Booking Holdings Inc. Surges: A Glimpse into the Travel Giant’s Robust Performance

Share Price Jumps Amidst Market Optimism, Reflecting Strong Investor Confidence and Sector Recovery

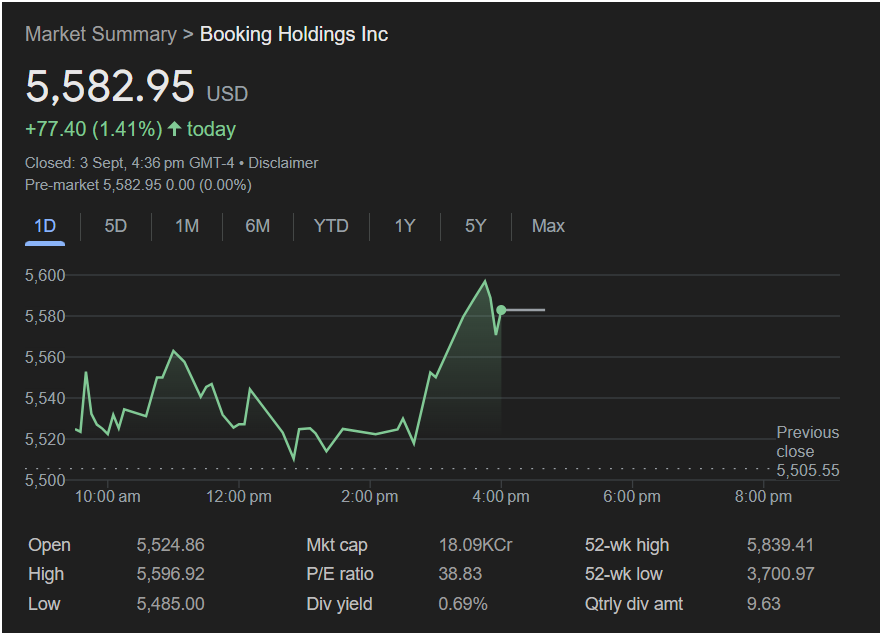

New York, NY – September 4, 2025 – Booking Holdings Inc. (BKNG) experienced a notable uplift in its stock performance on September 3, 2025, closing at a remarkable

77.40, or a 1.41% increase, over the day, signaling robust investor confidence and potentially a thriving outlook for the global travel and leisure sector. The day’s trading activity, captured up to 4:36 PM GMT-4, paints a picture of dynamic market engagement, with the stock maintaining its momentum even into pre-market hours on September 4, 2025, holding steady at its closing price.

The daily chart for Booking Holdings Inc. reveals a fascinating trajectory throughout September 3rd. Starting the day with an open price of $5,524.86, the stock experienced a series of fluctuations but demonstrated an overall upward trend, particularly in the latter half of the trading day. After an initial dip and rebound in the morning, the stock found strong footing around midday, steadily climbing from approximately $5,500 to surpass

5,596.92**, underscoring a strong closing push from investors. The day’s low was recorded at $5,485.00, indicating a trading range of over $111, which suggests active trading and significant market interest.

Market Fundamentals and Valuation Insights

Beyond the daily price movements, the provided market summary offers crucial insights into Booking Holdings’ financial health and valuation metrics. The company boasts a substantial market capitalization of $18.09 trillion (18.09K Cr), positioning it as a heavyweight in the market and a dominant player in the online travel agency (OTA) space. This impressive market cap reflects the sheer scale of its operations, which include popular brands like Booking.com, Priceline, Agoda, Rentalcars.com, and OpenTable.

The P/E ratio stands at 38.83, which is a key indicator often scrutinized by investors. A P/E ratio of this magnitude suggests that investors are willing to pay a premium for Booking Holdings’ earnings, likely anticipating future growth and profitability. This can be interpreted as a sign of strong market confidence in the company’s long-term prospects, its ability to innovate, and its resilience in an evolving travel landscape.

For income-focused investors, the dividend yield is noted at 0.69%, with a quarterly dividend amount of $9.63. While perhaps not the highest yield in the market, it demonstrates the company’s commitment to returning value to shareholders, even as it continues to invest in growth and expansion. This consistent dividend payout can be an attractive feature for a diversified investment portfolio.

Historical Performance and Future Outlook

Looking at the broader context, the 52-week high for Booking Holdings Inc. is

3,700.97. The current closing price of $5,582.95 is comfortably above the midpoint of this range, indicating a significant recovery and sustained upward momentum over the past year. This strong performance, especially when viewed against its 52-week low, suggests that the company has effectively navigated market challenges and capitalized on opportunities within the travel industry’s recovery and growth phases.

The travel sector, having faced unprecedented challenges in recent years, has shown remarkable resilience and adaptability. Booking Holdings, with its diverse portfolio of services spanning accommodation, flights, car rentals, and restaurant reservations, is exceptionally well-positioned to benefit from the resurgence of global travel. As consumers increasingly prioritize experiences and travel, platforms like those offered by Booking Holdings become indispensable tools for planning and booking.

Analysts and industry observers will undoubtedly be keen to assess whether this upward trajectory for Booking Holdings Inc. is sustainable. Factors such as global economic stability, consumer travel patterns, competitive landscape, technological advancements, and the company’s strategic investments will all play crucial roles in shaping its future performance. However, based on the robust gains seen on September 3, 2025, and its solid market fundamentals, Booking Holdings Inc. appears to be on a strong course, making it a compelling entity for investors tracking the pulse of the global travel market.

The pre-market data for September 4, 2025, showing the stock holding steady at its closing price, suggests that the positive sentiment is carrying over. As the market opens today, eyes will be on Booking Holdings Inc. to see if it can continue its impressive run and further solidify its position as a leader in the dynamic and ever-evolving travel industry.