IBM Shares Climb as Market Confidence Grows

Big Blue Continues Upward Trend, Signaling Strong Performance and Investor Optimism

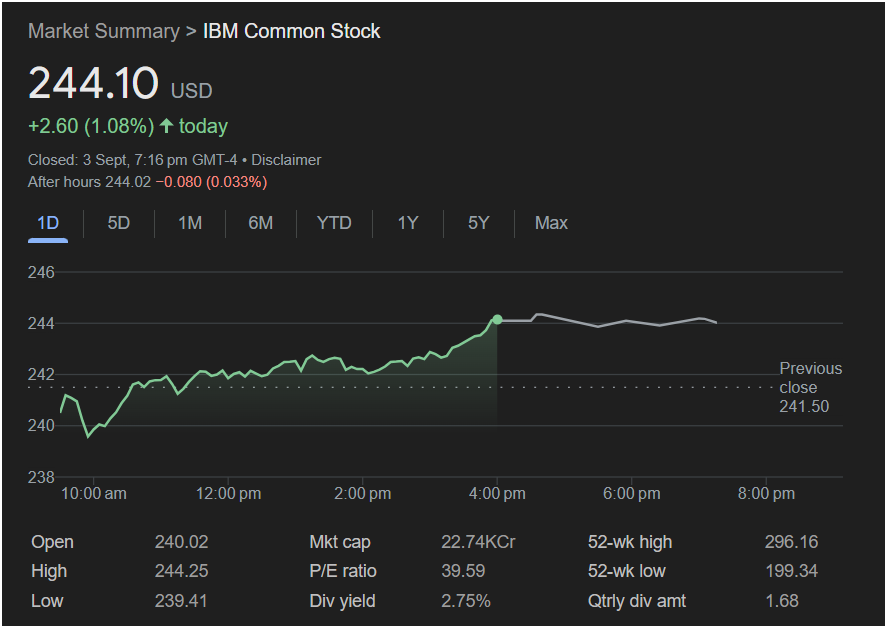

New York, NY – September 4, 2025 – International Business Machines (IBM) is once again in the spotlight as its common stock continues a positive trajectory, reflecting growing investor confidence and a robust market performance. As of yesterday’s close on September 3, 2025, IBM shares were trading at $244.10, marking a healthy increase of $2.60, or 1.08%, for the day.

The positive movement extended into after-hours trading, with shares holding steady at $244.02. This steady performance underscores a period of sustained growth for the technology giant, which saw its stock fluctuate between a daily high of $244.25 and a low of $239.41 before settling at its impressive closing price.

Market indicators further illustrate IBM’s strength. The company boasts a substantial market capitalization of 22.74KCr, indicating its significant presence and stability in the global market. With a P/E ratio of 39.59, investors are showing a willingness to pay a premium for IBM’s earnings, a testament to its perceived future growth potential. Furthermore, a dividend yield of 2.75% and a quarterly dividend amount of $1.68 make IBM an attractive option for income-focused investors.

Looking at the broader picture, IBM’s 52-week high stands at $296.16, while its 52-week low was $199.34. The current trading price of $244.10 positions the company well within this range, demonstrating recovery and consistent upward momentum following previous market fluctuations.

Analysts point to IBM’s strategic focus on hybrid cloud, AI, and consulting services as key drivers behind its recent success. The company’s commitment to innovation and its ability to adapt to evolving technological landscapes continue to resonate positively with both institutional and individual investors. As Big Blue navigates the complexities of the tech industry, its latest market performance serves as a strong indicator of its enduring relevance and potential for future expansion.