Amazon Stock Surges, Adding Billions in Market Value in Early Trading

Amazon.com Inc. (AMZN) demonstrated significant strength in the market on July 24th, with its stock price climbing over 1.5% in early trading. The upward momentum for the tech and e-commerce behemoth reflects sustained investor confidence. This analysis breaks down the technical, fundamental, and sentiment factors driving the day’s performance.

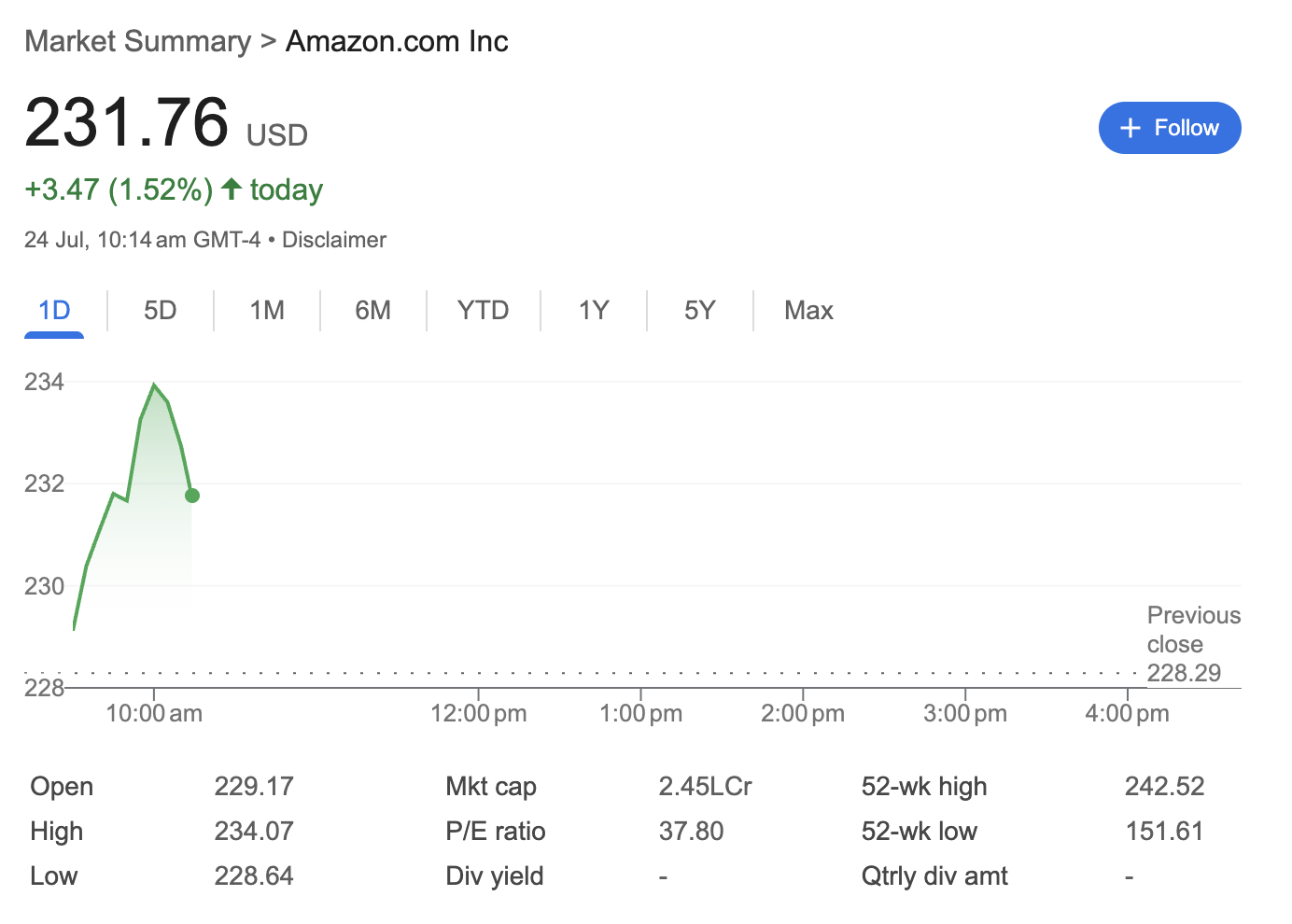

Daily Performance Snapshot

As of 10:14 am GMT-4, the key metrics for Amazon’s stock were:

-

Current Price: $231.76

-

Day’s Gain: +$3.47 (1.52%)

-

Day’s Range: $228.64 (Low) to $234.07 (High)

-

Previous Close: $228.29

-

52-Week Range: $151.61 to $242.52

Technical Analysis: Strong Upward Momentum Nears Key Levels

The technical data from the trading session highlights a clear bullish trend for Amazon stock.

-

Bullish Opening and Rally: The stock opened at $229.17, gapping up from the previous day’s close of 234.07**. This type of price action indicates aggressive buying interest right from the start of the session.

-

Consolidation After Peak: After reaching its morning high, the stock experienced a slight pullback to the $231.76 level. This is a common pattern, suggesting either minor profit-taking or that the stock is consolidating its gains before a potential next move.

-

Proximity to Yearly High: The current price is trading much closer to its 52-week high of $242.52 than its low of $151.61. This is a strong long-term indicator, suggesting the stock is in a sustained uptrend and investor confidence remains high. The 52-week high now acts as the next major resistance level for the stock to test.

Fundamental Analysis: A Premium Valuation for a Global Leader

Amazon’s fundamental metrics underscore its position as a dominant global company with a focus on aggressive growth.

-

Mega-Cap Status: With a market capitalization of 2.45LCr (representing approximately $2.45 trillion USD), Amazon is one of the largest and most influential companies in the world. Its massive scale provides it with a significant competitive advantage.

-

Growth-Oriented Valuation: The stock’s P/E ratio is 37.80. This figure, while not excessively high for a leading technology company, indicates that investors are pricing in significant future earnings growth. It reflects expectations that Amazon’s investments in areas like AI, cloud computing (AWS), and advertising will continue to drive profitability.

-

Reinvestment Over Dividends: Amazon does not pay a dividend, as indicated by the “-” for Div yield. This is a long-standing company strategy to reinvest all available profits back into the business to fuel innovation, expansion, and market share dominance across its diverse segments.

Sentiment Analysis: Confidence in Tech Leadership

The market sentiment surrounding Amazon on this day was clearly positive and confident.

-

Broadly Positive Sentiment: A gain of over 1.5% for a company of Amazon’s immense size is significant, representing an increase of over $35 billion in market value. This reflects a broadly positive sentiment not just for Amazon, but likely for the tech sector as a whole.

-

Investor Willingness to Buy High: The strong buying activity that pushed the stock near its 52-week high demonstrates high investor confidence. Buyers are not deterred by the high price, signaling a belief that there is still room for growth.

-

Focus on Future Growth: The positive sentiment is tied to the company’s fundamental story of continuous innovation and market expansion. Investors are clearly optimistic about Amazon’s ability to maintain its leadership position and capitalize on future technological trends.

Disclaimer: This article is for informational purposes only and is based on data from a specific point in time as shown in the provided image. It should not be considered financial advice. Investors should conduct their own research and consult with a financial professional before making any investment decisions.