JPMorgan Chase Sees Strong Gains, Closes Day Upbeat

Investor Confidence Soars as Financial Giant Continues Upward Trajectory

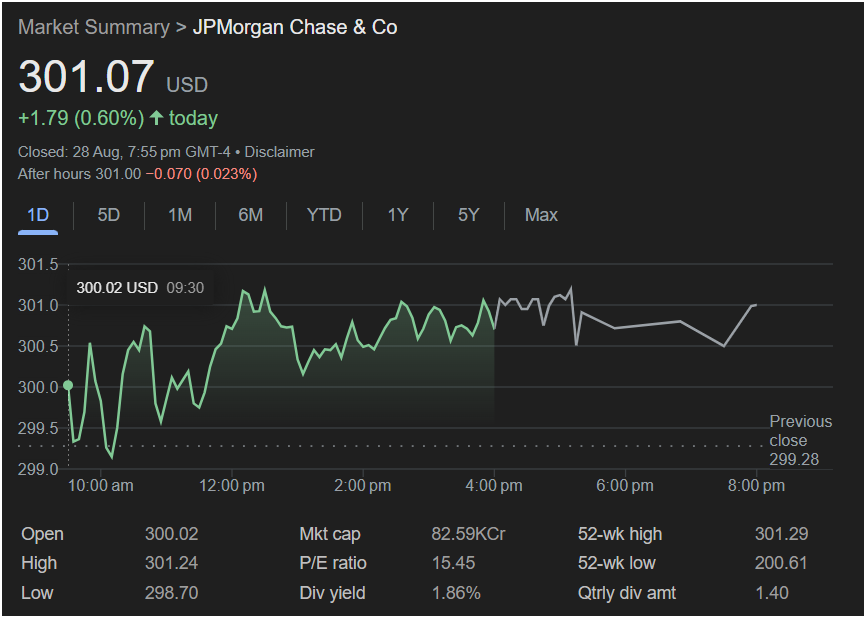

New York, NY – August 29, 2025 – JPMorgan Chase & Co. (NYSE: JPM) concluded trading on August 28th with a robust performance, adding to its impressive year. The financial behemoth’s stock price climbed to

1.79 (0.60%) for the day. This positive movement underscores strong investor confidence and highlights the company’s continued stability and growth in a dynamic market.

Throughout the trading day, JPMorgan Chase demonstrated resilience, opening at $300.02 and reaching a high of $301.24 before settling at its closing price. The intraday chart illustrates a healthy upward trend, with consistent gains appearing from mid-morning through to the afternoon, showcasing steady buying interest.

This latest uptick brings the company’s market capitalization to a staggering 82.59KCr, a testament to its vast influence and operational success. With a P/E ratio of 15.45, JPMorgan Chase remains an attractive prospect for investors seeking value. Furthermore, the company continues to reward its shareholders with a competitive dividend yield of 1.86% and a quarterly dividend amount of $1.40, reinforcing its commitment to shareholder returns.

Looking at the broader picture, the stock’s performance is particularly encouraging. Its current 52-week high stands at $301.29, just shy of today’s peak, indicating that the company is operating at or near its strongest levels within the past year. This is a significant improvement from its 52-week low of $200.61, reflecting substantial appreciation and successful strategic initiatives over the past year.

As the financial sector navigates evolving economic landscapes, JPMorgan Chase’s consistent positive performance signals its strong leadership and adaptability. The market’s reaction to the close of August 28th trading reinforces the narrative of a well-managed institution poised for continued success, offering a bright outlook for investors and stakeholders alike.