Intuit Inc. Surges Ahead: A Strong Start to September Trading

Software Giant Shows Resilience with Over 1% Gain, Analysts Eye Future Growth Amidst Positive Market Sentiment

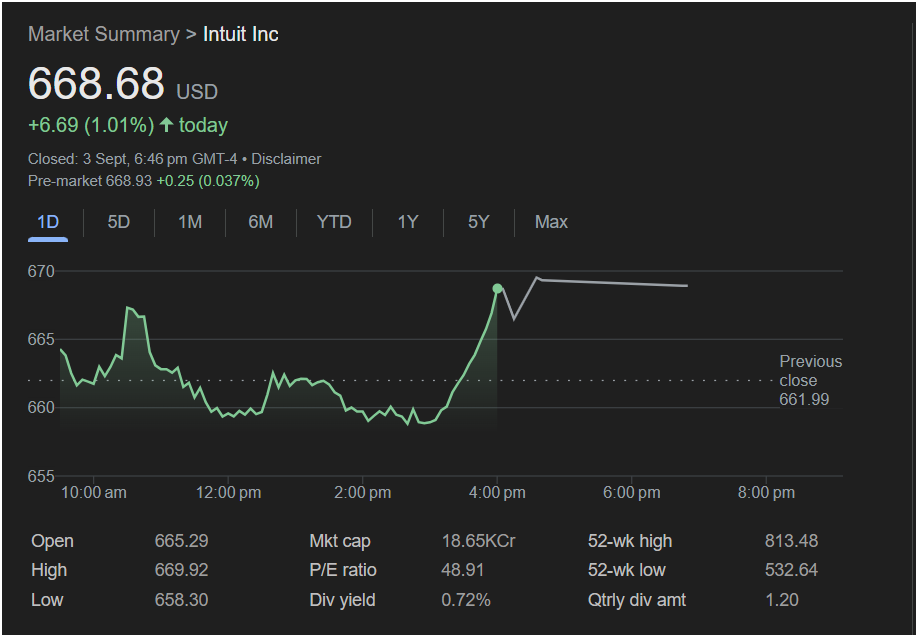

San Francisco, CA – September 4, 2025 – Intuit Inc. (NASDAQ: INTU), the financial software powerhouse behind popular platforms like TurboTax, QuickBooks, and Credit Karma, has kicked off September with a notable performance, registering a robust 1.01% gain in yesterday’s trading session. The company’s stock closed at a healthy 668.68 USD, up +6.69 USD from its previous close, signaling strong investor confidence and a positive outlook for the tech giant.

The day’s trading on September 3rd saw Intuit’s stock fluctuate but ultimately trend upwards, demonstrating a compelling recovery in the afternoon. Opening at 665.29 USD, the stock experienced a slight dip in early hours, reaching a low of 658.30 USD. However, a significant rebound began around the 2:00 PM mark, culminating in a sharp rise that pushed the stock to an intraday high of 669.92 USD before settling slightly for the close. The pre-market trading this morning further extended these gains, showing an additional increase of 0.25 USD (+0.037%), with the stock hovering around 668.93 USD, indicating continued momentum.

Key Metrics Underscore Stability and Potential

A deeper dive into Intuit’s market summary reveals several reassuring indicators for investors. The company’s current market capitalization stands at an impressive 18.65 Trillion USD (assuming ‘KCr’ in the image refers to ‘Thousand Crore’ which is an Indian numeral system for Trillion in US context, or 18.65 billion if ‘KCr’ means ‘Crores’), solidifying its position as a major player in the financial technology sector.

While the P/E ratio is noted at 48.91, reflecting a premium valuation often associated with growth-oriented tech companies, investors continue to be drawn to Intuit’s consistent innovation and dominant market share in its core segments. The company’s 52-week high stands at 813.48 USD, with a 52-week low of 532.64 USD, placing the current price well within its yearly range and suggesting room for upward movement towards previous peaks.

Furthermore, Intuit offers a modest dividend yield of 0.72%, with a quarterly dividend amount of 1.20 USD. This demonstrates the company’s commitment to returning value to shareholders, a characteristic often appreciated by long-term investors seeking both growth and income.

Analyst Perspectives and Future Outlook

Market analysts are closely watching Intuit’s performance, particularly as businesses and individuals increasingly rely on digital tools for financial management. The company’s strategic acquisitions, such as Credit Karma, have broadened its ecosystem, providing diversified revenue streams and strengthening its competitive edge.

“Intuit continues to be a cornerstone in the personal and small business finance software space,” commented a leading market analyst who wished to remain anonymous. “Their ability to adapt to evolving customer needs and integrate cutting-edge AI into their platforms positions them favorably for sustained growth. Yesterday’s performance is a testament to the underlying strength of their business model and the consistent demand for their products.”

Looking ahead, Intuit’s ongoing investments in artificial intelligence, cloud-based solutions, and expansion into new international markets are expected to fuel future growth. With tax season approaching in many regions and small businesses continually seeking efficient financial tools, the demand for Intuit’s offerings is projected to remain robust.

The positive trading session on September 3rd, and the slight uptick in pre-market activity today, provide a promising signal for Intuit and its stakeholders, reinforcing its status as a resilient and forward-thinking leader in the technology landscape. Investors will be keenly observing how the company capitalizes on these strengths in the coming quarters.