Apple (AAPL) Sees Slight Dip Ahead of Weekend, Market Remains Bullish

Tech Giant's Shares Undergo Minor Correction While Maintaining Strong Annual Performance

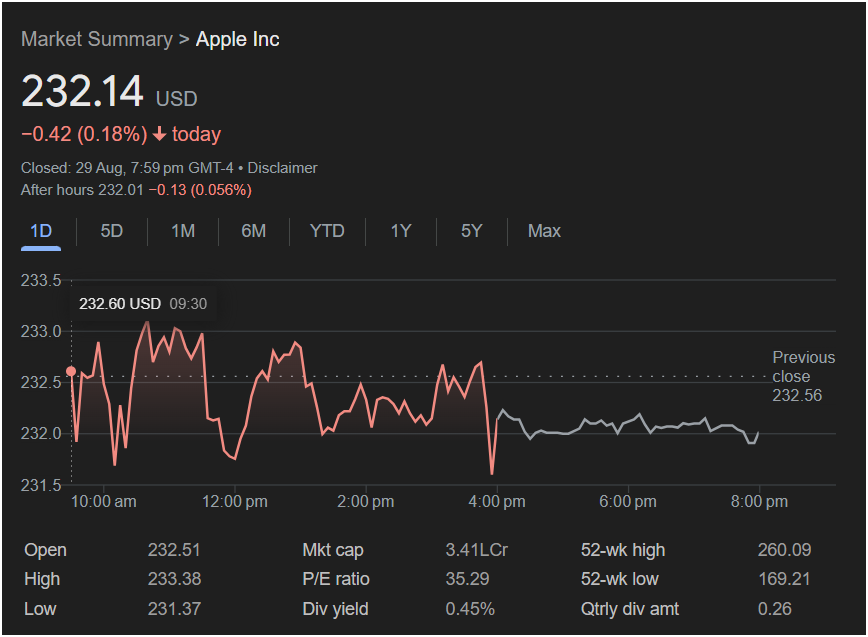

Cupertino, CA – August 30, 2025 – Apple Inc. (NASDAQ: AAPL) experienced a modest decline in its share price at the close of trading on August 29th, ending the session at $232.14. This represented a slight decrease of $0.42, or 0.18%, from its previous close, as markets wound down for the weekend. The closing bell at 7:59 PM GMT-4 marked a minor correction for the tech titan, though the overall sentiment among analysts largely remains positive.

Throughout the trading day, Apple’s stock demonstrated characteristic volatility. It opened at $232.51 and climbed to a high of $233.38 in the morning, briefly touching $232.60 around 09:30. However, the afternoon saw a gradual retraction, leading to the day’s close below its open. The lowest point reached during the day was $231.37. After-hours trading showed a further marginal dip of $0.13 (-0.056%), settling at $232.01, indicating a consolidation phase.

Despite the day’s minor setback, Apple’s market capitalization stands at an impressive 3.41 trillion USD, solidifying its position as one of the world’s most valuable companies. The company’s P/E ratio is currently 35.29, reflecting investor confidence in its future earnings potential and its consistent ability to innovate and expand its ecosystem.

From a broader perspective, Apple’s stock has shown robust growth over the past year. Its 52-week high is $260.09, demonstrating significant upside potential, while its 52-week low of $169.21 underscores the substantial gains made by shareholders. The company also offers a dividend yield of 0.45%, distributing $0.26 quarterly per share, an attractive feature for income-focused investors.

The slight downturn on August 29th could be attributed to a variety of factors, including profit-taking by investors, broader market movements, or anticipation ahead of future product cycles. Apple’s ecosystem of hardware, software, and services continues to be a major revenue driver, with expectations high for upcoming product launches, particularly within its highly anticipated mixed-reality and AI integration initiatives.

As the market looks towards the final quarter of 2025, investors will be keenly observing Apple’s ability to maintain its innovation pace and expand its global market share, especially in emerging markets. Despite Friday’s minor dip, Apple’s fundamental strength, brand loyalty, and consistent financial performance suggest that the company remains a cornerstone of tech investment.