Linde PLC (LIN) Stock Today: A Deep-Dive into Market Performance, Business Fundamentals, and Global Industrial Gas Trends

Linde PLC (ticker symbol: LIN) is a global leader in industrial gases and engineering solutions, serving customers in diverse industries including healthcare, energy, manufacturing, and chemicals. As one of the largest industrial gas companies worldwide, Linde’s performance is closely watched as a proxy for industrial activity and global economic health.

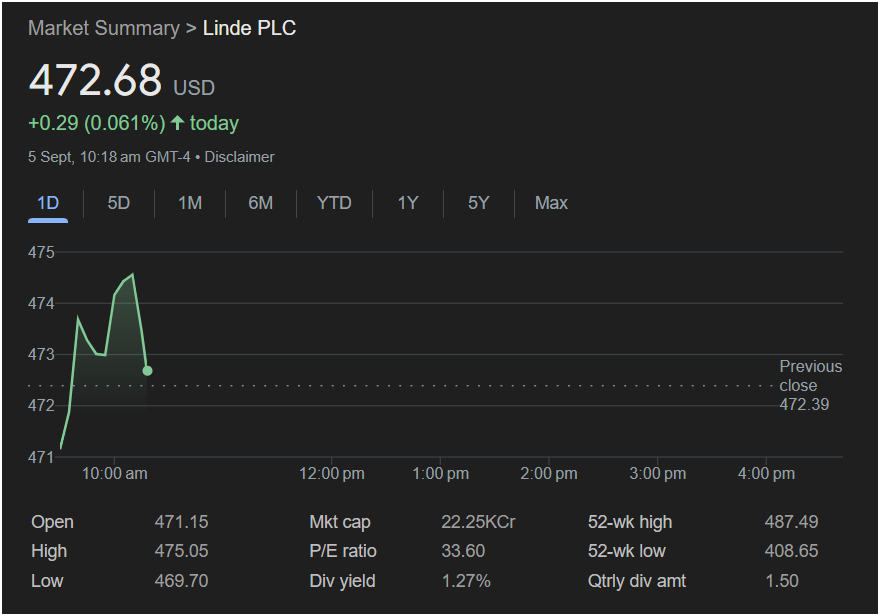

On September 5th, 2025, Linde’s stock opened at $471.15 and traded at $472.68 as of 10:18 AM GMT-4, representing a modest gain of +0.29 points or +0.061% compared to the previous close of $472.39. The stock briefly touched an intraday high of $475.05, showing early buying interest before stabilizing around the $472–$473 range.

This open-ended analysis explores Linde’s real-time performance, its core business fundamentals, industry outlook, competitive landscape, and strategic initiatives, offering an ongoing narrative of the company’s position in the global industrial gas market.

Real-Time Price Performance

Linde’s intraday price action suggests steady investor sentiment, with limited volatility despite broader market fluctuations. The quick rise toward $475.00 followed by consolidation indicates early-session optimism tempered by profit-taking. The stock remains near its 52-week high of $487.49, signaling strong investor confidence in the company’s growth prospects.

Fundamental Analysis

Linde generates revenue through the production and distribution of atmospheric gases (oxygen, nitrogen, argon) and process gases (hydrogen, carbon monoxide, helium, and specialty gases). Its business fundamentals are driven by:

- Long-Term Contracts: Stable revenue streams from multi-year agreements with industrial and healthcare customers.

- Geographic Diversification: Presence in over 100 countries reduces exposure to regional economic slowdowns.

- Innovation: Investment in clean energy technologies such as hydrogen production and carbon capture solutions.

With a P/E ratio of 33.60, Linde trades at a premium valuation relative to some industrial peers, reflecting expectations for continued growth in the hydrogen economy and decarbonization initiatives.

Competitive Landscape

Linde competes with Air Liquide, Air Products & Chemicals, and other regional industrial gas players. Its scale, global infrastructure, and engineering expertise give it a competitive edge, allowing it to deliver cost-efficient and reliable gas solutions to customers worldwide.

Industry Outlook

The industrial gas market is poised for steady growth, supported by rising demand in sectors such as healthcare, clean energy, and advanced manufacturing. Key trends include:

- Hydrogen Economy: Global investment in hydrogen as a clean fuel source creates new revenue streams for industrial gas companies.

- Sustainability Initiatives: Governments and corporations are seeking low-carbon solutions, boosting demand for carbon capture and green gas production.

- Semiconductor and Electronics Demand: Specialty gases play a crucial role in chip manufacturing, a fast-growing industry.

Investor Sentiment

Analyst ratings for Linde remain favorable, with many maintaining buy or overweight recommendations. Investors are encouraged by the company’s consistent free cash flow generation, disciplined capital allocation, and shareholder returns through dividends and share repurchases. The dividend yield of 1.27% adds income appeal to growth-oriented investors.

Risks and Challenges

Linde faces several key risks:

- Commodity Price Volatility: Changes in energy prices can affect production costs.

- Global Economic Slowdowns: Reduced industrial activity could weigh on demand.

- Regulatory Pressure: Stricter environmental regulations may increase compliance costs but also create opportunities for sustainable solutions.

Strategic Growth Opportunities

Linde is expanding its footprint in hydrogen production, partnering with governments and energy companies to develop large-scale hydrogen infrastructure projects. Its engineering division plays a key role in delivering turnkey solutions for clean energy and industrial decarbonization.

Open-Ended Analysis

The story of Linde’s growth continues to unfold as global demand for industrial gases rises in tandem with technological innovation and sustainability goals. Investors will watch for:

- Progress on hydrogen and carbon capture projects.

- Expansion into emerging markets.

- Evolution of industrial demand across sectors like electronics and healthcare.

- The impact of macroeconomic conditions on capital expenditure cycles.

Linde’s role as a key enabler of the energy transition and industrial efficiency ensures that its performance remains a critical indicator for global economic trends.