AMD Shares Edge Up as Market Anticipates Future Moves

Chipmaker Posts Modest Gains on August 29th, Closing at $168.58 Amidst Pre-Market Jitters and High P/E Ratio

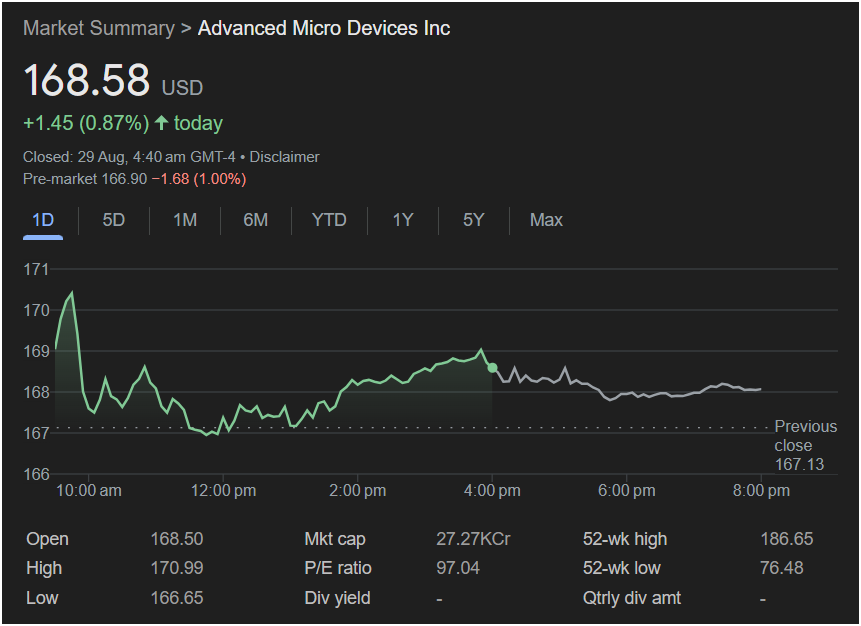

Sunnyvale, CA – August 29, 2025 – Advanced Micro Devices Inc. (AMD) saw its stock price tick slightly upwards today, closing at $168.58 per share, marking a modest gain of $1.45, or 0.87%. The day’s trading, concluding just before 5 AM GMT-4, reflects a cautiously optimistic market sentiment for the semiconductor giant, even as pre-market trading indicated a slight dip.

The day’s trading session for AMD was a dynamic one. Opening at $168.50, the stock reached an intra-day high of $170.99 before pulling back to a low of $166.65. This volatility points to active trading as investors weighed various factors impacting the chip industry. Despite the previous day’s close at $167.13, AMD managed to finish the regular session in positive territory.

However, the picture became more complex in pre-market trading, where AMD shares were observed at $166.90, down $1.68 or 1.00% from the official close. This pre-market movement suggests that while the main trading session ended positively, some investors were reacting to new information or adjusting positions ahead of the next day’s open.

Analyzing the broader financial health, AMD maintains a significant market capitalization, reported at 27.27 KCr (assuming a localized reporting unit). The company’s Price-to-Earnings (P/E) ratio stands at a robust 97.04, indicating that investors are willing to pay a premium for AMD’s future earnings potential, often a sign of strong growth expectations in the technology sector.

Looking at the longer-term performance, AMD has experienced a wide range over the past year. Its 52-week high stands at $186.65, while its 52-week low was $76.48. This considerable spread highlights the stock’s significant growth and its susceptibility to market fluctuations within the competitive semiconductor landscape. Currently, the company does not offer a dividend yield or quarterly dividend amount.

As the tech sector continues its rapid evolution, particularly in artificial intelligence, data centers, and gaming, AMD’s performance remains a key indicator for the industry. Investors will be closely watching for future announcements and market trends to gauge the company’s trajectory beyond today’s marginal gains.