its shareholders.

In a broader annual perspective, Mastercard’s 52-week high is $601.77, while its 52-week low rests at $465.59. Today’s closing price of $595.29 positions the stock just shy of its annual peak, reflecting a robust year of growth. The accompanying chart clearly illustrates the positive trend and resilience demonstrated by Mastercard’s stock throughout the trading day.

As the world increasingly shifts towards cashless transactions and digital payment solutions, Mastercard’s strategic innovations and expansive global network continue to drive its market performance. Analysts are closely watching the company as it navigates evolving consumer behaviors and technological advancements in the ever-competitive financial technology landscape.