D-Wave Quantum (QBTS) Stock Plunges in Morning Trade: An Analysis of the Sell-Off

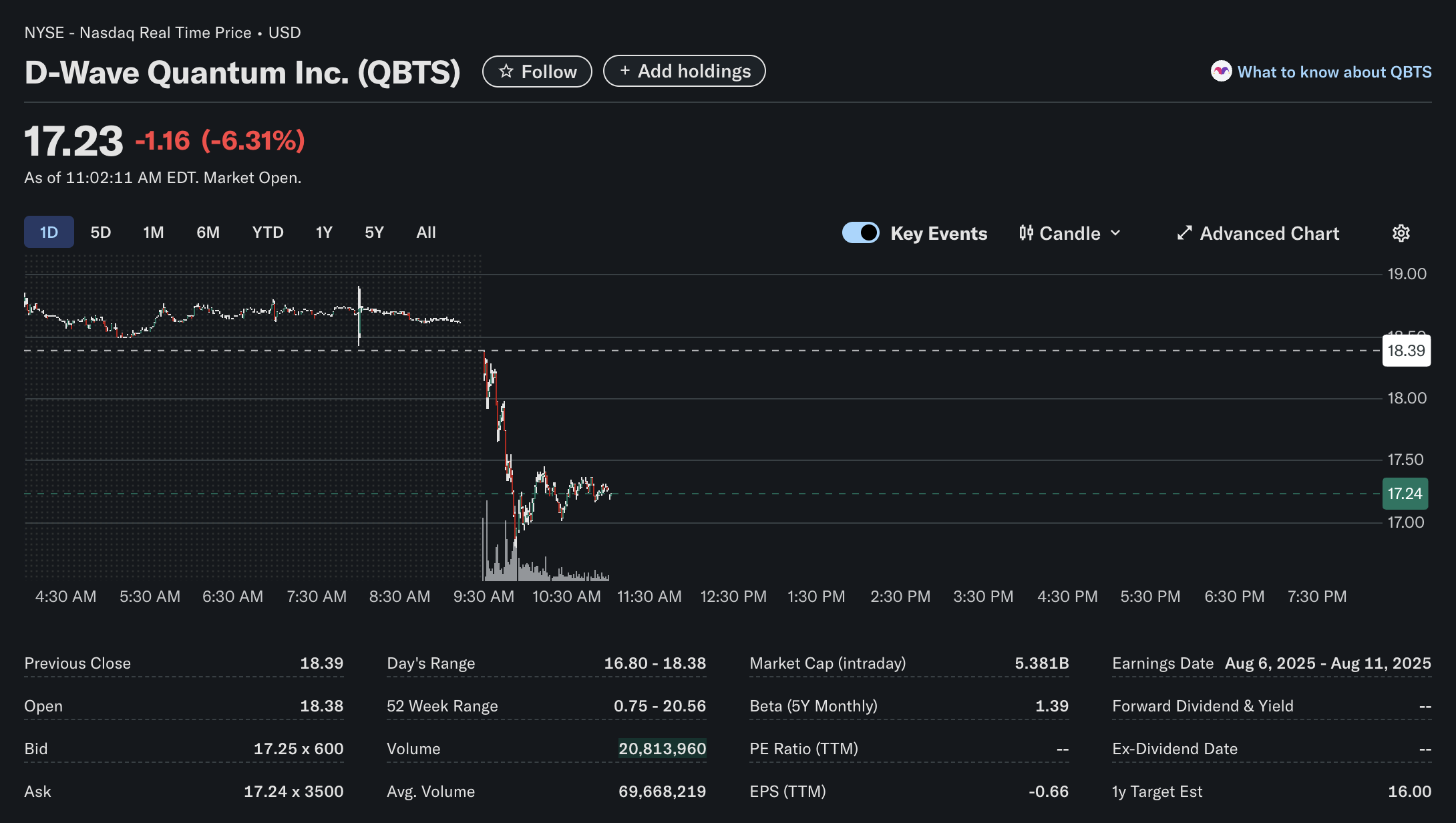

Shares of D-Wave Quantum Inc. (QBTS), a company at the forefront of quantum computing systems, experienced a sharp downturn in early market hours today. As of 11:02:11 AM EDT, the stock was trading at $17.23, a significant drop of $1.16, representing a 6.31% loss for the session. This sharp move has caught the attention of investors, prompting a closer look at the technical and fundamental factors at play.

Technical Analysis: A Sharp Rejection at the Open

The intraday chart for QBTS paints a clear picture of a bearish start to the day. After trading relatively flat in the pre-market session, the stock opened at $18.38, just shy of its previous close of $18.39. Immediately following the market open, the stock was hit with intense selling pressure, evidenced by a large red candle and a significant spike in trading volume. This sell-off drove the price down to an intraday low of $16.80.

-

Current Price: $17.23

-

Intraday Change: -$1.16 (-6.31%)

-

Previous Close: $18.39

-

Day’s Range: $16.80 – $18.38

-

Volume: 20,813,960

Since hitting the session low, the price has attempted to consolidate in a tight range, but remains substantially below its opening price. The trading volume, while heavy during the initial drop, is currently tracking below its daily average of 69,668,219, though the day is still young. The failure to hold the previous day’s support level suggests strong bearish control in the short term.

Fundamental Analysis: A Look Under the Hood

D-Wave’s fundamental profile is characteristic of a pioneering technology company in a high-growth, pre-profitability phase.

-

Market Capitalization (Intraday): $5.381 Billion. This reflects significant investor belief in the long-term disruptive potential of quantum computing and D-Wave’s role within the industry.

-

Profitability: The company is not yet profitable, with a trailing twelve-month (TTM) Earnings Per Share (EPS) of -$0.66. Consequently, a Price-to-Earnings (PE) ratio is not applicable. This is common for companies heavily investing in research and development for future growth.

-

Volatility (Beta): With a 5-Year Monthly Beta of 1.39, QBTS is more volatile than the broader market. This indicates that its price swings, both up and down, tend to be more pronounced than the S&P 500.

-

52-Week Range: The stock’s performance over the last year has been impressive, trading in a wide range from $0.75 to $20.56. The current price, despite today’s drop, remains near the upper end of this range, signaling substantial investor returns over the past year.

-

Analyst Target: The 1-year analyst target estimate is $16.00. This is a critical metric to note, as it sits below the current trading price of $17.23, suggesting that analysts, on average, may view the stock as currently overvalued or anticipate a price correction.

-

Earnings Date: The provided earnings date is listed for August 6 – August 11, 2025, a date far in the future which could be a placeholder or indicative of a specific long-term reporting schedule.

Sentiment Analysis: Caution Creeps In

The market sentiment for QBTS today is overtly bearish, as demonstrated by the sharp sell-off at the market open. While the stock has enjoyed a strong bullish run over the past year, today’s price action and the analyst price target of $16.00 could signal a shift in sentiment. Investors may be taking profits after a significant run-up, or reacting to broader market trends or sector-specific news. The speculative nature of the quantum computing industry means that sentiment can shift rapidly based on technological milestones, competitive developments, and overall market risk appetite.

Conclusion

D-Wave Quantum (QBTS) is a highly speculative, high-growth stock that has rewarded long-term investors over the past year. However, today’s trading session highlights the inherent volatility of the stock. The technical picture is currently bearish, with the stock breaking below key support levels. Fundamentally, while the company’s market cap shows strong belief in its future, the lack of current profitability and a bearish analyst price target suggest that investors should proceed with caution. The future performance of QBTS will likely be tied less to traditional financial metrics and more to its progress in the revolutionary field of quantum computing.

Disclaimer: This analysis is based solely on the provided image data as of 11:02:11 AM EDT. It is for informational purposes only and does not constitute financial advice. Stock prices and market conditions are subject to rapid change. Investors should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions.