AbbVie (ABBV) Showcases Tenacity in Strong Rebound, Closing Higher After Erasing Steep Morning Losses

Shares for the pharmaceutical giant reversed a sharp early decline to close in the green, signaling powerful investor support. A premium 3.11% dividend yield highlights the company's appeal as a top-tier blend of income and long-term growth

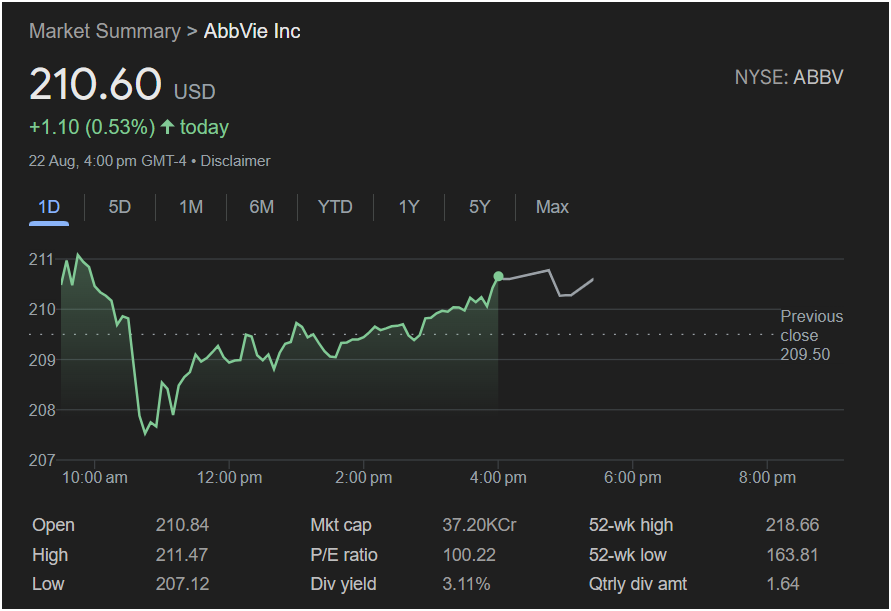

NEW YORK, August 25 – In a remarkable display of resilience and underlying strength, shares of the biopharmaceutical powerhouse AbbVie Inc. (NYSE: ABBV) finished the trading session on August 22 with a solid gain, a feat made all the more impressive by the dramatic intraday comeback that secured the victory for the bulls. The stock closed at

1.10, or 0.53%, for the day.

This performance was far more than a modest uptick; it was a powerful narrative of investor conviction. After facing a significant sell-off in the opening hour, the stock methodically clawed back every cent of its losses and pushed into positive territory. This V-shaped recovery is a potent technical signal, suggesting that dip-buyers see immense value at current levels.

This tenacity, combined with AbbVie’s sector-leading dividend yield and the market’s high expectations for its future growth, solidifies its position as a premier name in the healthcare space. Today’s session was a clear demonstration of why investors continue to flock to this unique combination of innovation, stability, and substantial shareholder returns.

A Tale of Two Halves: Deconstructing the Intraday Comeback

The true “good news” of the day lies not just in the final closing price, but in the journey the stock took to get there. The trading session was a story of two distinct and dramatic halves:

The day began with a wave of selling pressure. Despite opening at $210.84, above the previous close of

207.12**. At this point, the stock was down more than 1% and the momentum appeared decidedly negative.

However, this low point proved to be a critical turning point. A formidable “wall of buyers” emerged, seeing the dip as an attractive entry point. The selling pressure evaporated and was replaced by steady, determined buying that would last for the rest of the day. The stock embarked on a methodical, upward grind, erasing its losses piece by piece.

By the afternoon, the stock had fought its way back into positive territory, peaking at a session high of $211.47 before settling for a strong close. This ability to completely reverse a steep morning decline and finish the day with a solid gain is a powerful indicator of underlying institutional and retail support. It signals that the long-term bullish thesis for AbbVie is firmly intact and that investors are eager to accumulate shares on any sign of weakness.

The Income Cornerstone: A Best-in-Class 3.11% Dividend Yield

While the day’s price action was impressive, a core driver of AbbVie’s enduring appeal is its exceptional dividend, which serves as a powerful magnet for income-seeking investors. AbbVie currently offers a substantial dividend yield of 3.11%.

A yield of this magnitude from a leading pharmaceutical company is a rare and valuable attribute. Here’s why it is such a critical piece of the “good news” story:

-

A Superior Income Stream: With a quarterly dividend of $1.64 per share, AbbVie provides a significant and reliable cash return to its shareholders. In an environment where safe yields can be hard to find, a 3.11% payout from a financially sound industry leader is a premier income-generating asset.

-

Dividend Aristocrat Status: AbbVie is a “Dividend Aristocrat,” a prestigious title reserved for S&P 500 companies that have increased their dividend for at least 25 consecutive years (a legacy inherited and continued after its separation from Abbott Laboratories). This track record is the ultimate proof of a stable business model and a management team dedicated to consistently rewarding its long-term shareholders.

-

Total Return Potential: The combination of a strong dividend and the potential for capital appreciation (as seen in today’s rally) creates a powerful “total return” profile. Investors are rewarded with regular income while also participating in the company’s growth story.

Decoding the Valuation: A High P/E Ratio Signals High Expectations

One of the most intriguing aspects of AbbVie’s financial profile is its Price-to-Earnings (P/E) ratio of 100.22. While a high P/E can sometimes be a warning sign of overvaluation, in the context of a research-driven biopharmaceutical company like AbbVie, it tells a different story: a story of immense future potential.

A P/E of 100 indicates that the market is pricing AbbVie not just on its current earnings, but on the massive potential of its drug pipeline and future breakthroughs. Investors are willing to pay a premium based on their confidence in:

-

A Diversified and Growing Portfolio: AbbVie has successfully worked to build a portfolio of blockbuster drugs beyond its legacy product, Humira. Its immunology drugs Skyrizi and Rinvoq are multi-billion dollar franchises, and its aesthetics division, led by Botox, is a global leader.

-

A Promising R&D Pipeline: The high valuation reflects optimism about the drugs currently in development within AbbVie’s labs, which could become the blockbusters of tomorrow.

-

Strong Future Earnings Growth: The market is essentially betting that AbbVie’s “E” (earnings) will grow significantly in the coming years, which will naturally bring the P/E ratio down to a more conventional level over time. It is a forward-looking vote of confidence in the company’s long-term strategy.

The Broader Context: Challenging All-Time Highs

Placing today’s resilient performance within its annual context further strengthens the bullish case.

-

52-Week High: $218.66

-

52-Week Low: $163.81

-

Today’s Close: $210.60

The stock has had a phenomenal year, rising nearly 30% from its 52-week low. Today’s close puts it a mere 3.7% away from its absolute peak. This proximity to its high confirms that the stock is in a powerful and sustained uptrend. Today’s intraday rebound was not just a one-day event; it was a successful defense of that uptrend, signaling that the stock may be preparing for its next attempt to break out into new all-time highs.

Conclusion: A Trifecta of Resilience, Income, and Growth

AbbVie’s performance was a compelling exhibition of everything that makes it a top-tier investment. The day’s good news came in three powerful forms:

-

Demonstrated Resilience: The stock’s dramatic V-shaped recovery proved that there is powerful demand for its shares.

-

Superior Income: The 3.11% dividend yield offers a reliable and substantial income stream that few peers can match.

-

Future-Focused Growth: The market’s valuation signals strong confidence in AbbVie’s innovative pipeline and long-term earnings power.

For investors, AbbVie continues to offer a uniquely attractive proposition: the stability and income of a mature blue-chip combined with the exciting growth potential of a leading biopharmaceutical innovator. Today’s session was a powerful reminder of that winning formula.