Goldman Sachs Group Inc. (GS) Stock Today: A Deep-Dive into Market Performance, Financial Strength, and Global Banking Trends

Goldman Sachs Group Inc. (ticker symbol: GS) is one of the world’s most prominent investment banks and financial services firms, offering a wide range of services across investment banking, asset management, trading, and wealth advisory. Known as a bellwether for global capital markets activity, Goldman Sachs’ stock performance often reflects investor sentiment toward the financial sector and overall economic outlook.

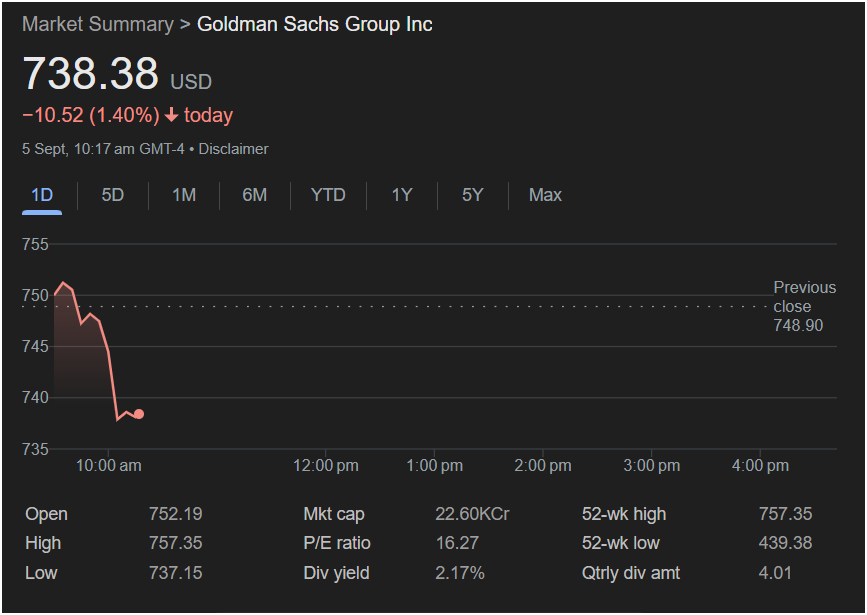

On September 5th, 2025, Goldman Sachs’ stock opened at $752.19 and traded at $738.38 as of 10:17 AM GMT-4, representing a decline of -10.52 points or -1.40% compared to the previous close of $748.90. The stock touched an intraday high of $757.35 before reversing sharply lower, signaling notable selling pressure early in the trading session.

This open-ended analysis examines Goldman Sachs’ market performance, business fundamentals, competitive positioning, macroeconomic exposure, and strategic initiatives.

Real-Time Price Performance

The early trading session for Goldman Sachs displayed significant downward momentum, with shares falling more than $10 from the open. The decline may be attributed to market-wide risk-off sentiment, sector-specific news, or investor concerns regarding interest rates, deal-making activity, or trading revenue. The stock remains within its 52-week range of $439.38 to $757.35, but the move highlights the volatility that can accompany financial sector equities.

Fundamental Analysis

Goldman Sachs’ revenue is derived from four main segments:

- Investment Banking: Advisory services for mergers & acquisitions, IPOs, and capital raising.

- Global Markets: Trading of equities, fixed income, currencies, and commodities.

- Asset & Wealth Management: Investment management solutions for institutions and high-net-worth clients.

- Platform Solutions: Consumer and transaction banking products.

With a P/E ratio of 16.27, Goldman Sachs trades at a valuation that suggests a balance between growth expectations and cyclical risks inherent in the banking sector. The firm’s dividend yield of 2.17% provides income for investors while reflecting its robust capital return policy.

Competitive Landscape

Goldman Sachs operates in a competitive financial services environment, facing rivals such as Morgan Stanley, JPMorgan Chase, Citigroup, and Bank of America. The company’s brand reputation, global reach, and deep client relationships give it a competitive edge, though it must constantly innovate to maintain market leadership.

Industry Outlook

The global financial sector is influenced by interest rate policy, regulatory frameworks, and macroeconomic conditions. Rising interest rates can boost net interest income but may also suppress deal activity. Meanwhile, trends such as digitization of financial services, growth in alternative investments, and ESG (environmental, social, and governance) investing present new opportunities and challenges.

Investor Sentiment

Investor sentiment toward Goldman Sachs remains mixed. Bulls argue that the firm’s diversified business model positions it well for long-term growth, while bears worry about earnings volatility tied to trading revenues and deal-making cycles. The stock’s performance often moves in tandem with economic data releases, Federal Reserve decisions, and geopolitical developments.

Risks and Challenges

Goldman Sachs faces several risks:

- Economic Cyclicality: Investment banking revenue is sensitive to M&A and IPO market activity.

- Market Volatility: Trading revenue can fluctuate significantly during periods of market stress.

- Regulatory Pressure: Compliance with global banking regulations adds operational complexity.

- Reputation Risk: As a leading financial institution, Goldman Sachs must manage reputational risk carefully.

Strategic Growth Opportunities

The firm continues to diversify its revenue base by growing its asset and wealth management business, focusing on recurring fee income. Expansion into consumer banking through its digital platform and credit partnerships adds new growth levers. Additionally, its focus on technology, automation, and data analytics enhances operational efficiency.

Open-Ended Analysis

Goldman Sachs’ trajectory will depend on:

- The health of global capital markets and M&A pipelines.

- The impact of interest rate movements on lending and trading activity.

- Growth in asset management inflows and recurring revenue streams.

- The firm’s ability to navigate regulatory changes and geopolitical risks.

The narrative surrounding Goldman Sachs will continue to evolve as macroeconomic conditions shift, capital markets activity ebbs and flows, and the financial services industry undergoes digital transformation.