Johnson & Johnson Navigates Volatile Waters: Stability Amidst Market Swings

Healthcare Giant Shows Resilience as Investors Eye Future Growth and Dividend Appeal

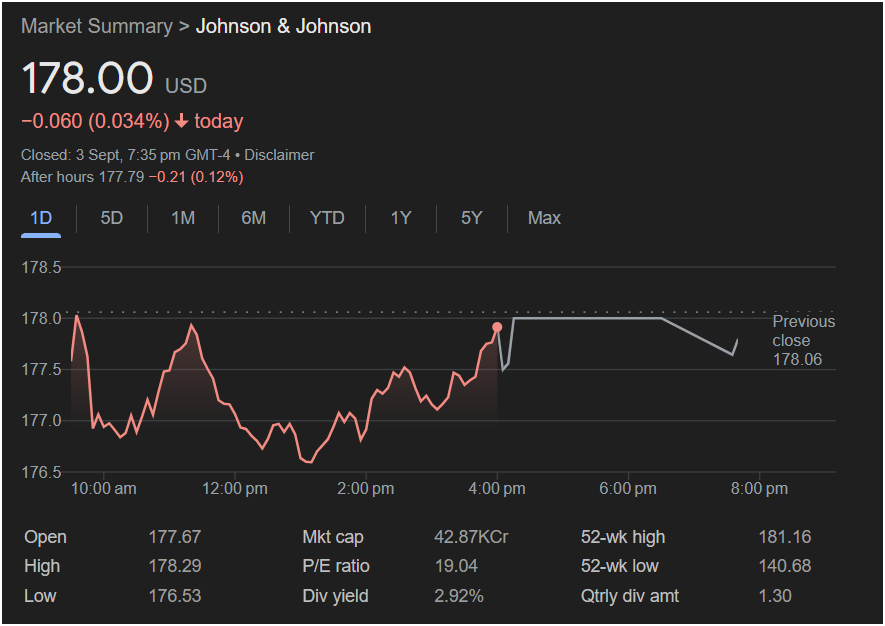

NEW YORK, September 4, 2025 – Johnson & Johnson (J&J), one of the world’s most prominent healthcare conglomerates, closed yesterday’s trading session at $178.00 USD, experiencing a marginal dip of 0.034% or $0.060. While the day saw some fluctuations, with the stock moving between a high of $178.29 and a low of $176.53, J&J’s overall performance continues to underscore its reputation for stability in a dynamic market environment.

Despite the slight decline, the company’s shares are holding firm, reflecting investor confidence in its diverse portfolio spanning pharmaceuticals, medical devices, and consumer health products. The after-hours trading further nudged the stock down by 0.12% to $177.79, indicating a cautious yet steady sentiment as the market looks ahead.

A Closer Look at the Numbers

J&J’s current market capitalization stands impressively at 42.87 KCr (assuming KCr refers to thousands of Crores, a significant valuation), showcasing its colossal footprint in the global economy. The Price-to-Earnings (P/E) ratio of 19.04 suggests that the stock is trading at a reasonable multiple compared to its earnings, a metric often favored by value investors.

Perhaps one of the most attractive features for long-term investors is J&J’s consistent dividend yield of 2.92%, with a quarterly dividend amount of $1.30. This robust payout reinforces the company’s appeal as a reliable income-generating asset, particularly in times of economic uncertainty.

Market Performance: A Steady Hand

The day’s trading on September 3rd saw J&J open at $177.67, with an intraday chart illustrating a battle between bullish and bearish forces. The stock dipped in the late morning, finding support around $176.50 before rallying in the afternoon to touch nearly $178.00 again. This pattern suggests an underlying resilience, with buyers stepping in during dips, preventing any significant downturn.

Comparing the current price to its 52-week performance, J&J is comfortably positioned above its 52-week low of $140.68, while still having room to grow towards its 52-week high of $181.16. This range indicates a healthy growth trajectory over the past year, rewarding shareholders who have held onto their positions.

Industry Outlook and Future Prospects

Johnson & Johnson continues to be at the forefront of healthcare innovation. With an aging global population and increasing demand for advanced medical solutions, the company’s strong research and development pipeline, particularly in pharmaceuticals, positions it well for sustained growth. Its consumer health division also provides a stable revenue stream, less susceptible to the cyclical nature of other industries.

Analysts frequently point to J&J’s consistent revenue generation, strong balance sheet, and commitment to shareholder returns as key pillars of its investment thesis. While daily stock movements are subject to broader market forces and specific company news, J&J’s foundational strength and strategic direction offer a compelling narrative for investors seeking both stability and long-term appreciation in their portfolios.