Advance Auto Parts Stock Slips 0.41% to $60.52 Amid Market Volatility

Shares of Advance Auto Parts closed lower on August 28, 2025, as investors weigh industry competition and margin pressures

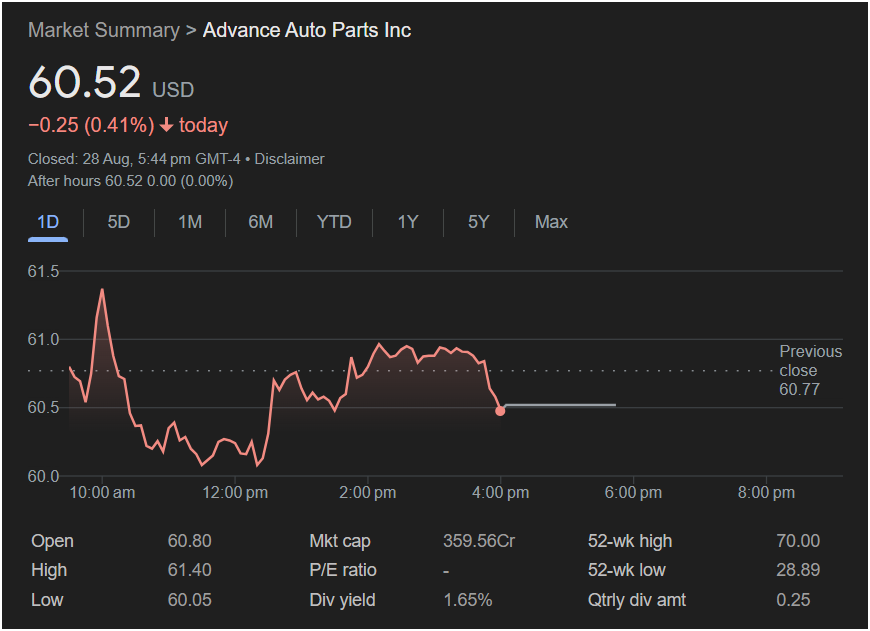

On August 28, 2025, Advance Auto Parts Inc. (NYSE: AAP) shares closed at $60.52, down 0.41% (-$0.25) from the previous day’s close of $60.77. Despite an intraday high of $61.40, the stock faced pressure throughout the trading session, closing in the red. After-hours trading showed no further movement, with the stock holding steady at $60.52.

The decline reflects continued investor caution toward the retail auto parts sector, which has been navigating rising costs, intense competition, and slowing consumer demand in some segments.

Daily Stock Performance

- Open: $60.80

- High: $61.40

- Low: $60.05

- Close: $60.52 (-0.41%)

- After Hours: $60.52 (no change)

Advance Auto Parts stock opened slightly higher than the previous close, but early gains quickly gave way to selling pressure. The company managed to stay above $60, with $60.05 marking the day’s low.

Market Position and Valuation

With a market capitalization of $359.56 crore, Advance Auto Parts remains a mid-cap player in the retail auto parts industry. The absence of a clear P/E ratio suggests either minimal profitability or a recent decline in earnings, raising questions about the company’s earnings outlook.

- Dividend Yield: 1.65%

- Quarterly Dividend: $0.25 per share

- 52-Week High: $70.00

- 52-Week Low: $28.89

The wide 52-week range reflects both volatility and recovery efforts, as the stock has nearly doubled from its lows but remains well below peak valuations.

Industry Context: Auto Parts Retail Challenges

The auto parts retail sector is facing significant headwinds in 2025:

- Rising Input Costs: Higher costs for raw materials and supply chain disruptions have pressured profit margins.

- Competition: Advance Auto Parts faces stiff competition from rivals such as AutoZone, O’Reilly Automotive, and online retailers.

- Shifting Consumer Trends: As more consumers transition to electric vehicles (EVs), demand for traditional auto parts has been gradually changing.

- Labor Costs: Wage inflation has increased operational expenses across retail stores and distribution centers.

Despite these challenges, the company’s dividend program provides some incentive for long-term investors seeking steady income.

Historical Performance: 52-Week Review

Over the past year, Advance Auto Parts has demonstrated significant volatility.

- From a low of $28.89, the stock staged a strong rebound, more than doubling in value.

- However, it remains below its 52-week high of $70, indicating mixed investor sentiment.

- The company has been restructuring operations to improve efficiency, but profitability pressures remain.

Analyst Opinions and Market Sentiment

Analysts remain divided on Advance Auto Parts:

- Bullish Case: Supporters argue that the company’s dividend yield of 1.65% and strategic cost-cutting measures could support future stability. Additionally, as vehicle ownership rises in emerging markets, long-term demand for auto parts may increase.

- Bearish Case: Critics point to weak margins, uncertain earnings, and competitive pressures as signs of potential stagnation. The lack of a clear P/E ratio underscores profitability concerns.

Investor sentiment remains cautious, with many preferring larger, more profitable competitors in the sector.

Future Outlook

Looking ahead, Advance Auto Parts’ performance will hinge on:

- Profitability Improvements: Whether management can restore margins through cost efficiencies and restructuring.

- EV Adaptation: Expanding product offerings for electric and hybrid vehicles to remain relevant.

- Digital Strategy: Growth in e-commerce and online sales will be crucial for competing with Amazon and other digital-first players.

- Dividend Sustainability: Maintaining its dividend program will be key for retaining long-term investors.

Advance Auto Parts closed slightly lower at $60.52 on August 28, 2025, reflecting ongoing challenges in the auto parts retail industry. While dividends and recent operational improvements provide some stability, investor caution remains high due to profitability concerns and fierce competition.

The stock’s rebound from last year’s lows highlights resilience, but sustained growth will depend on the company’s ability to adapt to shifting industry dynamics, particularly the transition toward EVs and online retail.

For now, Advance Auto Parts remains a cautious pick for investors—appealing to those seeking dividend income but less attractive compared to higher-performing peers.