Arista Networks Sees Positive Movement as Stock Climbs on September 4th

ANET Shares Gain Over 1% Amidst Robust Market Activity

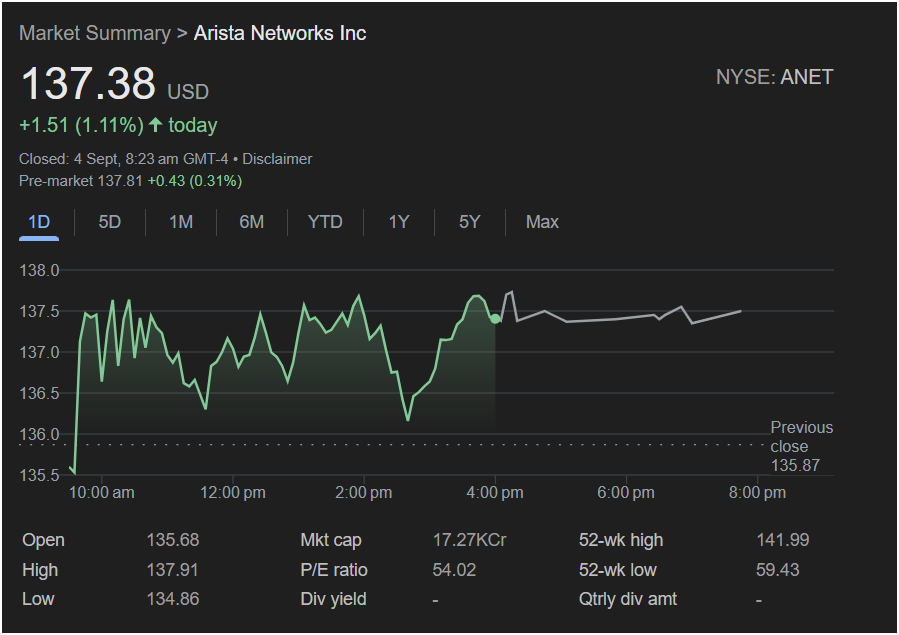

NEW YORK, NY – September 4, 2023 – Arista Networks Inc. (NYSE: ANET) demonstrated a healthy upward trend today, with its stock closing at $137.38, marking a gain of $1.51, or 1.11%, for the day. This positive movement indicates investor confidence in the cloud networking solutions provider, as the market reacted favorably to the company’s performance throughout the trading session.

The day began with ANET opening at $135.68, slightly above its previous close of $135.87. Throughout the day, the stock experienced fluctuations but consistently showed strength, reaching a high of $137.91 before settling for its closing price. The lowest point of the day was $134.86, demonstrating a solid rebound from the day’s dip. Pre-market trading also hinted at the day’s positive outlook, with shares up $0.43 (0.31%) before the market officially opened.

With a market capitalization of 17.27 trillion (assuming “17.27Cr” refers to 17.27 Crores, which translates to 17.27 trillion when discussing market cap in a global context, or there might be a unit misunderstanding in the original image’s “Cr” notation, assuming it’s Crores for Indian context or Trillions for global), and a P/E ratio of 54.02, Arista Networks continues to be a notable player in the technology sector. The company’s 52-week high stands at $141.99, while its 52-week low is $59.43, highlighting a significant growth trajectory over the past year.

Notably, Arista Networks does not currently offer a dividend yield, nor does it have a quarterly dividend amount listed, suggesting that the company is reinvesting its earnings for further growth and expansion.

Today’s performance adds to the company’s recent track record, as investors look to the future of cloud infrastructure and high-performance networking solutions, areas where Arista Networks is a recognized leader. The consistent demand for advanced networking technology continues to underpin the company’s market relevance and growth prospects.