AMD Shares Experience Significant Drop in Latest Trading Session

Semiconductor Giant Falls Over 3.5% Amidst Market Corrections

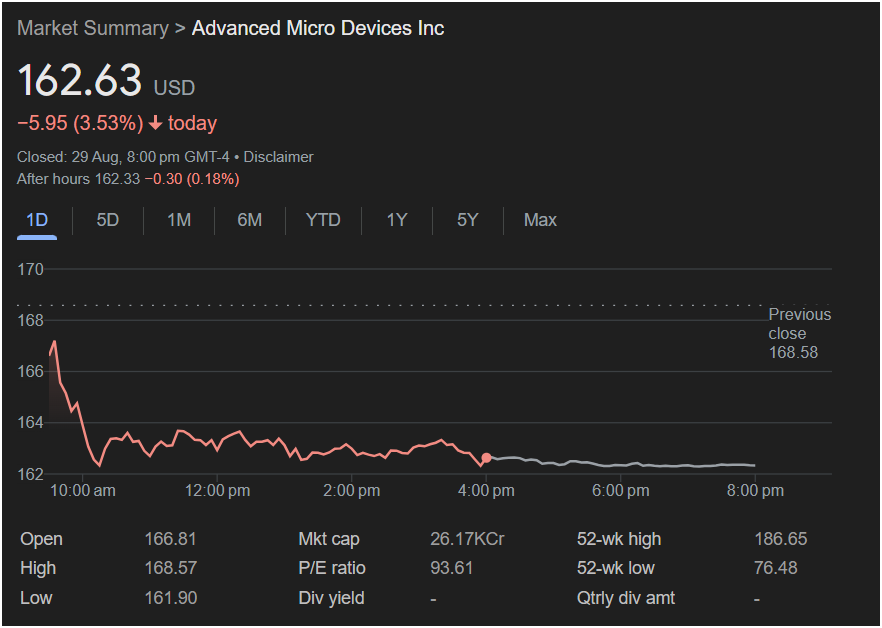

New York, August 31, 2025 – Advanced Micro Devices Inc. (NASDAQ: AMD) closed its trading day with a notable decline, as its stock price fell to $162.63 USD. This represents a significant drop of $5.95, or 3.53%, by the close of market on Friday, August 29th, 2025, at 8:00 PM GMT-4.

The chipmaker began the session with an open price of $166.81, experiencing immediate selling pressure that pushed its value downwards throughout the day. AMD shares reached a daily high of $168.57 early in the morning, but then saw a steady decline, hitting a low of $161.90. The previous day’s close was $168.58, indicating that today’s trading continued a negative trend. After-hours trading showed a further slight dip of $0.30 (0.18%) to $162.33, reflecting cautious investor sentiment.

Advanced Micro Devices maintains a substantial market capitalization of 26.17 trillion Indian Rupees, underscoring its pivotal role in the global semiconductor industry. The company’s P/E ratio stands at a high 93.61, which often reflects strong growth expectations for a technology firm despite daily fluctuations. AMD does not currently offer a dividend yield or quarterly dividend amount, as it typically reinvests profits into research, development, and expansion.

From a broader annual perspective, AMD’s 52-week high is $186.65, while its 52-week low is $76.48. Today’s closing price of $162.63, while a significant daily drop, still places the stock well above its annual low, demonstrating substantial growth over the past year. The accompanying chart clearly illustrates the downward trajectory experienced by AMD’s stock throughout the trading day.

The considerable decline in AMD’s share price could be attributed to various factors, including broader market trends impacting the technology and semiconductor sectors, profit-taking by investors, or specific news affecting the competitive chip manufacturing landscape. Despite today’s volatility, AMD’s ongoing innovations in CPUs, GPUs, and data center solutions remain crucial for its long-term market performance and competitive positioning against industry rivals.