Broadcom Navigates Market Dip, Analysts Remain Bullish on Long-Term Prospects

Despite a Recent Downturn, Broadcom's Robust Fundamentals and Strategic Positioning Continue to Attract Investor Confidence

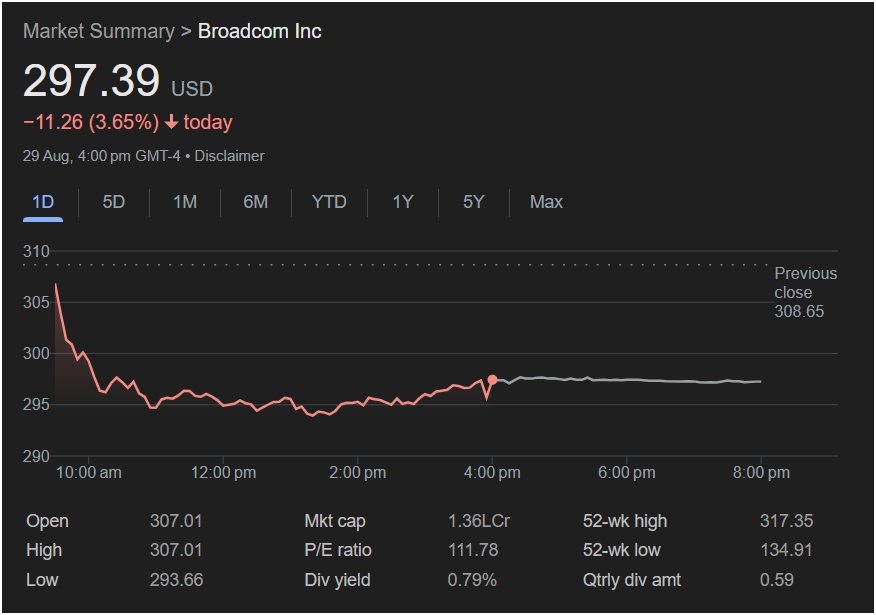

Broadcom Inc. (NASDAQ: AVGO) experienced a noticeable dip in its stock performance today, closing at $297.39, down $11.26 or 3.65% from its previous close of $308.65. The semiconductor and infrastructure software giant saw its shares fluctuate throughout the trading day, opening at $307.01, reaching a high of $307.01, and touching a low of $293.66. While the day’s trading reflects a cautious sentiment, market observers are quick to contextualize the movement within Broadcom’s broader financial strength and strategic outlook.

Today’s decline, though significant for a single trading session, comes after a period of strong performance for Broadcom. The company’s 52-week high of $317.35 underscores its recent growth trajectory, while its 52-week low of $134.91 highlights a remarkable recovery and consistent upward momentum over the past year. This resilient performance is a testament to Broadcom’s critical role in key technological sectors, including data centers, broadband communication, enterprise storage, and industrial applications.

Understanding the Day’s Movement

The intraday chart shows a sharp decline in the morning, with the stock stabilizing and showing minor recovery attempts in the afternoon before closing lower. This pattern can be attributed to various factors, including broader market trends, profit-taking by investors after recent gains, or specific news that might have influenced trading today. Without immediate specific news directly impacting Broadcom on this date, the movement is likely part of the normal ebb and flow of market dynamics, especially given its robust year-to-date and year-over-year performance.

Key Financial Indicators Remain Strong

Despite the day’s downturn, Broadcom’s fundamental indicators paint a picture of a healthy and valuable company. With a substantial market capitalization of $1.36 trillion, Broadcom stands as a titan in the technology sector. Its P/E ratio of 111.78 suggests that investors are willing to pay a premium for its earnings, often indicative of strong growth expectations and investor confidence in its future profitability.

Furthermore, Broadcom continues to reward its shareholders with a dividend yield of 0.79% and a quarterly dividend amount of $0.59. This consistent dividend payout reinforces the company’s financial stability and commitment to delivering value to its investors, even during periods of market volatility.

Looking Ahead: Growth Drivers and Strategic Acquisitions

Broadcom’s strategic acquisitions and consistent innovation are key drivers of its long-term growth. The company has a well-established history of acquiring and integrating complementary businesses, expanding its product portfolio and market reach. Its focus on high-growth areas like artificial intelligence, cloud computing, and next-generation connectivity positions it strongly for future market leadership.

Analysts often highlight Broadcom’s disciplined operational management and its ability to generate significant free cash flow as major strengths. These factors provide the company with the flexibility to invest in research and development, pursue strategic mergers and acquisitions, and return capital to shareholders.

Investor Confidence and Future Outlook

While a single day’s market performance can be a point of discussion, seasoned investors often look beyond short-term fluctuations to the underlying strength and future potential of a company. Broadcom’s impressive 52-week performance, substantial market capitalization, and strategic positioning in critical technology markets continue to foster strong investor confidence.

Today’s trading session serves as a reminder that market movements are dynamic. However, for a company with Broadcom’s established track record, innovative pipeline, and solid financial health, a single day’s decline is generally viewed as a momentary pause rather than a shift in its overall upward trajectory. Investors will undoubtedly be watching Broadcom’s upcoming earnings reports and strategic announcements for further insights into its continued growth story.