Mastercard Navigates Modest Dip: Steady Performance Amidst Market Fluctuations

Payments Giant Closes Slightly Down on August 28, 2025, Maintaining Strong Fundamentals and Investor Confidence

Date: August 29, 2025

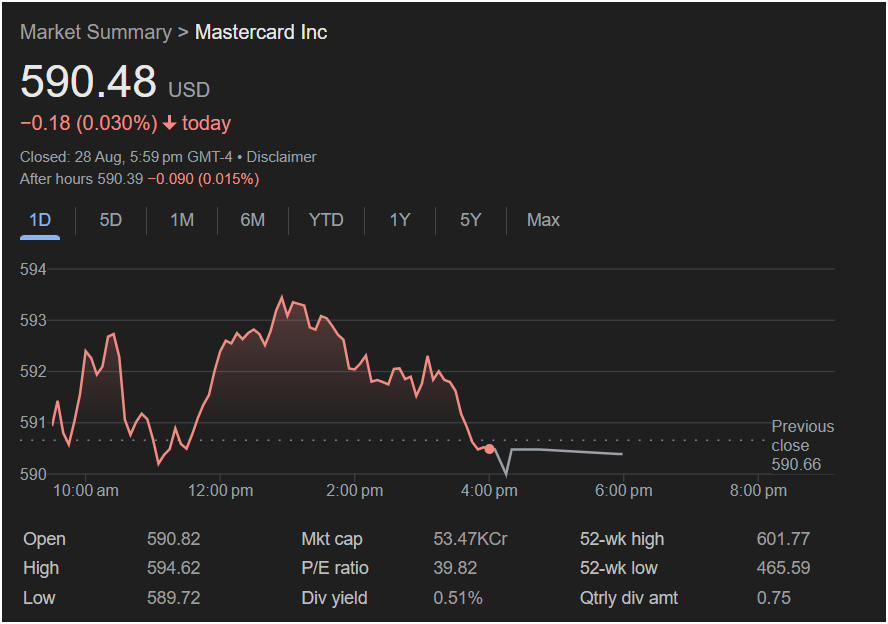

New York, NY – On August 28, 2025, Mastercard Inc. (NYSE: MA) concluded the trading day with a slight decline, closing at $590.48 USD. The stock experienced a minor dip of $0.18, representing a 0.030% decrease for the day. While a modest downward movement, this performance is set against the backdrop of a dynamic market, with the payments giant demonstrating resilience and stability in its core operations. The market officially closed at 5:59 PM GMT-4, with after-hours trading showing a further slight adjustment down by $0.090 (0.015%) to $590.39.

The trading session for Mastercard began with the stock opening at $590.82. Throughout the day, shares saw fluctuations, reaching an intraday high of $594.62 before settling near its closing price. The lowest point during the day’s trading was $589.72. Compared to the previous close of $590.66, today’s slight decrease underscores a period of consolidation for the company rather than a significant shift in its market standing.

Analyzing the Day’s Movement: Stability in a Dynamic Sector

Mastercard’s performance on this particular day reflects the inherent volatility of financial markets, even for established blue-chip companies. A marginal decline of 0.030% is often viewed within normal trading variations and does not typically indicate fundamental issues with the company’s business model or future prospects. Instead, it speaks to the continuous ebb and flow of investor sentiment driven by broader economic news, sector-specific developments, or profit-taking activities.

The payments industry, in which Mastercard is a dominant force, continues to experience rapid evolution driven by digital transformation, e-commerce growth, and emerging payment technologies. Mastercard’s consistent investment in innovation, security, and expanding its global network are critical factors that contribute to its long-term stability and market leadership. The company’s strategic partnerships and ongoing efforts to facilitate seamless and secure transactions across various platforms reinforce its pivotal role in the global economy.

Key Financial Metrics: A Foundation of Strength

Despite the marginal daily dip, a look at Mastercard’s key financial indicators reveals a company built on robust fundamentals. With a commanding market capitalization of 53.47KCr, Mastercard stands as a cornerstone of the financial services sector. This substantial valuation reflects its extensive global network, strong brand recognition, and a business model that benefits from the continuous growth of digital payments worldwide.

The company’s Price-to-Earnings (P/E) ratio is reported at 39.82. This P/E ratio, while reflecting healthy investor expectations for future earnings, is often considered more moderate for a growth-oriented financial technology company compared to some high-growth tech firms. It suggests a balanced view from investors, acknowledging both Mastercard’s strong growth prospects and its established profitability.

Mastercard also offers a dividend yield of 0.51%, with a quarterly dividend amount of $0.75. The presence of a consistent dividend payout underscores the company’s financial health and its commitment to returning value to shareholders, a characteristic often favored by investors seeking both growth and income.

Longer-Term Perspective: 52-Week Performance and Outlook

Examining Mastercard’s performance over the past year provides essential context. The company’s 52-week high stands at an impressive $601.77, while its 52-week low was $465.59. This range illustrates the stock’s growth trajectory and its ability to rebound and achieve new highs. Today’s closing price of $590.48 positions it near the upper end of its 52-week performance, indicating strong underlying momentum despite the minor daily correction.

Looking forward, Mastercard is strategically positioned to capitalize on the ongoing global shift towards digital and cashless transactions. Its extensive network, innovative payment solutions, and strong focus on security are competitive advantages that are likely to drive continued growth. The company’s efforts in expanding into new markets, developing advanced payment technologies (such as real-time payments and blockchain-based solutions), and fostering partnerships with fintech innovators will be crucial for its sustained success.

Investor Sentiment and Expert Commentary

The slight decline on August 28, 2025, is unlikely to deter long-term investors who view Mastercard as a stable and growth-oriented asset. Financial analysts generally hold a positive outlook on Mastercard, citing its indispensable role in the global payments ecosystem. The secular trends favoring digital payments, coupled with Mastercard’s strong brand, technological leadership, and effective risk management, continue to make it an attractive investment.

Experts often emphasize Mastercard’s ability to generate significant revenue from transaction fees, which are tied directly to consumer spending. As global economies recover and e-commerce continues its expansion, Mastercard is well-placed to benefit from increased transaction volumes. Its robust network infrastructure and commitment to cybersecurity also provide a layer of trust that is paramount in the financial industry.

Mastercard’s Steady Hand in the Payments Revolution

In summary, while Mastercard Inc. experienced a minor dip on August 28, 2025, its overall market position remains robust. The day’s marginal decline is a typical market fluctuation and does not overshadow the company’s strong fundamentals, impressive market capitalization, consistent dividend payout, and strategic initiatives. As a leader in the global payments industry, Mastercard continues to drive innovation and facilitate secure transactions worldwide. Its consistent performance, even during periods of minor market adjustment, underscores its stability and its promising long-term outlook in an increasingly digital global economy.