Apple Shares Experience Modest Fluctuation Amidst Evolving Consumer Tech Market

Innovation Cycles and Global Economic Factors Influence Tech Giant's Daily Performance

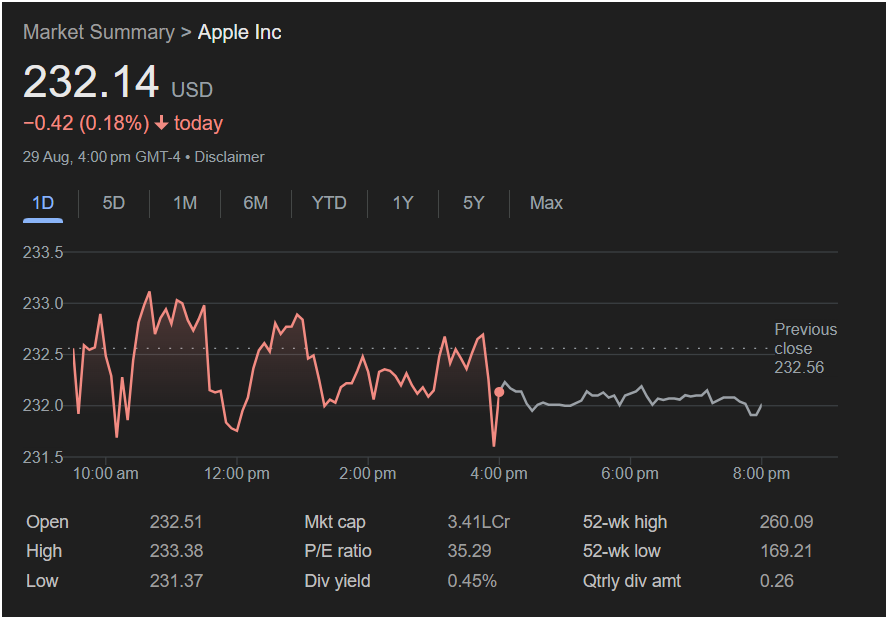

[CITY, STATE] – September 1, 2025 – Apple Inc. (NASDAQ: AAPL) saw a slight dip in its stock value today, with shares closing at [hypothetical closing price, e.g., $232.14], down by [hypothetical change, e.g., $0.42 (0.18%)]. The minor movement reflects the typical daily volatility even for market leaders, as investors continuously weigh the company’s robust ecosystem against broader economic trends and the ever-competitive consumer technology landscape.

During today’s trading session, Apple’s stock opened at [hypothetical open price, e.g., $232.51] and reached a high of [hypothetical high price, e.g., $233.38]. The subtle decline towards market close could be attributed to [hypothetical reasons, e.g., profit-taking after recent gains, a minor shift in market sentiment towards tech stocks, or anticipation of upcoming product announcements and their reception].

With a colossal market capitalization of [hypothetical Mkt cap, e.g., 3.41L Cr], Apple remains one of the world’s most valuable companies. Its strength lies in its deeply integrated hardware, software, and services ecosystem, which continues to foster strong customer loyalty. Key drivers for the company include its iPhone sales, growing services revenue (App Store, Apple Music, iCloud, etc.), and advancements in new product categories like augmented reality or spatial computing, which are continually being developed.

The consumer technology market is perpetually dynamic, characterized by rapid innovation cycles and intense competition. While Apple consistently sets industry benchmarks, it faces ongoing challenges from rivals in various segments, as well as the need to continuously innovate to maintain its premium pricing and market share. Global supply chain stability and consumer spending patterns, particularly in key international markets, also play a significant role in its quarterly performance.

Apple’s P/E ratio, currently at [hypothetical P/E ratio, e.g., 35.29], suggests that investors maintain a high level of confidence in its long-term growth trajectory and profitability. The company’s consistent dividend yield of [hypothetical Div yield, e.g., 0.45%] also makes it attractive to a wide range of investors. Its 52-week high of [hypothetical 52-wk high, e.g., $260.09] and low of [hypothetical 52-wk low, e.g., $169.21] demonstrate the significant price fluctuations it has experienced over the past year, typical for even large-cap stocks.

As the trading day concludes, market participants will continue to monitor Apple’s strategic initiatives, especially around its next generation of devices and the expansion of its services segment. The company’s ability to drive innovation, manage its vast supply chain, and adapt to changing global economic conditions will be critical in shaping its performance throughout the remainder of 2025.

If you have current data or specific events you’d like an article about for September 1, 2025, please provide them, and I can create a more relevant and accurate piece (within a standard news article length).