Grab Holdings (GRAB) Navigates Volatile Session as Investors Eye High Valuation and Analyst Targets

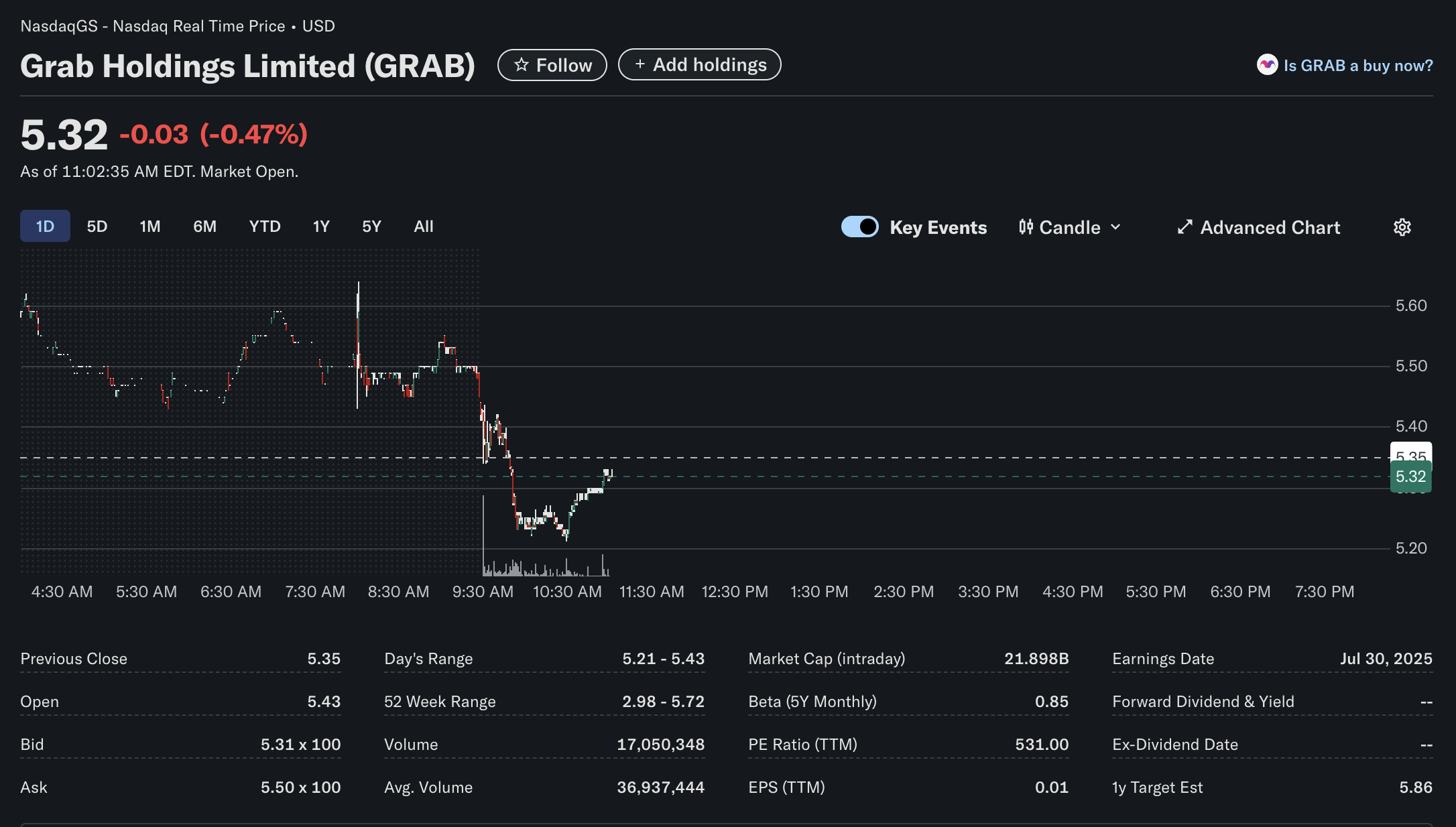

Grab Holdings Limited (NASDAQ: GRAB), the Southeast Asian super-app, is experiencing a volatile trading day. As of 11:02 AM EDT, the stock was priced at $5.32, marking a slight decrease of 0.47%. This movement comes after a sharp drop from its opening price, drawing investor attention to the company’s technical posture, fundamental valuation, and overall market sentiment.

Technical Analysis: Intraday Reversal After Sharp Morning Sell-Off

The intraday chart for GRAB tells a story of significant short-term volatility.

-

Price Action: The stock opened higher at $5.43, above the previous day’s close of $5.35. However, it was immediately met with strong selling pressure, causing the price to fall to an intraday low of $5.21. Since hitting that low, the stock has shown signs of a recovery, climbing back above $5.30.

-

Volume: Trading volume stood at over 17 million shares mid-morning. While substantial, this is currently tracking below its average daily volume of nearly 37 million shares, suggesting the morning’s sharp moves occurred on less than overwhelming conviction.

-

Key Levels: The previous close of $5.35 is now acting as an important pivot point. For the stock to regain a bullish intraday trend, it will need to reclaim and hold this level. The day’s low of $5.21 serves as the immediate support level to watch.

Fundamental Analysis: A Classic Growth Stock Profile

Grab’s fundamental metrics paint the picture of a company in a high-growth phase, with a valuation that reflects strong future expectations.

-

Valuation: Grab’s market capitalization is approximately $21.9 billion. The most notable metric is its Price-to-Earnings (P/E) ratio, which stands at an exceptionally high 531.00. This sky-high P/E is based on a slim trailing twelve-month Earnings Per Share (EPS) of just $0.01, indicating that investors are placing a massive premium on the company’s potential for future earnings growth rather than its current profitability.

-

Analyst Outlook: The 1-year analyst target estimate is $5.86. This suggests that, on average, analysts see moderate upside from the current price, placing the stock’s fair value near its 52-week high of $5.72. This indicates a generally positive, albeit not overwhelmingly bullish, consensus from Wall Street.

-

Volatility: The stock has a 5-year monthly Beta of 0.85. A beta below 1.0 typically suggests that a stock is less volatile than the overall market. However, this long-term measure contrasts with the significant intraday volatility seen on the chart, a common characteristic for high-growth stocks with lofty valuations.

Sentiment Analysis: A Tug-of-War Between Bulls and Bears

The market sentiment surrounding GRAB appears to be a mix of long-term optimism and short-term caution.

-

Short-Term Uncertainty: The sharp sell-off at the market open points to immediate bearish pressure or profit-taking, especially after the stock opened higher. The subsequent rebound from the lows, however, indicates that “dip-buyers” are present and willing to step in at lower prices.

-

Long-Term Growth Bet: The extremely high P/E ratio is the clearest sign of bullish long-term sentiment. Investors are betting heavily on Grab’s ability to dominate the ride-hailing, food delivery, and digital finance markets in Southeast Asia and to translate that market share into significant profits in the future.

-

Analyst Alignment: Unlike some stocks where analyst targets diverge sharply from market prices, the consensus target for GRAB is reasonably close to its current trading level. This suggests that the market’s current valuation, while high, is generally in line with professional expectations for the company’s trajectory over the next year.

In conclusion, Grab Holdings is exhibiting the classic characteristics of a major growth stock: high volatility, an expensive valuation based on future promise, and a market divided between short-term traders and long-term believers. Investors will be closely watching if it can sustain its recovery and push towards analyst price targets.

Disclaimer: This article is for informational purposes only and is based on publicly available data as of a specific point in time. It does not constitute financial, investment, or trading advice. All investment activities carry risks, and individuals should consult with a qualified financial professional before making any investment decisions.