Accenture Navigates Shifting Market: Slight Dip Amidst Broader Trends

Tech Consulting Giant Sees Modest Retreat as Investors Digest Latest Figures

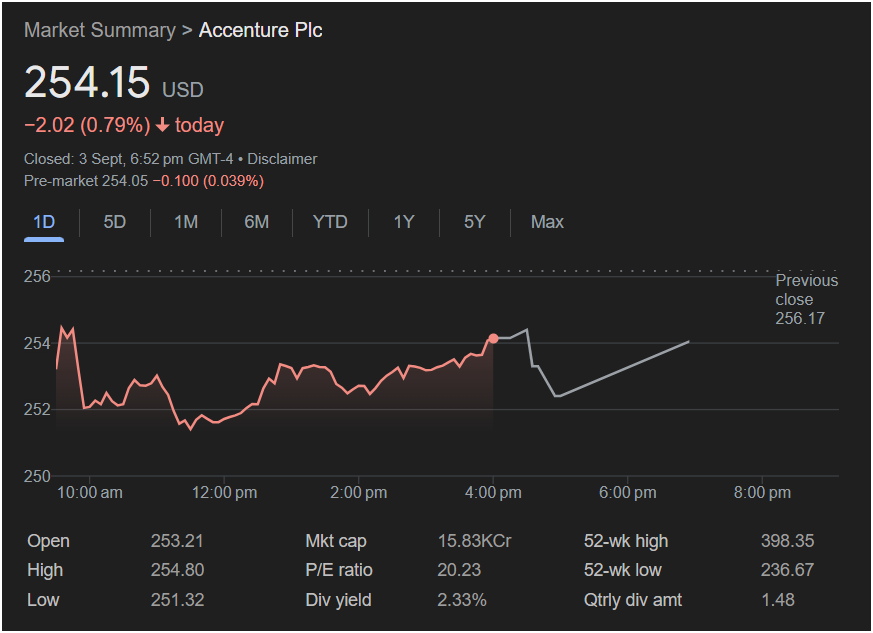

September 4, 2025 – Accenture Plc (NYSE: ACN), a global professional services company specializing in IT services and consulting, experienced a slight decline in its stock price on September 3, 2025, closing at $254.15 per share. The modest downturn of $2.02, representing a 0.79% decrease from its previous close, occurred as market participants continued to assess the broader economic landscape and sector-specific performance.

Throughout the trading day, Accenture’s stock saw fluctuations, opening at $253.21 and reaching a daily high of $254.80 before settling. The intraday low was recorded at $251.32, indicating a degree of volatility common in today’s market environment. Despite the day’s dip, the pre-market trading activity showed a slight easing of the decline, with shares at $254.05, down 0.100 (0.039%) before the market officially opened on the subsequent trading day.

Accenture’s current market capitalization stands at a robust 15.83 trillion, underscoring its significant presence in the global services industry. Investors will note the company’s P/E ratio of 20.23, which provides insight into its valuation relative to earnings. Furthermore, Accenture maintains a dividend yield of 2.33%, distributing $1.48 per share quarterly, a factor that often appeals to income-focused investors.

Looking at the broader context, Accenture’s 52-week high stands at $398.35, while its 52-week low is $236.67. This range highlights the stock’s movements over the past year, reflecting both periods of strong growth and market corrections. The current price of $254.15 sits closer to its yearly low, suggesting that the stock might be viewed as offering a more attractive entry point by some investors, or it could be reflecting ongoing market pressures impacting the tech and consulting sectors.

Market analysts are likely to be closely watching Accenture’s upcoming financial reports and management commentary for insights into its performance drivers, new client acquisitions, and strategies for navigating competitive pressures and evolving technology trends. As a bellwether in the professional services space, Accenture’s trajectory often provides valuable indicators for the broader economic health and corporate investment in digital transformation.

While one day’s performance is rarely indicative of long-term trends, the slight moderation in Accenture’s stock price on September 3rd offers a snapshot of current investor sentiment and market dynamics affecting one of the industry’s leading players.