Bank of America Corp. Sees Positive Gains, Closes Up 0.50%

Financial Giant Continues Steady Growth as Market Reacts Positively

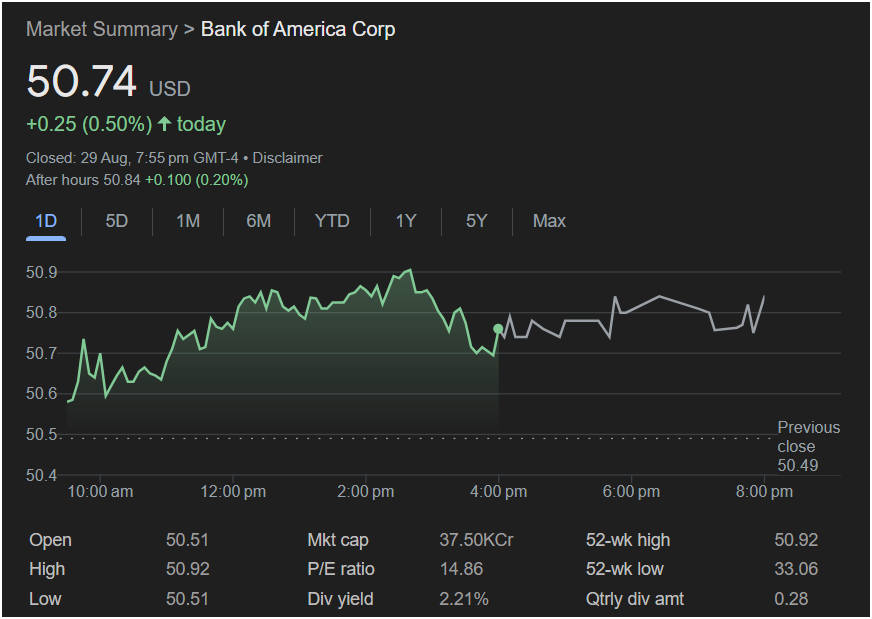

New York, NY – August 31, 2025 – Bank of America Corporation (NYSE: BAC) closed its trading day with positive momentum, seeing its shares rise by $0.25, or 0.50%, to reach $50.74 USD. This steady increase reflects continued investor confidence in one of the nation’s leading financial institutions.

Throughout the day, Bank of America’s stock demonstrated resilience. It opened at $50.51, hit a daily high of $50.92, and maintained a low of $50.51, indicating strong support at that level. After-hours trading further reinforced this positive trend, with shares gaining an additional $0.10, or 0.20%, to $50.84.

The bank boasts a substantial market capitalization of 37.50 KCr, solidifying its position within the financial sector. With a P/E ratio of 14.86, Bank of America presents a strong valuation, and its dividend yield of 2.21% makes it an attractive option for income-focused investors.

The stock’s current price is nearing its 52-week high of $50.92, while its 52-week low stands at $33.06, showcasing significant growth over the past year. The quarterly dividend amount of $0.28 further underscores the bank’s commitment to delivering shareholder value.

Bank of America’s solid performance today highlights its consistent stability and positive outlook in a dynamic economic environment, providing reassuring news for its shareholders and the broader market.

Would you like an image to accompany this article?