Eli Lilly Maintains Upward Momentum: Shares Climb Amidst Steady Market Performance

Pharmaceutical Giant Shows Resilience as Investors Watch for Future Growth Drivers

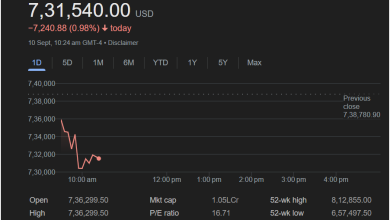

September 4, 2025 – Eli Lilly and Company (NYSE: LLY) continued its positive trajectory on September 3rd, with its stock closing at $737.83, marking a gain of $2.64, or 0.36%, during regular trading hours. The pharmaceutical behemoth demonstrated steady performance throughout the day, providing a reassuring signal to investors.

The company’s shares opened the trading day at $732.02, experiencing minor fluctuations before a notable surge in the late afternoon, peaking at its daily high of $737.83. This upward movement pushed the stock above its previous close of $735.19, reflecting consistent investor confidence. Although after-hours trading saw a slight dip of $1.83 (0.25%) to $736.00, the overall sentiment remains optimistic following the solid performance.

Eli Lilly’s market capitalization stands impressively at 69.83KCr, underscoring its significant presence in the global pharmaceutical landscape. The company’s P/E ratio is currently at 48.19, suggesting that investors are willing to pay a premium for its earnings, often indicative of strong growth expectations.

While the stock traded within a 52-week range of $623.78 to $954.00, the latest closing price positions it comfortably above its annual low, though still below its peak. This suggests potential room for further appreciation, provided the company continues to innovate and deliver on its pipeline.

For income-focused investors, Eli Lilly offers a dividend yield of 0.81%, with a quarterly dividend amount of $1.49, highlighting its commitment to returning value to shareholders. The daily low for the stock was $729.02, showing that even on a positive day, there was some intra-day volatility.

Analysts and market observers will be keenly watching Eli Lilly’s upcoming developments, particularly regarding its robust drug pipeline and potential blockbuster therapies, which are key to sustaining its growth and defending its market position. The company’s ability to maintain its upward momentum in a competitive sector will largely depend on these future innovations and their commercial success.

Investors are encouraged to consider these figures in the broader context of the company’s long-term strategy and the pharmaceutical industry’s evolving landscape.