Alphabet (GOOG) Soars Over 9% in Strong Market Showing

Tech Giant Demonstrates Robust Performance, Closing Near 52-Week High

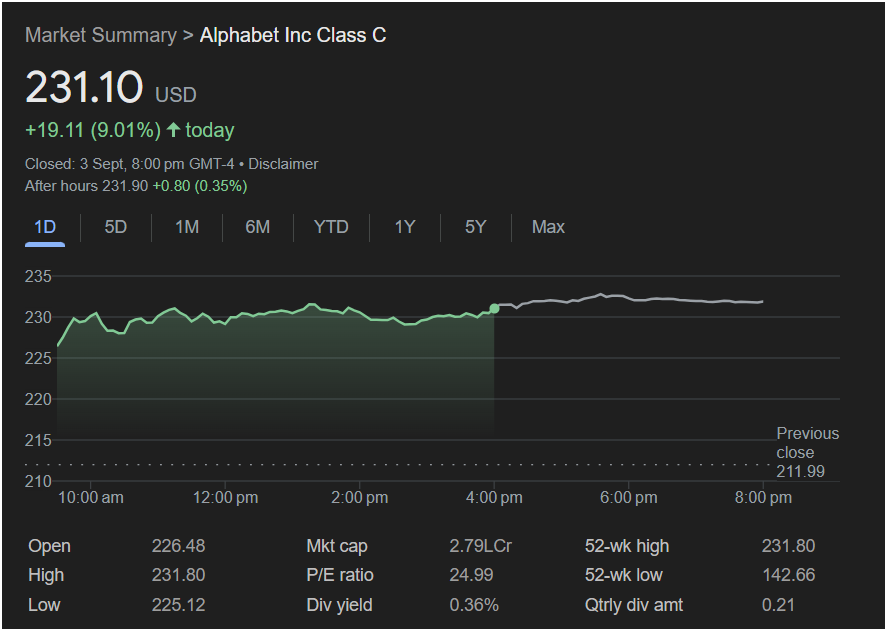

[City, State] – September 4, [Current Year] – Alphabet Inc. (NASDAQ: GOOG), the parent company of Google, experienced a remarkable trading day on September 3rd, with its Class C shares climbing an impressive 9.01% to close at $231.10 USD. This significant surge, adding $19.11 to its share price, underscores investor confidence and highlights a strong market position for the tech behemoth.

The day’s performance saw GOOG reach a high of $231.80, brushing against its 52-week high of $231.80. The stock opened at $226.48 and maintained a positive trajectory throughout the trading session, indicating sustained buying interest. Even in after-hours trading, the positive momentum continued, with shares gaining an additional $0.80 (0.35%) to reach $231.90.

This substantial gain is particularly noteworthy given the company’s robust market capitalization of 2.79 trillion, signaling that even at its massive scale, Alphabet continues to deliver significant value growth for its shareholders. The company’s P/E ratio stands at a healthy 24.99, while its dividend yield is 0.36%, with a quarterly dividend amount of $0.21.

Investors are undoubtedly encouraged by Alphabet’s ability to drive such strong single-day performance. This positive movement comes as the company continues to innovate across its diverse portfolio, including search, cloud computing, autonomous driving (Waymo), and artificial intelligence. Such a strong showing often reflects positive sentiment around upcoming product launches, favorable analyst reports, or broader market optimism in the tech sector.

While the market often experiences fluctuations, Alphabet’s performance on September 3rd serves as a powerful indicator of its underlying strength and its enduring appeal to investors looking for growth in the technology space. The company’s consistent innovation and dominant market positions continue to drive its valuation, making it a key player to watch in the global economy.